Today’s edition is brought to you by Heatbit - the world’s only heater-purifier that makes $15 / month in Bitcoin.

Get your Heatbit Mini and join the Bitcoin network today!

GM to all 14,861 of you. Crypto Nutshell #122 flyin’ thru. 🦅🥜

We’re the crypto newsletter more empowering than being chosen by a sword in a stone to rule a kingdom... 🗡️👑

Today, we’ll be going over:

🚀 Bitcoin smashes yearly high - here’s why

🐂 SEC now bullish on ETF?

💰 Critical pricing model reached

🤑 And more…

MARKET WATCH ⚖️

Prices as at 6:30am ET

Only the top 20 coins measured by market cap feature in this section

BITCOIN SMASHES YEARLY HIGH 🚀

BREAKING: Bitcoin smashes yearly high as BlackRock prepares for Bitcoin ETF launch - lines up seed investment and reveals ETF ticker

Bitcoin surged over 10% today following MASSIVE news that suggests the imminent launch of the Bitcoin ETF’s.

Recent filings revealed that BlackRock intends to contribute seed funding in October 2023 (exact date not specified).

Seed funding occurs when an ETF issuer purchases a set amount of “creation units” (Bitcoin). This is done to kick start the fund.

Think of it as a mini IPO.

Analysts believe that BlackRock purchasing Bitcoin implies that ETF’s are expected to launch very soon. 👀

Seed funding is nothing out of the ordinary. Funds typically start this leading into a launch. Balchunas also noted that it’s unlikely BlackRock will purchase a tonne of Bitcoin, as seed funding is usually just enough to get the fund started.

BlackRock’s planned ETF has also been listed on the Depository Trust and Clearing Corporation (DTCC) website. The ticker will be: IBTC

This is also standard procedure for funds that are expected to launch soon.

Summing up all of the news out of the last 24 hours, Eric Balchunas had this to say:

“Def notable BlackRock is leading charge on these logistics (seeding, ticker, dtcc) that tend to happen just prior to launch. Hard not to view this as them getting signal that approval is certain/imminent.”

It’s definitely been a crazy 24 hours. Bitcoin’s price put in a god candle shortly after this news went viral, surpassing $35,000 at one point.

This is also a yearly high for Bitcoin 😎

The cat is out of the bag - BlackRock is going through the motions typical of an institution about to launch an ETF. 🐈

Imagine the reaction when approval is confirmed… 💭

TOGETHER WITH HEATBIT 🔥

If you read the Crypto Nutshell - you’re probably a fan of Bitcoin... 🤔

But unless you know what you’re doing, joining the network & mining Bitcoin is pretty complex and difficult…

Well now, thanks to Heatbit - there’s an easy way. Heatbit Mini is the world’s first and only heater-purifier that mines Bitcoin and puts $15 in your pocket monthly.

Powered by last generation silicon chips - same as iPhones and Macs to mine at 10 TH/s ⛏️

Maintains energy consumption on par with traditional appliances and operates silently 😴

Connects seamlessly to your phone to manage the heater and your mined Bitcoin 📲

Heatbit has partnered with us to offer all Crypto Nutshell readers 5% off any of their purchases. Just use the discount code: TREE

Click here to grab a heater that warms you up, purifies the air and generates you a monthly income through Bitcoin. 🚀

SEC NOW BULLISH ON ETF? 🐂

Can you feel it?

The hype surrounding a Bitcoin ETF is reaching a fever pitch. 🌡

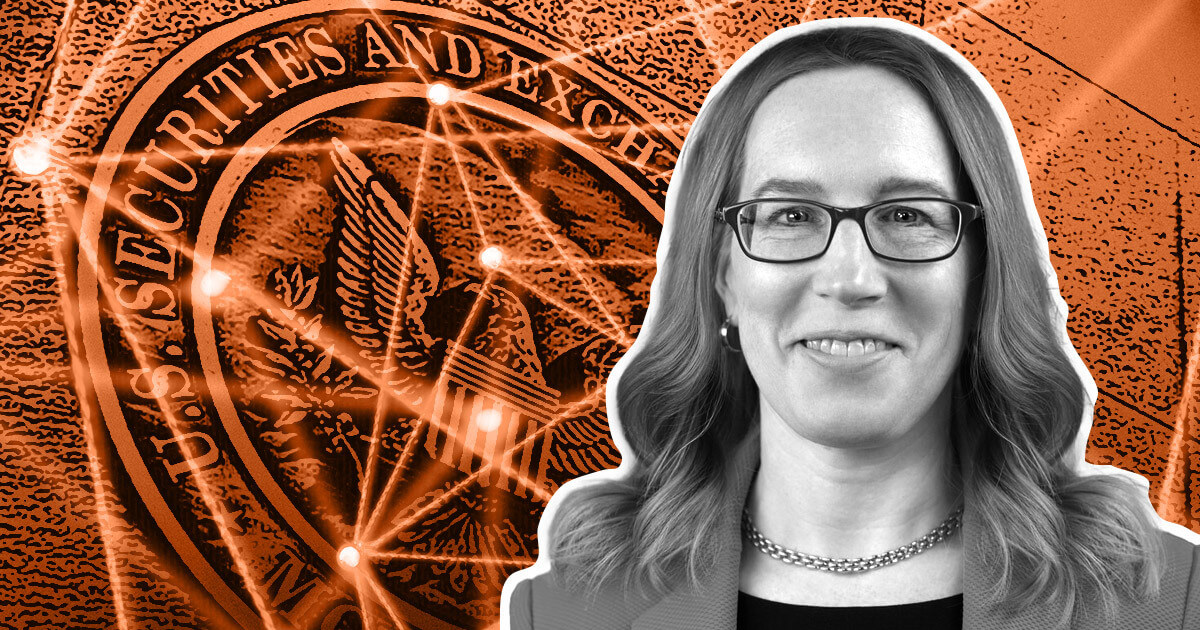

Comments made today by SEC commissioner - Hester Peirce - added fuel to the fire.

The SEC is made up of 5 commissioners, including the chairman - Gary Gensler. (the bald guy we talk about all the time)

Hester is one of these 5 commissioners.

In a CNBC interview this morning, Hester was asked about the Bitcoin ETF.

Her comments were incredibly revealing:

“I’ve been thinking we should approve one (Bitcoin ETF) for the last 5 years. The logic for why we haven’t has always mystified me.”

She also took shots at fellow commissioners:

“The agency has not been very good when it comes to Bitcoin or other crypto assets. Everyday I hope that they’ll wake up and think ‘we need to take a more productive approach.’ That hasn’t happened yet but I’m of course hoping that it will.”

Hester finished the interview commenting on the increased demand for Bitcoin products:

“We’re seeing more & more interest from firms in these products. And I hear a lot of interest from investors in these kind of products as well.”

Reading between the lines, the SEC is far from a united front when it comes to their stance on Bitcoin & crypto.

A chairman voicing her own personal support for Bitcoin on national news?

We are on the brink of an approval. 🧨

CRITICAL PRICING MODEL REACHED🤑

Yesterday we looked at the cost basis of short and long term holders.

We finished with the following:

“This is a great set-up leading into ETF approval & the Bitcoin halving. It bodes well for short-term price action.”

Bitcoin has increased by $4,000 since yesterday’s newsletter…

Looks like it boded EXTREMELY well for short-term price action 🤣

Anyway, today we’ll be taking a look at another pricing model.

With Bitcoin’s price rocketing above $34,000, it has convincingly broken through the 200-day SMA.

Here’s how this model works:

🟠Realized Price: average purchase price of all coins. During deep bear markets the spot price will be above the realized price.

🔵 200-day Simple Moving Average: a widely observed model, even in traditional financial assets. Commonly used to distinguish between bull and bear markets (calculated by taking the closing price over the past 200 days and dividing by 200)

🟩 Spot price is above both the Realized Price and 200-day SMA

When this model flashes green, it signals a return of high conviction and confidence within the market.

Taking a look at the chart above you’ll notice that the spot price has blasted through the 200-day SMA (it’s pretty much vertical).

The last time this happened was January 2023 as we recovered from the bottom. During this time Bitcoin rose from ~$17,000 all the way to ~$31,000.

Bottom Line: Another super bullish pricing model for Bitcoin.

Like yesterdays chart, this one also bodes well for short-term price action… 🚀

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Future Blueprint

Learn to do the impossible. We deliver insights and practical tools to give you AI superpowers.

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

Sponsored

Alex & Books Newsletter

Join 50,000+ subscribers and get the best 5-minute book summaries every week + my list of 100 life-changing books.

CAN YOU CRACK THIS NUT? ✍️

In 2009, what was the block reward for mining Bitcoin?

A) 25 BTC

B) 12.5 BTC

C) 32 BTC

D) 50 BTC

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) 50 BTC 🥳

In 2009, the reward for each block mined was 50 Bitcoin. After the first halving, it was 25, and then 12.5, and then it became 6.25 Bitcoin per block as of May 11, 2020. The next halving (April 2024) will reduce this reward to 3.125 Bitcoin.

GET IN FRONT OF 14,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.