Today’s edition is brought to you by RAREMINTS

GM to all of you nutcases. It’s Crypto Nutshell #580 shootin’ for the moon… 🌙🥜

We're the crypto newsletter that's more intense than a lone survivor navigating a world overrun by terrifying creatures... 🦇🌍

What we’ve cooked up for you today…

💰 The Fed holds steady

🪐 Bitcoin should be $200,000

📉 Historical lows

💰 And more…

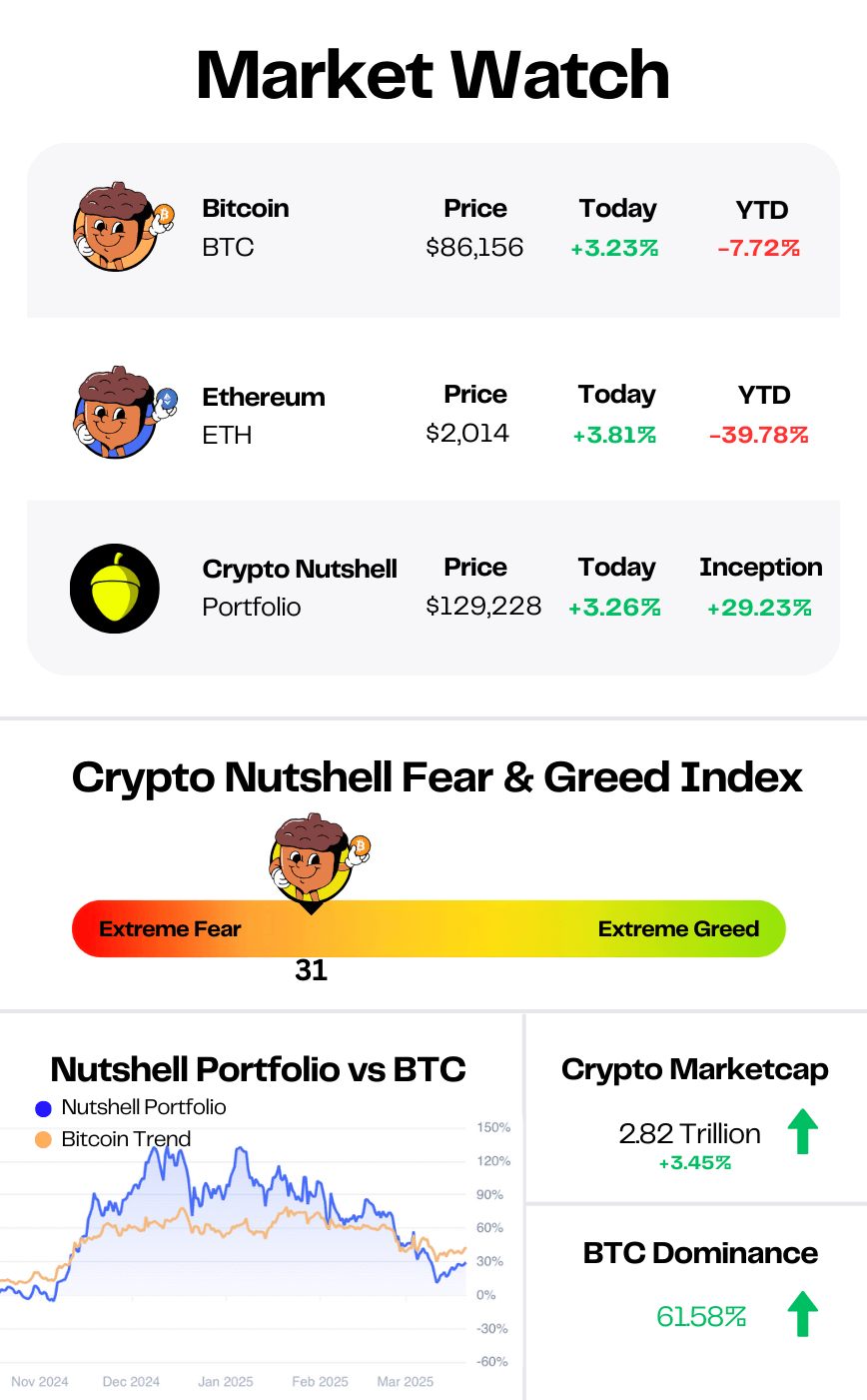

Prices as at 5:15am ET

THE FED HOLDS STEADY💰

BREAKING: Bitcoin, Ethereum and Solana Rise Alongside Stocks Following Fed Comments

No surprise here…

The Fed maintained rates at their current range between 4.25% and 4.50%.

Here’s what they had to say:

"Recent indicators suggest that economic activity has continued to expand at a solid pace… The unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated."

Continuing on, the Fed acknowledged that the market is still facing a high level of uncertainty:

"Uncertainty around the economic outlook has increased… The Committee is attentive to the risks to both sides of its dual mandate."

So why is everything up today?

During the Fed’s press conference, Jerome Powell shrugged off economic concerns, claiming that Trump’s tariffs will have a “transitory” effect on inflation.

That reassurance alone was enough to lift market sentiment…

But perhaps the bigger news came from the Fed’s stance on Quantitative Tightening (QT).

Here’s what they had to say:

"The Committee will slow the pace of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $25 billion to $5 billion."

In simple terms, QT is slowing down - which is extremely bullish for risk assets like Bitcoin and crypto.

(We broke this down earlier in the week, check that out here)

So when can we expect rate cuts?

According to CME FedWatch, there’s an 18.7% chance of a rate cut at the Fed’s next meeting on 7th May.

If rates remain unchanged in May, the probability jumps to 55.1% for the June 18 meeting.

All in all, this was a very positive Fed meeting for the markets.

With QT slowing and rate cut expectations rising, the future’s looking bright. 🚀

DISCOVER THE NEXT 100X TOKEN 💎

The Harsh Truth About Crypto: Most retail traders lose money.

While those late to the party finally get in, project founders, VCs and early investors sell their bags for millions.

That said, there are still hundreds of tokens with 100X potential, you just need to find the right ones.

Crypto is an alpha-driven industry, where those who are early gain outsized returns, often for FREE via airdrops.

If you want to join RAREMINTS exclusive community where they break down trending crypto news, hand-pick tokens with 100X potential and share ALL of their trades, click on THIS LINK here.

What to expect:

Trending news, price alerts, and exclusive alpha to stay ahead of the curve

New projects and innovations broken down in under 5 minutes

Hand-picked tokens and memecoins with 100X potential, based on historical data and macro narratives

Join for FREE before others do. Your portfolio will thank you.

BITCOIN SHOULD BE AT $200,000 🪐

With everything that has unfolded in 2025, Bitcoin should already be trading between $150,000 and $200,000.

That’s the latest bold claim out of Matt Hougan.

Matt Hougan, Chief Investment Officer at Bitwise, just did a new interview with Coindesk.

During it, he dropped this bombshell:

“These are game-changing positive developments that should put Bitcoin trading at $150,000 or $200,000 today.”

What game-changing developments is Matt referring to?

He outlines 5:

“There has been so much fundamentally positive news and it's just been buried sort of in the background... There's the Strategic Bitcoin Reserve, there's the SEC pulling back on essentially every lawsuit, there's progress on Stablecoin legislation, there's talk of market structure legislation, there was the White House crypto summit.”

So, Bitcoin should be trading at $150,000 - $200,000.

But why isn’t it?

“It's been suppressed because in the short term, this overhang of the economic uncertainty is weighing on the markets. I think if that is released, we're at new all-time highs quickly.”

Matt finished up with a prediction:

“We're on our way to where I think we'll be at the end of the year, which is Bitcoin $200,000.”

Matt & the team at Bitwise nailed their Bitcoin price prediction for 2024.

Let’s hope they nail it again in 2025. 🥂

HISTORICAL LOWS 📉

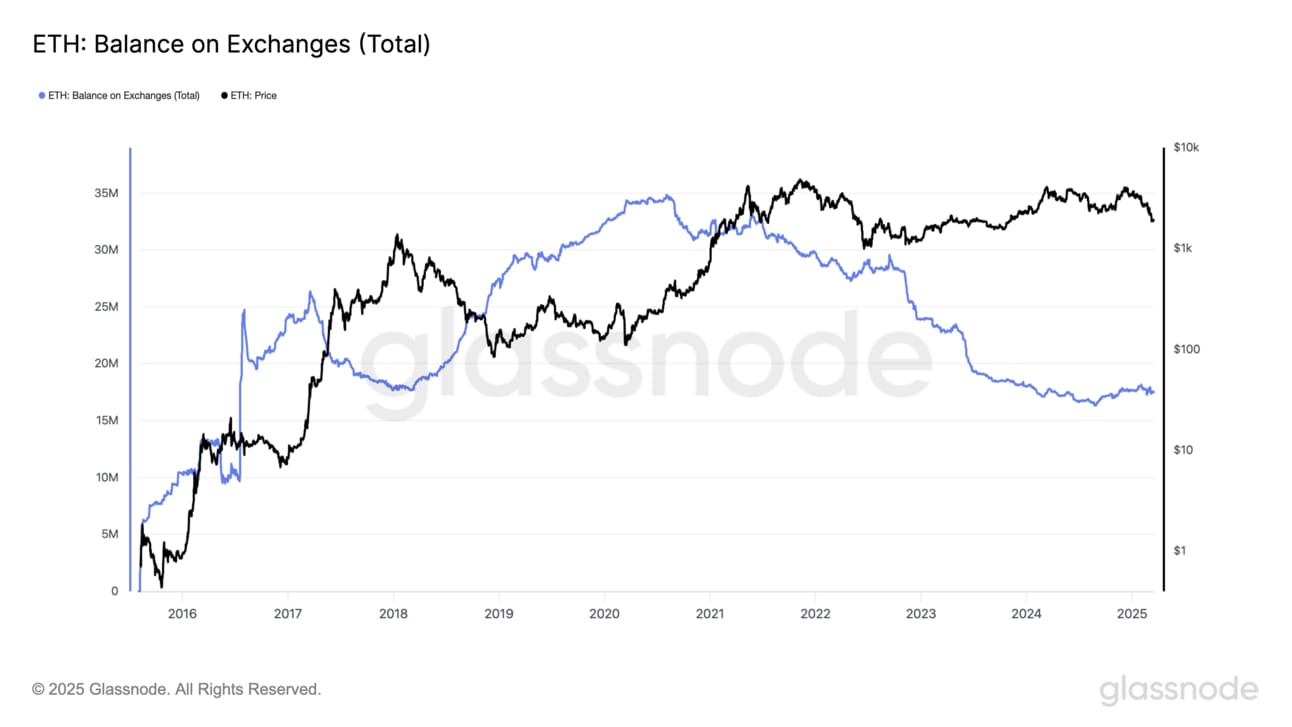

Today we’ll be checking in on the amount of Ethereum available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

According to Glassnode, there are currently 17.57 million ETH available for sale on exchanges.

That’s just 14.56% of the entire circulating supply.

What’s more, this metric has declined by 387,639 ETH over the past two weeks.

That’s a ~$791.3 million at today’s prices!

Despite growing negative sentiment surrounding ETH, this trend suggests that long-term holders aren’t budging.

But here’s the key takeaway:

ETH exchange balances are still hovering near historic lows. (A sign that supply is tightening)

Long-term holders aren’t letting go…

CRACKING CRYPTO 🥜

XRP surges 10% as Ripple claims decisive win over SEC regulations. SEC's appeal withdrawal marks a transformative moment for Ripple, setting precedent for future crypto disputes.

Minnesota senator proposes Bitcoin Act after going from skeptic to believer. Minnesota state Senator Jeremy Miller has made his state the latest to float investing in Bitcoin after he went “from being highly skeptical” to a crypto believer.

First Solana Futures ETF To Hit Markets This Week. The products are a significant step forward for the approval of a spot Solana ETF.

Bitwise CIO explains why bitcoin often reacts to moments of crisis like Trump's tariffs with 'dip then rip' pattern. While bitcoin is often referred to as a hedge asset for the longer term, it tends to pull back sharply during periods of short-term volatility.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 2012 🥳

Coinbase was founded in June 2012 by Brian Armstrong.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.