Today’s edition is brought to you by Uphold

Get started buying crypto with Uphold today. Buy, sell and swap over 300 different assets including BTC and ETH.

GM to all you crypto nuts. Crypto Nutshell #508 reelin’ it in… 🎣🥜

We're the crypto newsletter that's more exhilarating than outsmarting a high-stakes casino heist... 🎲💰

What we’ve cooked up for you today…

🇷🇺 Russia Bitcoin reserve

👑 Bitcoin to $913,067

📉 Who’s selling?

💰 And more…

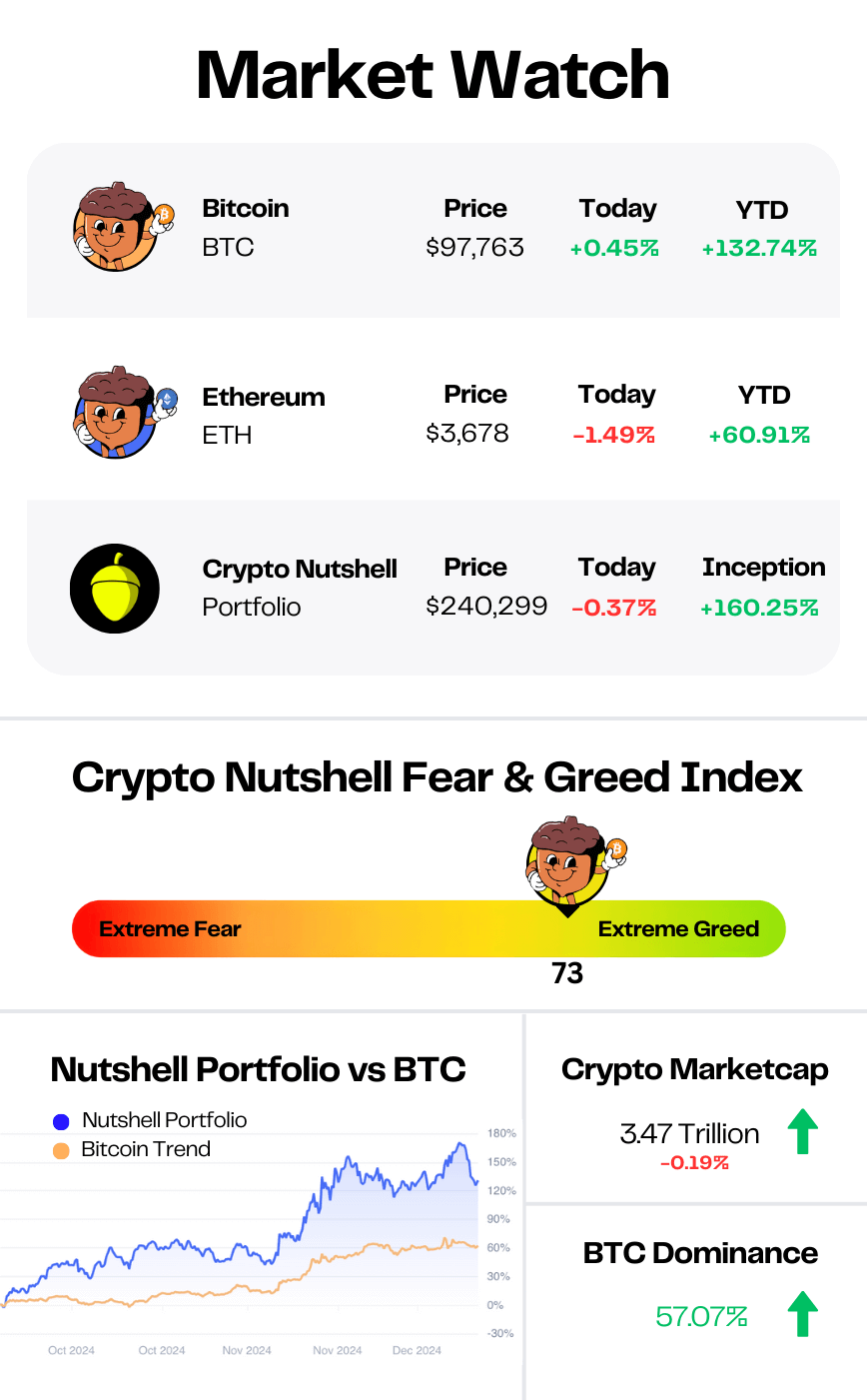

Prices as at 2:10am ET

RUSSIA BITCOIN RESERVE 🇷🇺

BREAKING: Russian Lawmaker Proposes Creating Strategic Bitcoin Reserve

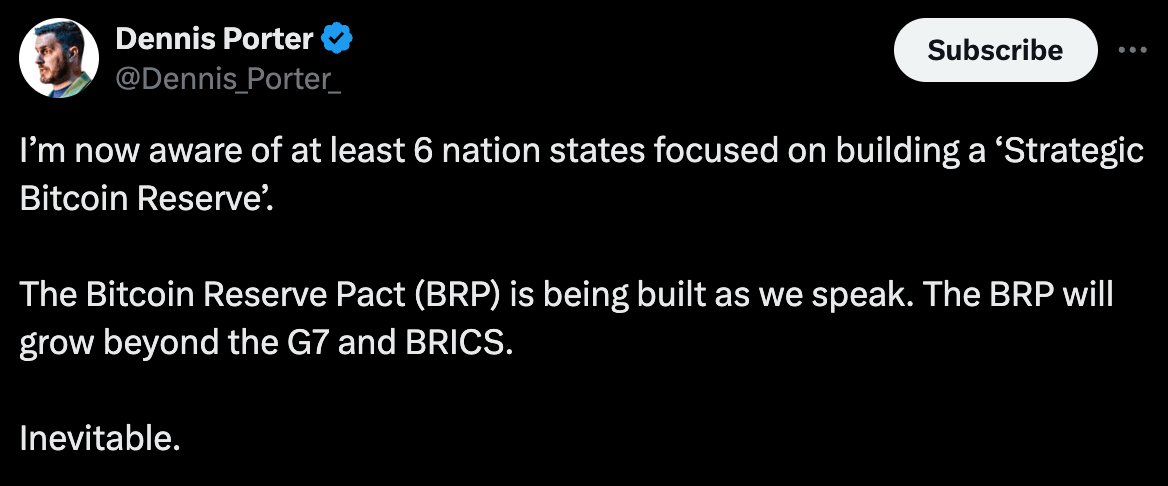

Here comes the global FOMO…

As soon as Trump and the Republicans announced plans to create a US strategic Bitcoin reserve, we knew this was coming.

Other countries weren’t just going to sit back and let the United States have all the fun.

And now Russia might be considering implementing their own Bitcoin strategic reserve.

A deputy in the Russian parliament just put forward a proposal for the creation of a Bitcoin reserve.

Anton Tkachev of the New People party asked Finance Minister Anton Siluanov to:

"Assess the feasibility of creating a strategic bitcoin reserve in Russia by analogy with state reserve in traditional currencies."

(The New People party was formed in 2020 and has 16 of the 450 seats in the State Duma)

Continuing on, Anton explains:

“In conditions of limited access to traditional international payment systems for countries under sanctions, cryptocurrencies are becoming virtually the only instrument for international trade.”

In his proposal Tkachev highlighted Bitcoin's potential as an independent asset free from international sanctions.

The creation of a Bitcoin reserve would also reduce the inflation risk associated with holding the dollar, euro, and yuan.

Even Vladimir Putin recently questioned the need for dollar reserves:

"A legitimate question: why accumulate reserves if they can be lost so easily?… For example, Bitcoin, who can prohibit it? No one.”

Global game theory is playing out before our very eyes.

The question is though…

Which G20 country will be the first to announce a Bitcoin strategic reserve? 🤔

UPHOLD: THE SMARTER WAY TO TRADE CRYPTO AND BEYOND 🤑

In today’s unpredictable markets, trust and reliability are key. Uphold offers a seamless, secure, and innovative platform for crypto trading and asset management. Here’s why over 10 million users across 150+ countries choose Uphold:

300+ Tradable Assets: Trade a wide variety of cryptocurrencies, traditional currencies, and more—all in one place.

Exclusive Early Access: Be among the first to access promising altcoins before they hit mainstream markets.

100%+ Reserve Model: Your assets are fully backed, with real-time proof of reserves updated every 30 seconds.

Deep Liquidity: Enjoy smooth trading, even during market volatility, thanks to connections with 30+ liquidity providers.

Explore curated crypto baskets tailored to trends like AI and the Metaverse, use advanced tools, and benefit from intuitive design and secure self-custody options.

Terms Apply. Don’t invest in crypto unless you're prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.

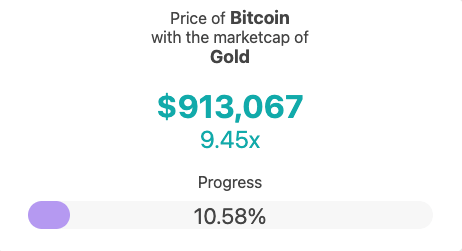

BITCOIN TO $913,067 👑

Bitcoin is on an unstoppable path to flip gold.

It’s inevitable.

That’s the latest out from Balaji.

If you’re not familiar with Balaji, he’s a top-tier entrepreneur and former CTO of Coinbase.

After leaving Coinbase, Balaji went all-in on Bitcoin and has turned that conviction into a $200+ million net-worth.

In his latest update to investors, Balaji posted this graph:

As you can see, the trend is pretty clear.

When priced in gold, Bitcoin is up & to the right.

“Bitcoin will flip gold. It’s already underway.”

Balaji’s not saying it’ll happen overnight.

After all, gold has been the heavyweight champ for thousands of years. But what he is saying is that the trend is in motion.

This begs the question: at what price would Bitcoin flip gold?

At today’s prices? $913,067.

Bitcoin’s unique properties make it superior to gold: it’s portability, verifiability, scarcity, and ease of transfer.

It only makes sense it will one day flip gold.

So buckle up, because when Bitcoin eventually takes that crown, the world will never be the same. 👑

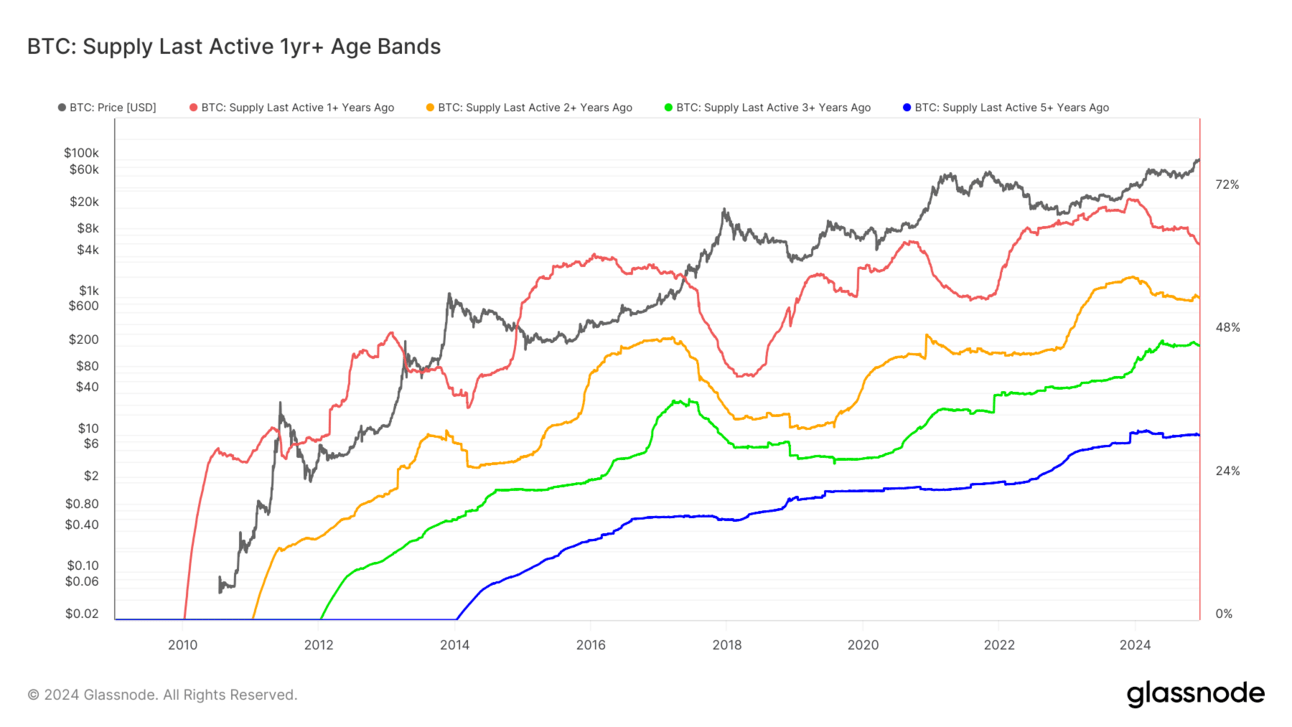

WHO’S SELLING? 📉

Time for a check in on one of our favourite charts.

The supply last active 1+ years ago metric is super simple to understand and extremely useful.

It categorises coins based on how long it’s been since they last moved on-chain. (As a percentage of the circulating supply)

Metrics rising: long-term holders are accumulating coins 📈

Metrics declining: long-term holders are selling coins 📉

Here’s the breakdown for each cohort (compared to what it was 2 weeks ago):

🔴 Supply last active 1+ years ago: 62.94% (down from 63.17%)

🟠 Supply last active 2+ years ago: 53.93% (down from 54.18%)

🟢 Supply last active 3+ years ago: 45.96% (down from 46.10%)

🔵 Supply last active 5+ years ago: 30.93% (down from 31.10%)

As you can see, all four cohorts experienced minor declines over the last two weeks.

Which goes hand in hand with what we explained on Monday.

Long-term holders are currently selling off some of their coins.

But…

A majority of this sell-off is coming from the youngest long term holders. Those who have held Bitcoin for less than 1 year.

(Long-term holders are categorised as those who have Bitcoin for more than 155 days)

And whilst there is a small amount of selling coming from the “older” long-term holders, it’s still relatively minor.

We maintain our position that a true top signal is categorised by substantial selling of long-dormant Bitcoin.

Which still hasn’t happened…

CRACKING CRYPTO 🥜

Google's Willow quantum chip brings Bitcoin security debate 10 years closer. The advent of Willow raises questions about the urgent need for post-quantum protection within Bitcoin's framework.

JPMorgan raises price targets on Bitcoin mining stocks. The increases partly reflect a "HODL premium" akin to MicroStrategy's, the analysts said.

Largest altcoin liquidation since 2021 hits amid crypto market selloff. Altcoins led a cryptocurrency market-wide selloff with $1.58 billion in liquidations, as Ether, Solana and Cardano prices dropped sharply.

BlackRock's Bitcoin ETF Drops Most in 4 Months Amid Quantum Computing FUD. IBIT fell 5.3% Monday as Google announced a quantum computing chip.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Twice weekly Bitcoin news

Crypto Pragmatist (link) - Actionable alpha 3x a week

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

In order to comply regulations, crypto exchanges must gather specific information about their customers. This process is typically known as:

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) KYC 🥳

Crypto KYC, or Know Your Customer, is the process of verifying a user's identity when joining a cryptocurrency exchange.

GET IN FRONT OF 64,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.