GM and welcome to The Crypto Nutshell! 🫶 🥜

The crypto newsletter less intense than running an illegal betting operation in 1920s Birmingham...🎩💰

Today, we’ll discuss:

Recapping the last 24 hours in the world of crypto 🌏

Crypto Expert outlines the MOST important date for Bitcoin 🤑

Bitcoin HODL waves 🏄♂️

And more…

MARKET WATCH ⚖️

BTC Dominance is currently at 50.44% and the current crypto market cap is $1.17T ▲0.25%

BTC Dominance YTD

Biggest Winners of The Day 🤑

Shiba Inu (SHIB) ▲8.27%

Toncoin (TON) ▲4.33%

Dogecoin (DOGE) ▲2.24%

Biggest Losers of The Day 😭

Chainlink (LINK) ▼1.10%

Cardano (ADA) ▼0.45%

Polygon (MATIC) ▼0.35%

All price data as of 7:05am ET

Only the top 20 coins measured by market cap feature in this section

SEC DELAYS ETF DECISION 🧑⚖️

JUST IN: SEC delays decision on ARK Invest spot Bitcoin ETF

To the surprise of absolutely no one… The United States Securities and Exchange Commission has delayed its official decision on a spot Bitcoin ETF submitted by ARK Invest. 🥱

The next date to look out for? January 2024 is the new deadline to reach a final decision.

If you remember a few days ago we reported that Cathie Wood was expecting this to happen and for the SEC to approve multiple ETF applications at the same time.

Turns out she’s correct… 🔮

EXPERT OF THE DAY 💰

This crypto expert believes that investors shouldn’t get excited until THIS date.

There are currently 8 outstanding spot Bitcoin ETF applications. Coming from the likes of institutions such as ARK Invest, 21 Shares, Fidelity and the big boy in the room - BlackRock. 🎩

Today’s crypto expert, Mark Yusko, believes that the first one to be approved will be BlackRock. This is despite the other applications being at the front of the line.

Mark Yusko is Founder, CEO and Chief Investment Officer at Morgan Creek Capital Management - which has billions of dollars under management.

He has decades of experience working in financial markets, so suffice to say - he knows his stuff. 🤓

In an interview yesterday, Mark broke down why he believes the only deadline investors should be looking at is the decision deadline on the BlackRock spot Bitcoin ETF.

His prediction is already playing out as correct. Last night, the SEC delayed their decision on the ARK Invest spot Bitcoin ETF, which was first in line. (Something we also predicted was the most likely outcome earlier in the week at a 95% chance!)🔮

I really do believe BlackRock will be first.

This prediction becomes more interesting as Yusko is a shareholder of 21 Shares. (which is also further ahead in the line for approval than BlackRock.)

It would be to Marks benefit if their spot Bitcoin ETF was approved first. Yet he argues the first approval is going to be BlackRock. 🤔

Why?

Because BlackRock are the G’s of the finance world.

Not only are they the largest & most influential asset manager in the world - they ALSO have a 99.826% win percentage with their previous ETF filings. (575 wins to 1 loss) 🏆

So the REAL date to watch out for?

March 16, 2024 - the SEC deadline for decision on BlackRocks Spot Bitcoin ETF.

P.S Yusko then went on to reveal that according to his Metcalfe’s Law Bitcoin pricing model, the fair value of Bitcoin at the April 2024 halving will be $100,000. 😮

Nutty’s takeaway: If you’re wondering why there’s such a big deal being made about an approval for a spot Bitcoin ETF, let’s break it down.

A good comparison is when the first spot gold ETF got approved in 2004. In the years that followed, the price of gold increased by a whopping 360%! 🚀

A spot Bitcoin ETF opens the door for the big boys to start buying up Bitcoin. If we saw such a huge move upwards with gold, the mind boggles at what that could do for Bitcoin… 💭 🥳

ON CHAIN DATA DIVE 📊

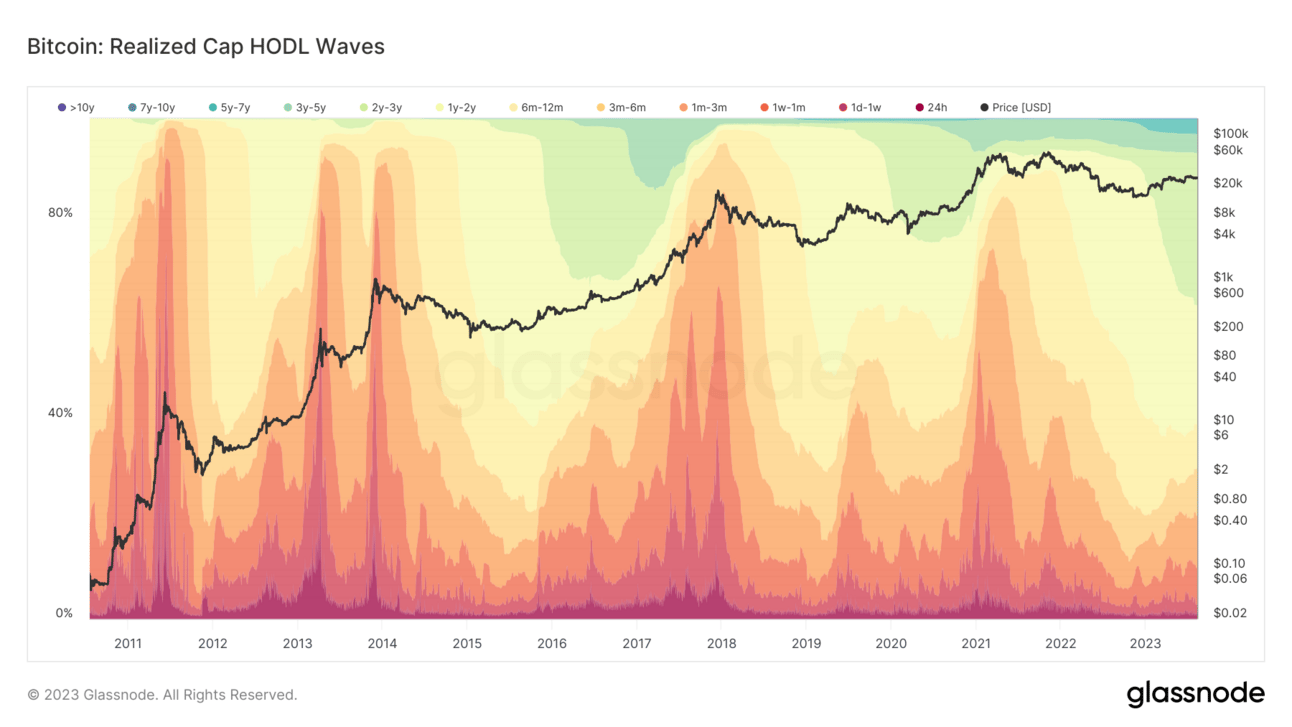

Today we’ll be going over this funky looking chart, known as the Realized Cap HODL Waves.

First things first, we need to know what Realized Cap means.

Realized Cap is the value of every Bitcoin at the last time it was moved. For example if I were to buy Bitcoin today, my cost basis would be ~$29,400 (price of BTC at time of writing).

Realized cap can be thought of as the collective cost basis for all Bitcoin owners. This chart takes the classic HODL Wave chart and displays how much each age band is contributing to the total Realized Cap.

The colors:

🔴 - Short term holders (1 day to ~1 month)

🟡 - Medium term holders (6 months to 12 months)

🟢 - Long term holders (1 year+)

Do you notice the pattern in this chart?

There’s a sharp increase in the short term holders (red shades) exactly where the price tops out… That’s pretty interesting. 🤔

This is because the long term holders (green shades) have now held there coins long enough, to the point that they are comfortable taking profits.

But who are these long term holders selling to?

They’re selling to new buyers who probably just heard about Bitcoin on the news or their friend told them it’s an easy way to get rich quick… 🤑

Once the price starts dipping from this peak, the amount of long term holders starts to grow again and the cycle repeats.

Bitcoin is a unique asset in that we can visualise this data and understand the behaviours of different investor groups. We can recognise the top of the bull run easily by looking at the sharp increase in short term holders. 🐂

This chart can also acts of as a FOMO (Fear Of Missing Out) indicator. We can see when people that think of it as a get rich quick scheme enter the market and crumble when the price drops. The smart move is to buy in periods that are dominated by longer term holders.

Nutty’s Takeaway: We love this chart, it’s a super easy way to visualise the current state of the market. Taking a look at today, long term holders dominate the market. If history repeats itself, now is the perfect opportunity to keep accumulating Bitcoin or enter the market if you are keen on getting in.

But always remember to: Do Your Own Research… 📝

CRACKING CRYPTO 🥜

TRIVIA TIME ✍️

Who wrote Ethereum's whitepaper?

A) Satoshi Nakamoto

B) Charles Hoskinson

C) Vitalik Buterin

D) Peter Schiff

Find out the answer at the bottom of this newsletter 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) Vitalik Buterin 🎉

Ethereum was initially described in late 2013 in a white paper by Vitalik Buterin, a programmer and co-founder of Bitcoin Magazine, that described a way to build decentralized applications.

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.