GM. Crypto Nutshell dropping in! 🫶 🥜

The crypto newsletter more exciting than a professor traveling through time in a British police box... 🕰️📞

Today, we’ll discuss:

Coinbase vs the SEC 🥊

Bitcoin ETF will open the floodgates 🌊

One chart to keep an eye on 👀

And more…

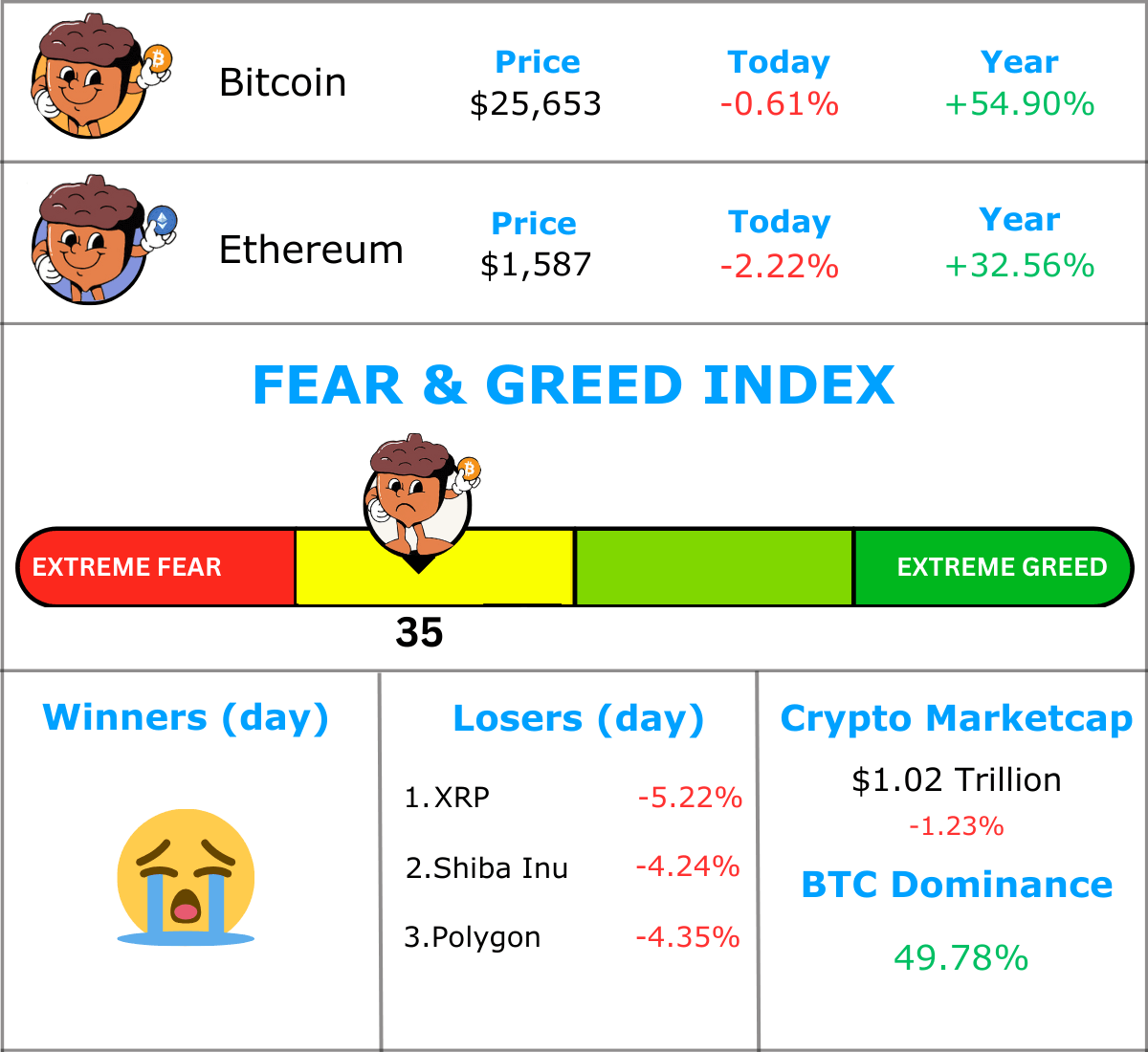

MARKET WATCH ⚖️

Prices as at 7:30am ET

Only the top 20 coins measured by market cap feature in this section

COINBASE VS THE SEC 🥊

JUST IN: It 'would certainly help' if Gary Gensler were no longer SEC chair says Coinbase CEO

TLDR: Coinbase CEO Brian Armstrong has come out swinging, saying that one way his company’s dispute with the SEC could get resolved is if Gary Gensler is replaced with someone else. 😲

Earlier this year the SEC sued Coinbase for operating as an unregistered exchange. Basically the SEC has said that Coinbase allowed the sale of certain crypto tokens that they consider to be securities - and therefore come under their jurisdiction.

But what constitutes a security? 🤔

That’s the big question and key to this case.

Brian Armstrong has been very public about his opposition of the lawsuit stating:

"I do think the leadership there has taken a very hostile view towards crypto ... regulation by enforcement posture instead of just engaging in rulemaking as they're required to by law… maybe next year we'll have a different SEC chair"

Checkout the full article here

ETF WILL OPEN THE FLOODGATES 🌊

Michael Saylor believes that the coming spot Bitcoin ETF is a “monstrous offering” that will unleash trillions upon Bitcoin. 🌊

Michael Saylor is arguably the king of Bitcoin.

This past weekend, he joined Crypto Banter to discuss what he believes is the game changing catalyst.

The spot Bitcoin ETF.

Saylor knows the investment and financial world intricately well.

You don’t become a billionaire without understanding it.

Not only does Saylor believe that the ETF will open the floodgates to Bitcoin, but he’s also highly confident in its approval. 👍

In fact Saylor doesn’t think it’s a matter of IF a Bitcoin ETF get’s approved but when it gets approved.

“That's what happens when you get to an ETF. That will plug every major bank, every investment bank, all the money managers, all of the conventional Wall Street players into the asset class immediately.”

He is confident approval will come either in Q4 of 2023 or Q1 of 2024.

Is it just us, or does the impact of a spot Bitcoin ETF seem to be underestimated?

With Bloomberg ETF analyst Eric Balcunhas estimating an ETF will bring $150 billion to Bitcoin and Saylor saying it will unleash trillions upon BTC…

That’s a lot of money for a $500 billion dollar asset.🚀

ONE CHART TO KEEP AN EYE ON 👀

Today we’ll be taking a look at Bitcoin’s Adjusted SOPR (Spent Output Profit Ratio). Using this metric we can get an idea of the general profitability of the market (or losses).

You can think of this metric as simply price sold divided by price paid. The “adjusted” part of the metric means that we ignore coins younger than an hour.

Also the cool thing about SOPR is that every transaction has equal importance, meaning that transaction volume’s don’t significantly impact this metric.

Values above 1: majority of transactions are being made at a profit 🤑

Values below 1: majority of transactions are being made at a loss 😢

Rising SOPR: bull market indicator 🐂

Declining SOPR: bear market indicator 🐻

As of today SOPR is currently at 0.9925. So on average the market is experiencing net losses. 😥

We’ve recovered from the cycle low in December 2022 (green arrow) when SOPR was only 0.937. It’s also important to point out that we also briefly dipped below 1.0 back in March 2023.

Going forward we recommend keeping a close eye on this metric. If it continues to decline, we could see further price dips. Although that wouldn’t be unexpected (checkout yesterday’s edition for why).

Another thing we’d just like to point out. On this chart we’ve put in a green line (1.14) and a red line (0.93). It’s interesting to see that the last two bull markets have topped out at 1.14 and the last three bear markets have bottomed out at 0.93… 🤔

CRACKING CRYPTO 🥜

CAN YOU CRACK THIS NUT? ✍️

Instead of storing money, Bitcoin wallets store something called “ _____”.

A) Coins

B) Tokens

C) Data sets

D) Keys

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) Keys 🥳

Bitcoin wallets are totally different from physical wallets. Instead of storing money, Bitcoin wallets store something called “ keys”. Checkout this video for more.

HOW DID WE DO? 🤷

Let us know you’re thoughts by clicking one of the options below.

We read every comment submitted in this poll and love to hear what you guys have to say. 😁

Bonus points for any feedback or content suggestions you may have

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.