GM to all 19,245 of you. Crypto Nutshell #144 floatin’ by. 🦦 🥜

The crypto newsletter that's as action-packed as a spy with a license to kill... 🕶️🔫

🤔 Why did XRP just explode?

🥊 How to beat Bitcoin by 250%

💪 Bitcoin halving gains

💰 And more…

MARKET WATCH ⚖️

Prices as at 5:30am ET

Only the top 20 coins measured by market cap feature in this section

XRP EXPLODES - BUT WHY? 🤔

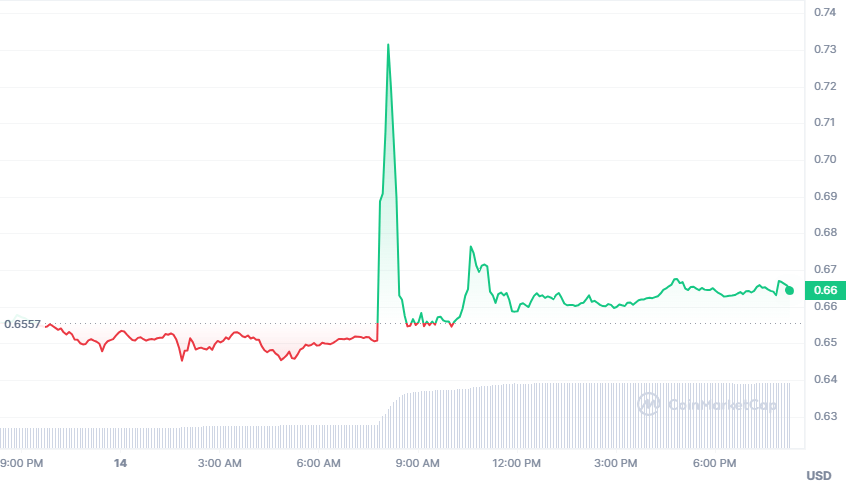

Breaking: BlackRock denies plans for XRP ETF after false filing sparks rumours

A recent BlackRock filing suggested that the asset manager was set to launch an XRP ETF.

But this was quickly shutdown by ETF expert Eric Balchunas who confirmed the filing was fake…

The news of this filing quickly began circulating around crypto twitter. Similar to the fake BlackRock ETF approval not long ago by CoinTelegraph.

The price of XRP immediately shot up 12% to $0.73 within 30 minutes of the news breaking.

However this pump was short lived as the filing was confirmed fake. XRP lost all of its gains returning back to $0.66 at the time of writing.

The reason why this filing was semi believable was due to BlackRock recently filing for an Ethereum ETF.

Clearly BlackRock intends to expand beyond Bitcoin, so an XRP ETF wasn’t that much of a stretch…

BUT this false filing did cause some to start doubting the legitimacy of BlackRock’s Ethereum ETF application.

But our trusty ETF expert James Seyffart reassured everyone that the Ethereum ETF filing is 100% real.

Another day, another pump and dump in the world of crypto. 😂 😔

TOGETHER WITH VENTURE SCOUT🤑

Check out these returns from IPO to September 2021:

Google (Alphabet) 64.24x

Netflix 550.47x

Facebook 9.02x

Question: What do these companies all have in common?

Answer: They’re all software companies.

Software companies, in our opinion, offer the highest potential returns to investors. (outside the world of crypto 😉)

The problem?

Keeping up with software startups is f*cking difficult.

The SAAS world is practically impossible to keep up with.

That’s why we read Venture Scout.

It’s a high quality weekly report on all the latest and greatest software startups, so you can keep a finger on the pulse of one of the greatest opportunities of our generation.

The best part? Just like us, their reports are completely free.

Subscribe now by hitting that big subscribe button below, there’s really nuttin’ to lose. 🥜

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

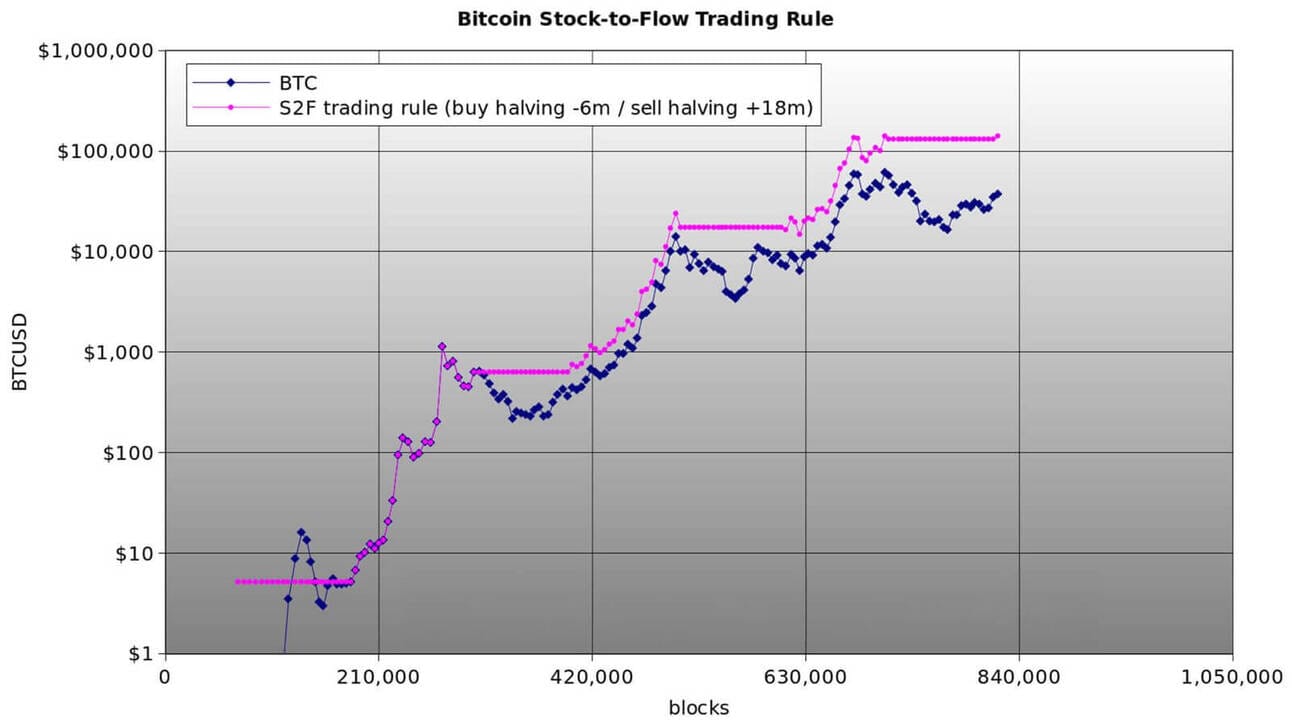

HOW TO BEAT BITCOIN BY 250%🥊

3 months ago, we covered a trading strategy that out returns Bitcoin by 250%.

The best part? It’s so dead simple - even a monkey could do it. 🐒

The strategy was outlined by the anonymous on-chain analyst, Plan B.

Plan B is the mastermind behind the infamous Stock2Flow Bitcoin valuation model.

Its accuracy earned him a following of close to 2 million crypto investors.

Plan B’s trading strategy is dead simple:

Step 1: Buy Bitcoin 6 months before the Bitcoin halving

Step 2: Sell Bitcoin 18 months after the Bitcoin halving

That’s it. If you had invested $5 in Bitcoin from it’s start, here’s the difference in returns:

Buy & hold strategy: $5 ➡ $37,000

Plan B’s trading strategy: $5 ➡ $130,000

An outperformance of 250%. Insane. 😱

Why does this work?

All Bitcoin’s price action concentrates around the halving. By buying 6 months before and selling 18 months after, you do 2 things:

You avoid the crypto winter ❄

You enjoy the bulk of the bull-market 🐂

Why did we bring up this rule again?

Because the ‘buy’ price for this trading rule is now locked in. 🔒

With under 6 months to go until the halving, an investor following this rule would’ve bought Bitcoin on October 18th.

The price of Bitcoin on October 18? $28,500

Meaning in under a month, the trading strategy is already up 28% 👏

Plan B’s trading strategy expects Bitcoin to peak ~18 months after the halving. Around October 18, 2025.

We will continue checking in to see how it’s performing. 🫡

Bottom Line: Trading strategies like this are fascinating to follow, but a word of warning before you try it out. Strategies and trading rules are easy to make work retroactively.

Once you have all the data of the past, you could come up with any strategy to far surpass the returns of an asset. Strategies & trading rules work perfectly up until they don’t. ❌

Although historically this rule has out-performed Bitcoin, there’s no guarantee that it will continue into the future. With the added catalyst of ETFs and institutions coming into the space, we suspect many pricing models & trading strategies are going to break. 💔

We will forever stand by the tried and true, buy & HODL strategy. 🫡

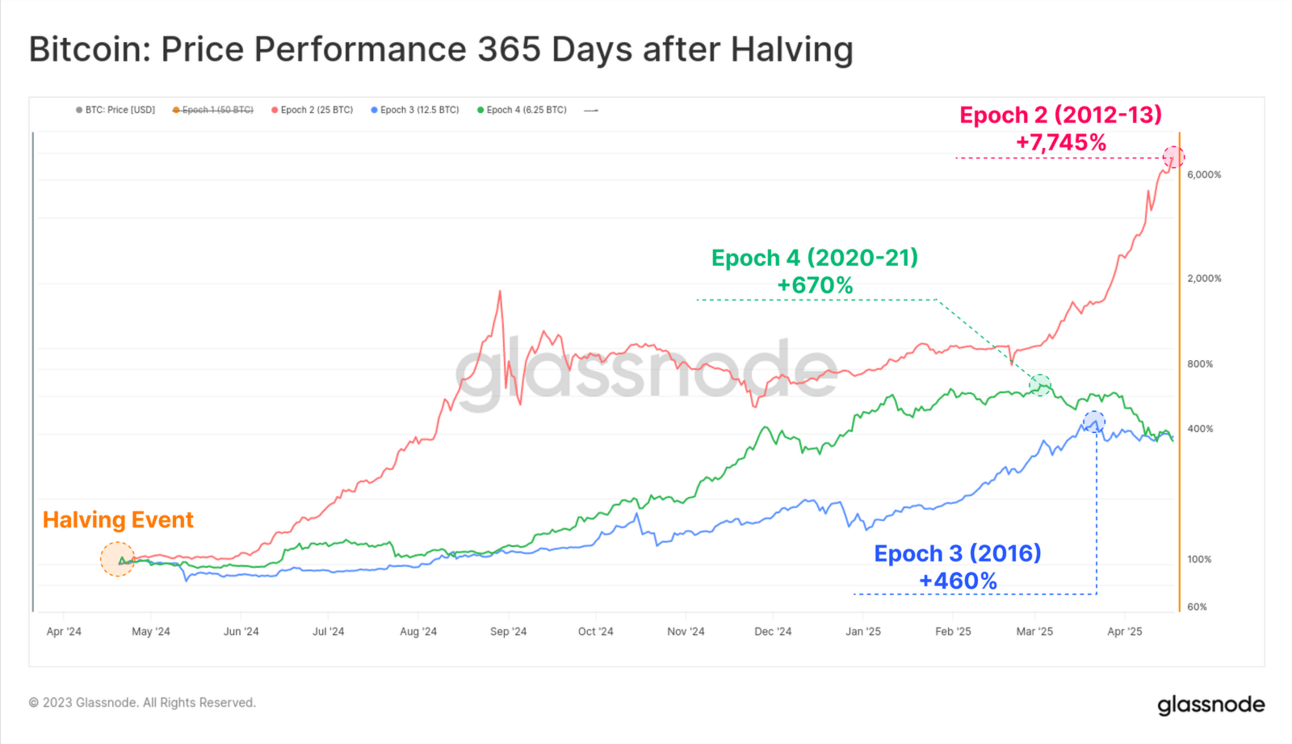

BITCOIN HALVING GAINS 💪

Let’s dive a little deeper and see just how crazy the returns are following the halving…

As a quick refresher, Bitcoin’s initial block reward (what miners receive) was set to 50 Bitcoin.

Every 210,000 blocks (roughly 4 years) the halving occurs meaning block rewards are cut in half.

The chart below outlines Bitcoin’s price performance 365 days after the halving.

Halving 1 🔴

Date: 28 November 2012

Block number: 210,000

Block reward: 25 Bitcoin

Price performance peak: +7,745%

Halving 2 🔵

Date: 9 July 2016

Block number: 420,000

Block reward: 12.50 Bitcoin

Price performance peak: +460%

Halving 3 🟢

Date: 11 May 2020

Block number: 630,000

Block reward: 6.25 Bitcoin

Price performance peak: +670%

The next Bitcoin halving will cut the block reward down to 3.125 Bitcoin.

Now there’s no denying that these price gains are crazy.

But keep in mind we only have three data points… So who knows what could happen with the upcoming halving.

By breaking down Bitcoin’s price performance post halving, you can really understand why so many are hyped for what’s about to come. 😎

Click here for a live halving countdown. ⏰

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Alex & Books Newsletter

Join 50,000+ subscribers and get the best 5-minute book summaries every week + my list of 100 life-changing books.

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

Sponsored

Stock Market Rundown

Your 3-minute morning read with an amusing angle on business and the stock market. Learn, laugh, stun your friends with your knowledge.

CAN YOU CRACK THIS NUT? ✍️

When was the first Bitcoin transaction performed?

A) October 11, 2009

B) May 22, 2010

C) January 12, 2009

D) October 31, 2008

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) January 12, 2009 🥳

On January 12, 2009, the well-known Hal Finney and Satoshi Nakamoto make history by performing the first Bitcoin transaction in history. Nakamoto sent Hal a total of 10 BTC, in a transaction that was recorded for history in block number 170 of the blockchain.

GET IN FRONT OF 19,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.