Today’s edition is brought to you by Crypto.com

Start earning up to 5% back on all your spending! No annual fees. Sign up for the Crypto.com Visa Card today to receive your instant $25 bonus!

GM to all 85,125 of you. Crypto Nutshell #521 anchorin’ down… ⚓ 🥜

We're the crypto newsletter that's more heart-pounding than escaping a relentless terminator from the future... 🤖🔥

What we’ve cooked up for you today…

🏦 Here come the crypto ETFs

🤡 How to stay poor forever…

💪 Holding on

💰 And more…

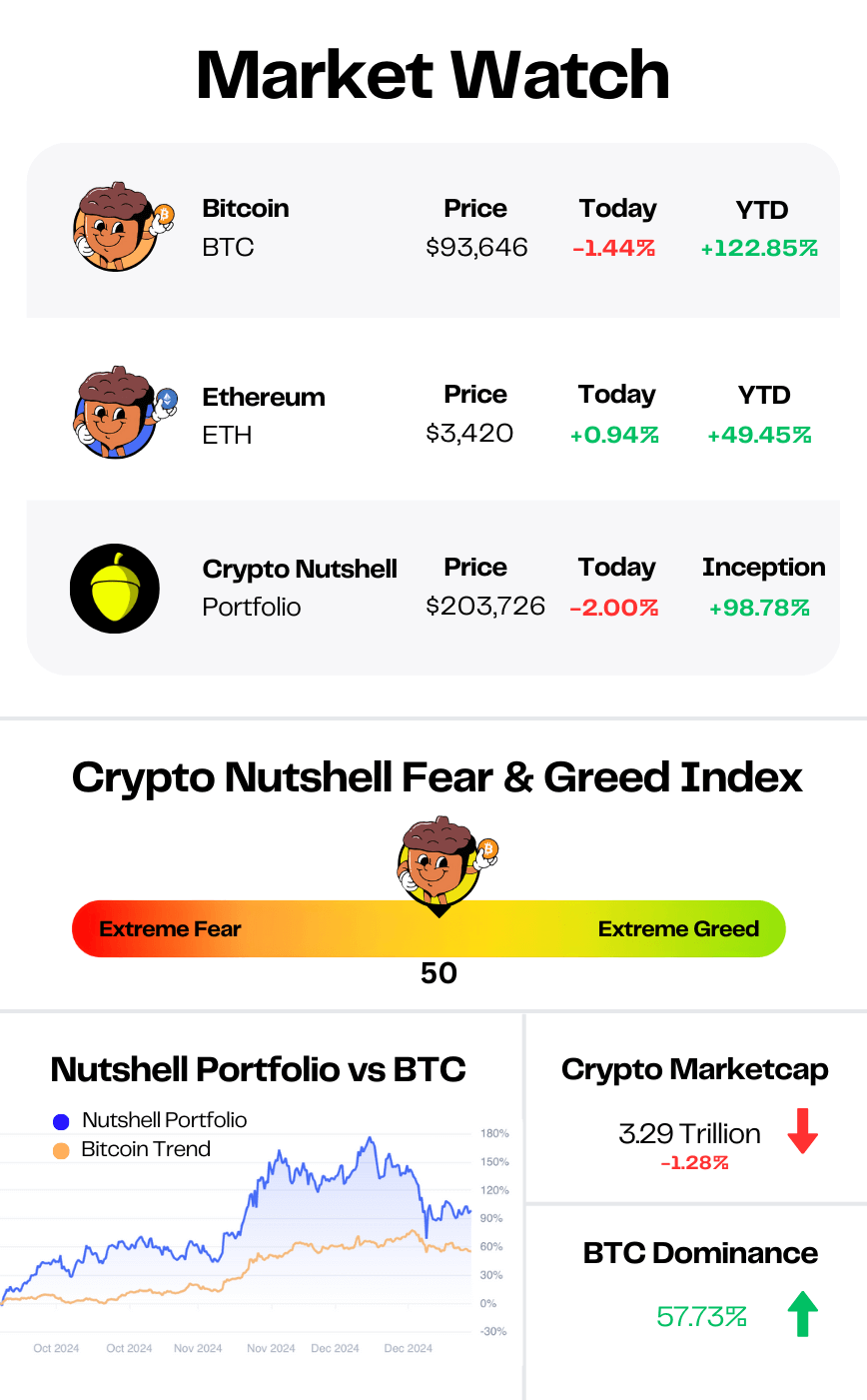

Prices as at 2:00am ET

HERE COME THE CRYPTO ETFs 🏦

BREAKING: Volatility Shares files for Solana futures ETF, despite lack of Sol futures products

Last week we mentioned that Vivek Ramaswamy’s Strive filed for a Bitcoin Bond ETF.

Since that filing, Strive made a very interesting statement on Twitter:

“Strive's first of many planned Bitcoin solutions will democratize access to Bitcoin bonds, which are bonds issued by corporations to purchase Bitcoin. We believe these bonds provide attractive risk-return exposure to Bitcoin, yet they are not available to be purchased by most investors.”

But it gets even juicier:

“Since our inception, Strive has called out the long-term investment risks caused by the global fiat debt crisis, inflation, and geopolitical tensions. We strongly believe there is no better long-term investment to hedge against these risks than thoughtful exposure to Bitcoin.”

And now we have even more crypto ETF filings.

Volatility Shares (~$2.38 billion in AUM) has filed for 3 new ETFs that would gain exposure to Solana futures contracts.

But here’s the thing…

Currently Solana futures don’t even exist.

Here’s what ETF analyst Eric Balchunas had to say:

“This is wild. Solana futures ETF filing before Solana futures even exist! Hard core.. And probably a good sign Solana futures are on the way which arguably bodes well for spot odds. And this was supposed to be a quiet week!”

Here’s why this is important:

Volatility Shares were one of the asset managers that really pushed the SEC on Ethereum futures ETFs.

If you remember back then, Ethereum futures ETFs were approved before the Ethereum spot ETFs.

So this is a good sign that Solana spot ETFs are just around the corner.

Finally, in other news…

Michael Saylor continued his Sunday ritual of posting a screenshot of SaylorTrack.com.

For the last 7 weeks, Saylor has been posting a screenshot similar to the one above before announcing another major Bitcoin buy on the Monday.

So it looks like another Bitcoin purchase announcement will be coming out shortly…

START MAKING EVERY TRANSACTION COUNT 💳

If you haven’t got a crypto card yet, you’re living in the past.

With a Crypto.com Visa Card you can spend your crypto anywhere you want.

The benefits are insane.

Not only is there NO monthly or annual fee, you also get up to 5% back on every transaction.

With your Crypto.com Visa Card you can:

Enjoy 100% cashback on Spotify, Netflix, and Amazon as a new customer. 🍿

Get complimentary access to airport lounges and elevate your travel experience. ✈️

Flaunt your style with the sleek and stylish metal card 🌟

Here’s how to get your $25 bonus and start earning up to 5% back:

Click here to Download the Crypto.com App

Sign Up: Use our referral code - Nutty - for your instant $25 bonus.

Get Your Crypto.com Visa Card: Start making transactions, earning rewards, and enjoying the perks!

Start making every transaction count - the future is here.*

HOW TO STAY POOR FOREVER 🤡

You will work 100,000 hours of your life in the pursuit of money.

You should invest 100 hours in figuring out how to keep your money.

If you don’t, you’ll likely die poor.

That’s the latest warning out from Michael Saylor.

In Saylor’s latest interview, he had some words of advice for Bitcoin holders.

First off, you need to realise this is the first time in history that humans have created perfect money:

“My advice for people is: Bitcoin is digital capital. In 100,000 years we finally came up with perfect money.”

Saylor then acknowledged that the system is not set up for you to win:

“The system is constructed to take all your money away from you unless you get really smart about economics.”

Keep in mind, this is coming from a self-made billionaire.

In a world rigged against you, what’s the solution?

“You will work 100,000 hours in your life as a student and as a laborer to make money… I would say a rational thing to do is invest 100 hours to figure out how to keep your money.”

After investing 100 hours into understanding how to keep your money, you’ll likely reach the same conclusion as Saylor and millions of others:

In a rigged game designed to keep you losing, Bitcoin is your cheat code. 🎮

HOLDING ON 💪

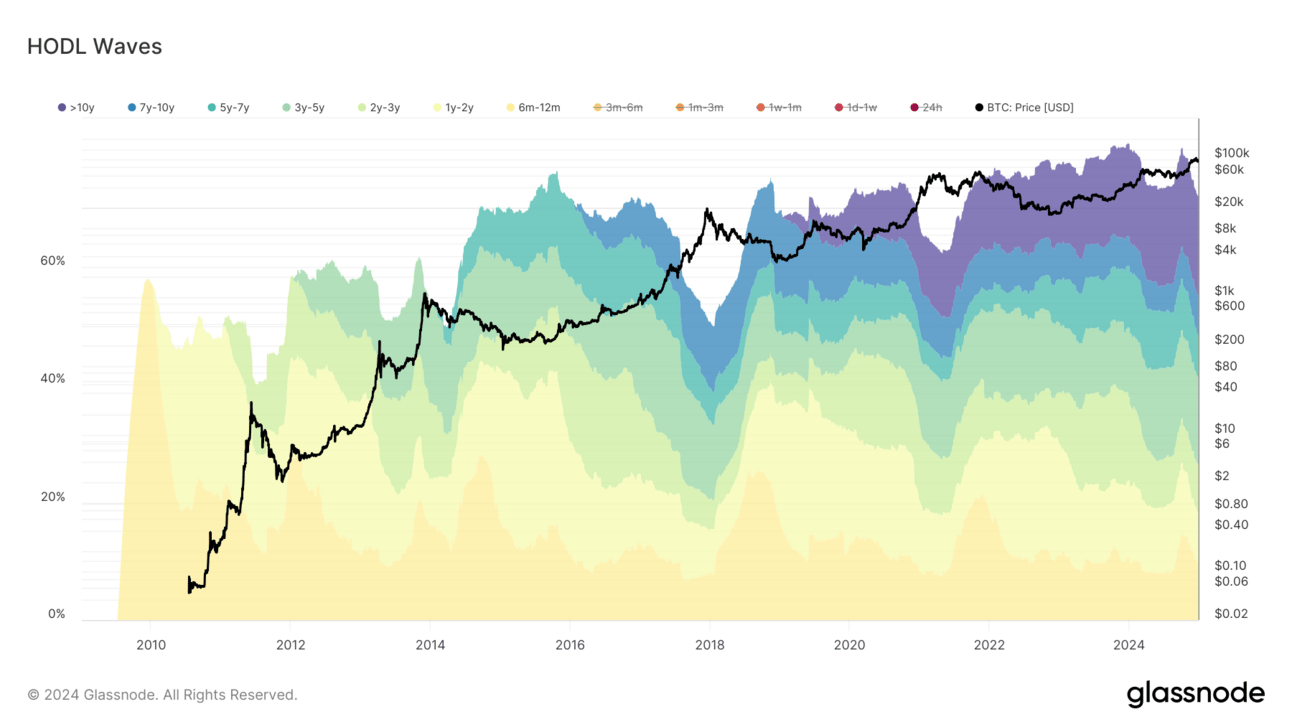

Let’s kick off the week with a checkin on the Bitcoin HODL waves! 🌊

Each coloured band shows the percentage of Bitcoin that last moved within that time period.

As the colours get cooler, the age bands get older (purple being the oldest, representing coins last moved more than 10 years ago).

As always, we’ll be focusing on long-term holders today. (coins held for more than 6 months)

Here’s the breakdown:

6m - 12m: 9.75%

1y - 2y: 8.73% down

2y - 3y: 8.08% up

3y - 5y: 14.76% down

5y - 7y: 7.13% down

7y - 10y: 6.77% up

>10y: 16.87% up

That means that ~72.09% of the Bitcoin supply has NOT moved in over 6 months.

Over the past two weeks, the amount of long-term holders has fallen by ~1.07%

But here’s the thing…

As we explained last week, the majority of this decrease has come from “younger” long-term holders.

More specifically, we’re once again talking about coins held for between 6 and 12 months.

Over the past two weeks, the 6m - 12m age band fell by ~0.60%

Whilst, coins held for longer than 7 years has increased by 0.20%

Ultra long-term holders STILL aren’t ready to let go of their coins just yet.

They are clearly holding out for higher prices…

CRACKING CRYPTO 🥜

Pig butchering scams top 2024 crypto fraud with $3.6 billion in losses. Cyvers traced $3.6 billion in stolen Ethereum funds to pig butchering scams, urging enhanced security measures and real-time monitoring.

Bitcoin may reach $150K or $400K in 2025, based on SBR and Fed rates. Bitcoin’s potential price range in 2025 is quite significant, but it bears down to three major factors, according to the crypto mining firm Blockware.

Bitcoin Kimchi Premium Spikes as South Korea's Political Turmoil Escalates. The South Korean won hit the lowest level against the dollar since March 2009.

Industry groups sue to stop IRS from collecting user info from DeFi front-ends. The requirement would “push this entire, burgeoning technology offshore,” the advocacy group’s top lawyer said.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Twice weekly Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What is the maximum number of Bitcoin that can ever be created?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) 21 million 🥳

Bitcoin has a hard cap of 21 million.

GET IN FRONT OF 80,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.