Today’s edition is brought to you by Crypto Nutshell Pro

Subscribe for exclusive research reports from our team of on-chain analysts to know exactly where we are in the cycle.

GM to all of you nutcases. It’s Crypto Nutshell #651 pluggin’ in… 🔌🥜

We're the crypto newsletter that's more heart-wrenching than a cowboy saying goodbye to the kid who believed in him... 🤠💔

What we’ve cooked up for you today…

🏦 It actually happened?

🧠 Bitcoin to $9.5 million?

📈 Violent upside?

💰 And more…

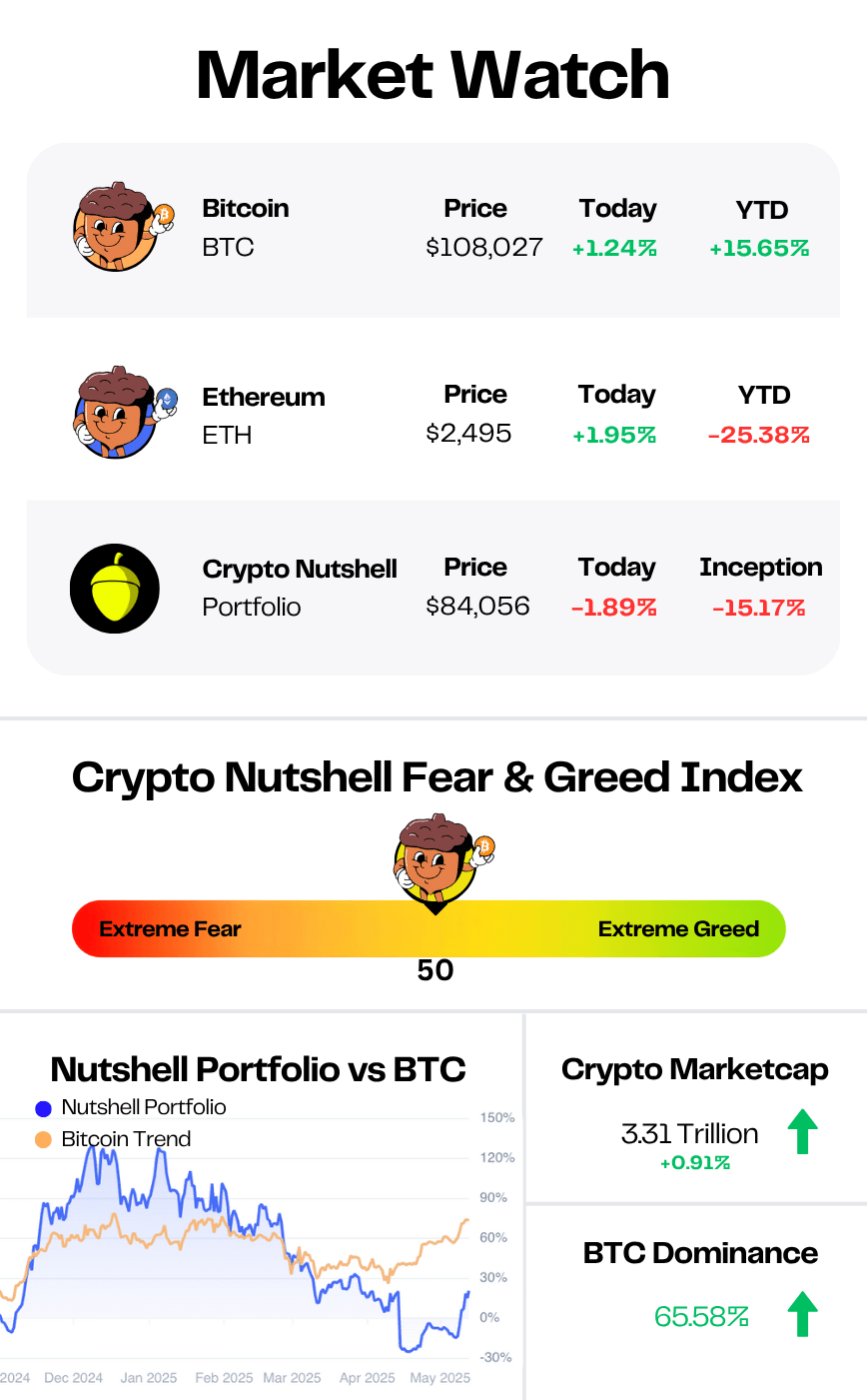

Prices as at 3:45am ET

IT ACTUALLY HAPPENED? 🏦

BREAKING: FHFA's Pulte Orders Crypto Consideration in Mortgage Applications

Yesterday, we told you the FHFA was studying crypto for mortgage approvals.

Today?

They’re ordering it.

FHFA Director Bill Pulte has now formally instructed Fannie Mae and Freddie Mac to prepare proposals for counting cryptocurrency as a qualifying mortgage asset.

“After significant studying, and in keeping with President Trump’s vision to make the U.S. the crypto capital of the world… I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count cryptocurrency as an asset for a mortgage.”

This isn’t speculation anymore.

It’s federal housing policy in motion.

What’s Happening:

The FHFA just told the two biggest players in U.S. home lending to treat crypto like cash on the balance sheet.

Bitcoin surged past $107,000 on the news

This marks the first time the U.S. government is considering crypto as mortgage collateral - without needing to convert it to fiat.

Strive CEO Matt Cole broke it down perfectly:

“This makes it substantially easier for holders of bitcoin to purchase a house without selling their Bitcoin. The U.S. government is taking Bitcoin risk on its own book as the U.S. government implicitly guarantees Fannie/Freddie mortgage loans.”

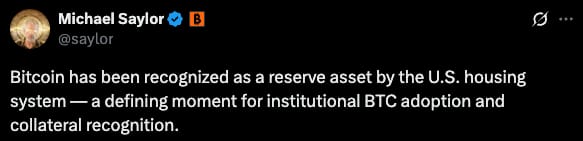

Even Michael Saylor weighed in:

But There’s a Catch…

The FHFA says crypto assets must be held on U.S.-regulated centralized exchanges, leaving self-custody wallets out for now.

Still, the shift is clear:

What started as a tweet…

…is now a top-down directive reshaping the foundation of U.S. housing finance.

Yesterday, Bitcoin was knocking on the door of middle-class wealth.

Today?

The door just cracked open.

This isn’t just adoption. It’s integration. 🏦💥

Okay, we admit it…

We messed up.

Yesterday we opened Crypto Nutshell Pro to an additional 15 members.

It sold out straight away.

After the huge amount of feedback we received, we realised this was unfair.

We all live busy lives - and not everyone can check their emails straight away.

To make it up to those that missed out, we’ve opened 10 more slots.

However, this is it. Once the new 10 slots are gone, they’re gone.

By signing up, here’s what you’ll get:

Exactly what we hold - A look into exactly what we’re holding in our portfolio

Weekly altcoin breakdowns - Detailed analysis on altcoins

Bull / Sell indicators - know exactly when we believe it’s a good time to enter and exit positions

Watch list - Which coins we’re keeping a close eye on

The final move has begun. Don’t miss what comes next.

If you want to stay ahead - and stop guessing - now’s your final chance.

👇 Click below to join before the window closes.

First in, first served. (Crypto Nutshell has 95,000+ daily readers - you do the math.)

BITCOIN TO $9.5 MILLION? 🧠

Adam Back just unpacked the most overlooked bull case in Bitcoin:

Monetary premium.

In plain English?

Bitcoin doesn’t need to replace fiat…

It just needs to replace the assets people already use to protect themselves from inflation.

Who Is Adam Back?

One of the earliest people contacted by Satoshi 🔐

Legendary cryptographer & creator of Hashcash (predecessor of Bitcoin) 🧠

CEO of Blockstream and widely considered a Bitcoin pioneer 🏗️

In a new interview, Adam explained:

“If there was a financial instrument that protected your purchasing power...

People wouldn’t need to park their money in things like vacant real estate.”

And that’s the key idea.

What People Use Today:

To avoid fiat debasement, people currently store value in:

Bonds 📉

Luxury real estate 🏙️

Fine art & collectibles 🖼️

Wine, watches, classic cars 🍷

Even vacant apartments in Shanghai and NYC 🚪

It’s inefficient. Illiquid. Pricey. But it’s all we had.

Until Bitcoin.

Bitcoin is liquid. Portable. Borderless. Capped in supply.

And if it captures even a fraction of that value?

We’re talking about a $200 trillion addressable market.

“That $200 trillion number? Might actually be conservative.”

Do the math:

If Bitcoin absorbed the full $200T?

Each coin = $9.523 million. 🤯

Just math.

The point isn’t predicting an exact price - it’s understanding how early we still are.

Because in Adam’s words:

“If everyone was 100% convinced it was going there… It would already be there.”

We don’t need Bitcoin to replace the dollar.

You just need it to replace the fear.

And it’s already begun. 🔓

VIOLENT UPSIDE? 📈

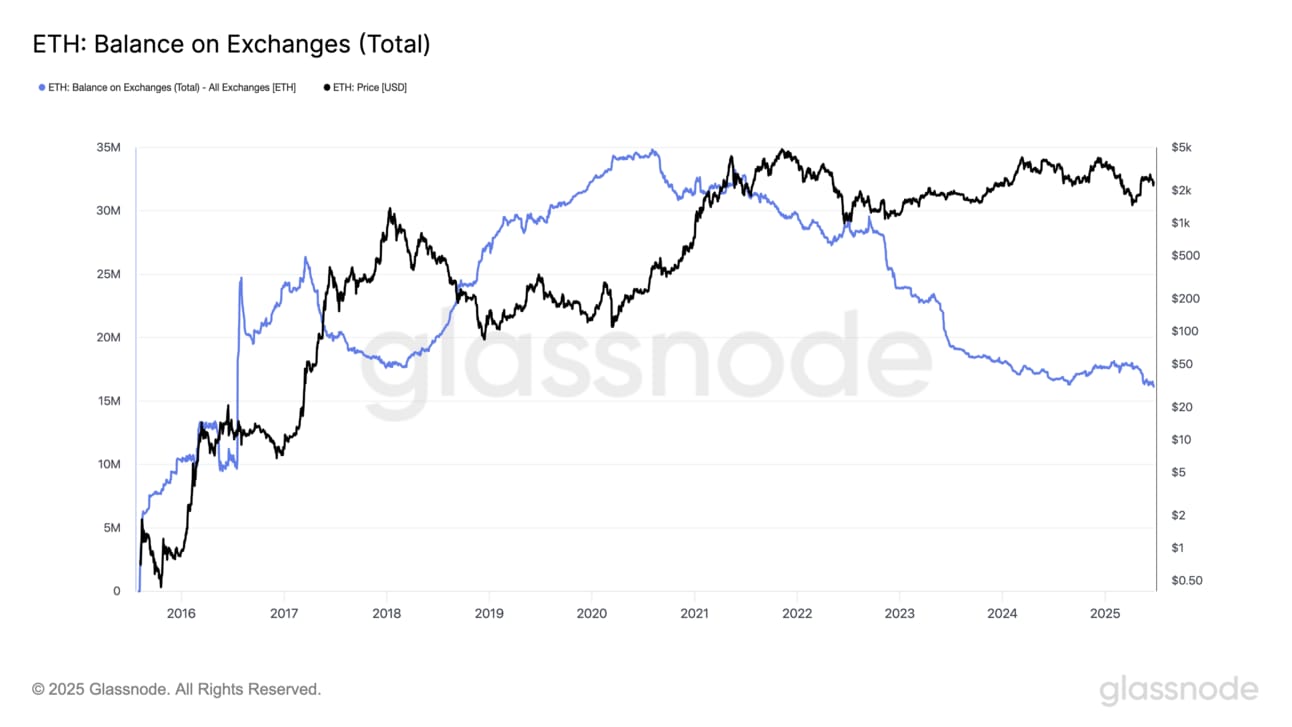

Today we’ll be checking in on the amount of Ethereum available for sale on exchanges.

Here’s how to interpret this metric:

Decreasing exchange balances: Bullish indicator as it signals a shift towards long-term holding 🐂

Increasing exchange balances: Bearish indicator as coins being transferred to exchanges are more likely to be sold 🐻

According to Glassnode, just 16.21 million ETH remains on exchanges - that’s only 13.40% of the total circulating supply.

And in the past 90 days alone, 1.61 million ETH (~$3.90 billion) has been pulled off exchanges.

We haven’t seen exchange balances this low since 2016! 🤯

Let that sink in…

This isn’t a market gearing up to sell. It’s a market gearing up to squeeze.

Supply is evaporating. Demand is building. Order books are getting thin.

And historically?

That kind of pressure only resolves one way:

With violent upside. 🚀

CRACKING CRYPTO 🥜

Arizona state won’t buy Bitcoin - But is happy to seize and hold it. Governor rejected a “buy Bitcoin” bill - now approves a bill to hold seized Bitcoin instead. Crypto held by the state, not self-sovereign citizens.

Unhedged spot Bitcoin ETF flows show BTC is now a macro asset. A new report reveals a new dynamic in Bitcoin investors’ methodology. Is this the final stage of Bitcoin’s macro asset evolution?

Consumer FinTech SoFi is Getting Back Into Crypto. The move comes after CEO shared plans to re-enter the crypto business under the Trump new administration after halting digital asset services in 2023.

Invesco and Galaxy enter race for Solana ETF with new SEC filing. Investment management company Invesco and crypto-focused firm Galaxy Digital have joined the race for a Solana exchange-traded fund.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What determines the cost of gas fees on the Ethereum network? A) Number of validators online

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: Network congestion and transaction complexity 🥳

Gas fees go up when Ethereum gets busy - especially during high-demand events like NFT drops or meme coin frenzies. More users = higher fees. 🧠📈

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.