GM to all 27,740 of you. Crypto Nutshell #176 checkin’ in. 🏝️ 🥜

We’re the crypto newsletter that's more unpredictable than a chemistry teacher turned criminal mastermind... ⚗️🔬

What we’ve cooked up for you today…

🚫 SEC says no to Coinbase petition

🔮 5 More Crypto Predictions

💪 Are Bitcoin long-term holders selling?

💰 And more…

MARKET WATCH ⚖️

Prices as at 5:10am ET

Only the top 20 coins measured by market cap feature in this section

SEC SAYS NO TO COINBASE PETITION 🚫

BREAKING: SEC responds predictably to Coinbase’s 2022 crypto rule-making petition: ‘No’

Since July 2022, Coinbase has been pushing the SEC for regulatory clarity in the crypto industry.

But in a Dec. 15 statement, Gary Gensler emphasised that existing laws are sufficient… (are they really Gary?)

The SEC denied Coinbase’s petition for three reasons:

Existing laws and regulations already apply to the crypto securities market as it stands

The timing was inappropriate as the SEC is currently soliciting comments on rules applicable to crypto (Binance and Coinbase lawsuits are still active)

The discretion of rule making lies solely with the agency itself

Interestingly, SEC commissioners Hester Peirce and Mark Uyeda released a joint statement criticising the decision:

“Any exploration of these issues should include public roundtables, concept releases, and requests for comment, which would afford us the opportunity to hear from a wide range of market participants and other interested parties. Then, using what has been learned, the Commission could issue guidance or engage in rulemaking as needed.

Make no mistake, Coinbase isn’t backing down. 💪

Coinbase CEO, Brian Armstrong mentioned that they’ll be challenging this decision in court.

Coinbase only wants clarity surrounding crypto regulations so that they can operate lawfully…

How is that such a big ask?

TOGETHER WITH STOCK MARKET RUNDOWN 📈

Do you want to sound smart in front of your boss? 🧠

How about stunning your friends with your business knowledge?

There’s an easy way to do it: the Stock Market Rundown.

It’s a daily 3-minute read that keeps you covered on the stock market and all things business.

We enjoy reading Stock Market Rundown because they make keeping up with the latest business news amusing and actually kind of fun.

The best part? They’re 100% free.

Whack that subscribe button to get smarter on business today. 😎

Sponsored

Stock Market Rundown

Your 3-minute morning read with an amusing angle on business and the stock market. Learn, laugh, stun your friends with your knowledge.

5 MORE CRYPTO PREDICTIONS 🔮

Bitwise, the largest crypto index fund manager in the United States, published a report this week.

CEO of Bitwise - Hunter Horsley

The report detailed 10 predictions for the 2024 crypto bull market.

Yesterday, we covered their first 5 predictions. If you missed it, you can check it out here.

Today, we’ll be diving into their final 5 predictions. 🤿

Prediction 6: Ethereum revenue will more than double to $5 billion

In 2023, users will pay ~$2.3 billion in fees to use the Ethereum network.

Bitwise predicts this will double in 2024 as crypto apps go mainstream.

This would make Ethereum one of the fastest growing tech platforms in the world.

Prediction 7: Taylor Swift will launch NFTs to connect with fans in new ways.

Taylor Swift is one of the most popular artists in the world.

She has a reputation for innovation. She’s also a strong believer in artists owning & monetising their own music.

Bitwise predicts in 2024, Taylor will experiment with NFTs. Following in the steps of artists such as Justin Bieber, Eminem and Snoop Dogg.

Prediction 8: AI assistants will start using crypto to pay for things online.

The rise of AI assistants promises to be a theme of 2024 & beyond.

Bitwise predicts that as opposed to using fiat money, AI assistants will prefer digitally native money. Such as Bitcoin or stablecoins.

They predict this will begin happening on a small scale in 2024.

Prediction 9: More than $100 million will be staked in prediction markets.

Prediction markets have been around for years.

However, crypto takes them to the next level by making them borderless & permissionless.

Bitwise predicts decentralised prediction markets will emerge as the new “killer” app for crypto.

Prediction 10: A major upgrade to the Ethereum blockchain will drive the average transaction cost below $0.01.

Many believe the approval of a spot Bitcoin ETF will be the biggest development in crypto in 2024.

But another candidate is “EIP-4844” - an upgrade coming for the Ethereum blockchain.

The goal of EIP-4844 is to reduce Ethereum transaction costs by 90%.

Watch out for this to be a major narrative in 2024 & to pave the way for mainstream applications in crypto.

Bottom Line:

As we pointed out yesterday, last year, Bitwise were correct on 5/10 of their predictions.

If they are again correct on even 50% of their 2024 predictions, 2024 will be a huge year.

Additionally, it’s clear Bitwise is very optimistic on Ethereum in 2024.

There’s two major catalysts to look forward to for Ethereum:

EIP-4844 upgrade

Spot Ethereum ETF approval

If Ethereum revenue does in fact double like Bitwise predicts, we would expect to see it out-perform in 2024. 🚀

ARE BITCOIN LONG-TERM HOLDERS SELLING? 💪

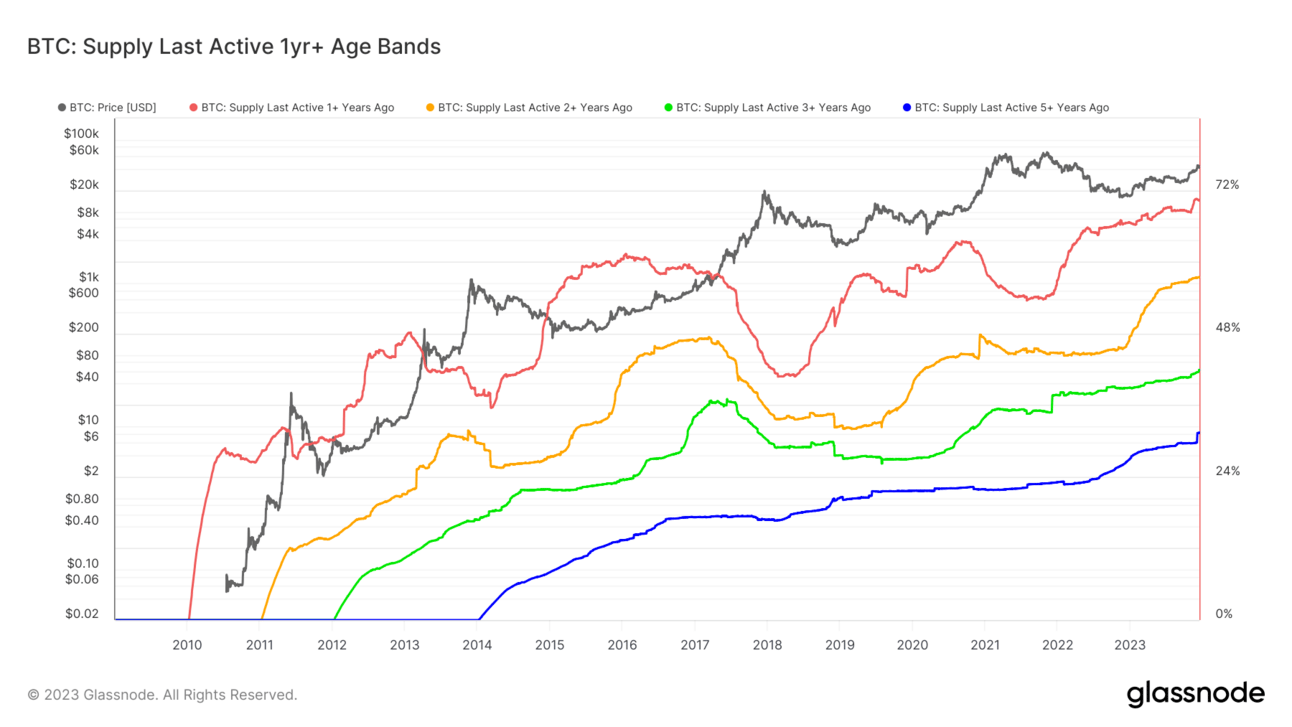

Today we’ll be checking in on the supply of Bitcoin last active 1+ years ago.

This metric is a simple one. It categorises coins based on how long it has been since they last moved on-chain.

Naturally, as long-term investors finally decide to sell their coins, this metric will decline. This is due to ‘older’ coins becoming ‘young’ again once they have been sold.

Currently 70.33% of the entire Bitcoin supply hasn’t moved in over a year…

That’s wild.

Especially considering Bitcoin is up ~160% for the year…

Here’s the breakdown for each cohort:

🔴 Supply last active 1+ years ago: 70.33%

🟠 Supply last active 2+ years ago: 57.43%

🟢 Supply last active 3+ years ago: 41.91%

🔵 Supply last active 5+ years ago: 31.37%

All of these cohorts are effectively at all time highs. Although the 1+ year cohort has decreased by 0.04% since the last time we looked at this metric.

Here’s the crazy part though.

57.43% of the Bitcoin supply hasn’t moved in 2+ years.

These investors rode Bitcoin all the way up to $69,000 down to $16,000 and back up to $44,000. 😱

If that couldn’t shake them off, then what could? 🤷♂️

Long-term conviction in Bitcoin continues to increase day by day. 💪

Prices will have to get much higher before long-term HODLers are even tempted to sell…

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

Sponsored

Stock Market Rundown

Your 3-minute morning read with an amusing angle on business and the stock market. Learn, laugh, stun your friends with your knowledge.

Sponsored

Vincent Spotlight

Alternative Investing News for the Savvy Investor

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What type of network is the Bitcoin network?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) Peer-to-Peer network 🥳

The Bitcoin network is a peer-to-peer decentralized network with no central oversight.

GET IN FRONT OF 27,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.