GM to all of you nutcases. It’s Crypto Nutshell #602 droppin’ in… 🪂🥜

We're the crypto newsletter that's more emotional than an old man lifting his house with balloons to chase a lifelong dream... 🎈🏡

What we’ve cooked up for you today…

😡 Trump is not happy

💎 No reason to sell

💪 Ticking higher

💰 And more…

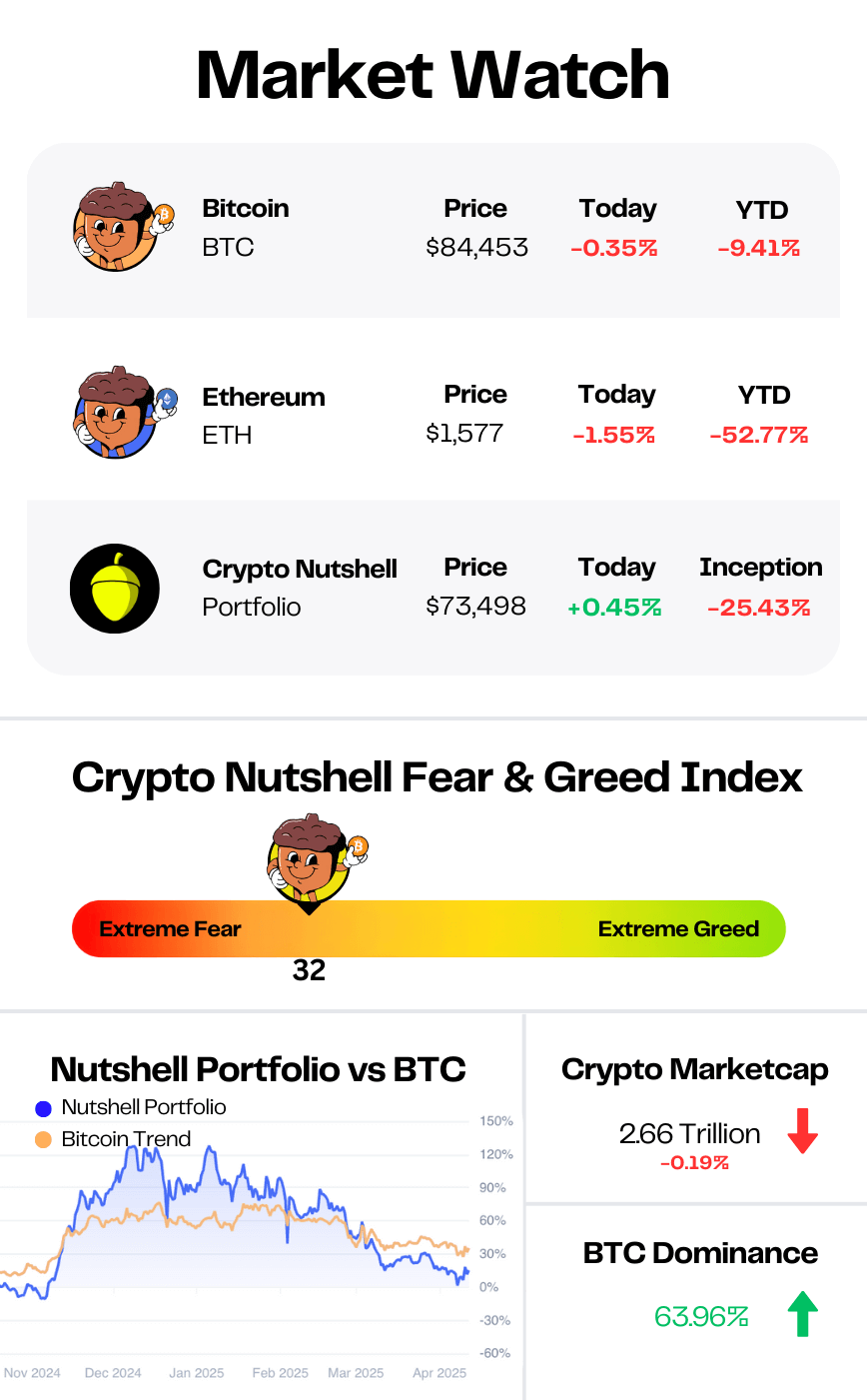

Prices as at 3:25am ET

TRUMP IS NOT HAPPY 😡

BREAKING: Trump blasts ‘too late’ Powell for not cutting interest rates

Following Jerome Powell’s latest remarks, markets have held steady - but the political pressure is building.

Bitcoin is hovering near $84,500, but beneath the surface, a power struggle is brewing that could shape crypto’s next big move.

President Trump has gone on the offensive against Fed Chair Jerome Powell (again), accusing him of dragging his feet on rate cuts.

Check out this recent post on Truth Social:

ECB = European Central Bank

Trump then doubled down on these comments by adding:

"If I want him out, he'll be out of there real fast, believe me."

Can Trump really fire Powell?

Legally, it’s complicated.

No Fed chair has ever been removed by a President.

And while the Federal Reserve Act allows for the dismissal of Board members, including the chair, “for cause.”

That has historically been interpreted as misconduct or incapacity, not policy disagreements.

Powell himself has also made it clear that he’s not stepping down anytime soon.

When asked in November if he would resign if Trump asked him to, he simply responded “No.”

Also if Trump were to fire Powell, the markets would likely descend into chaos…

So when will the Fed finally cut?

As we covered yesterday, Powell and the Fed are still in wait-and-see mode - citing uncertainty around how Trump’s tariffs will impact inflation.

But according to Truflation, real-time inflation is falling fast - far quicker than official CPI data suggests.

And the markets are starting to take notice…

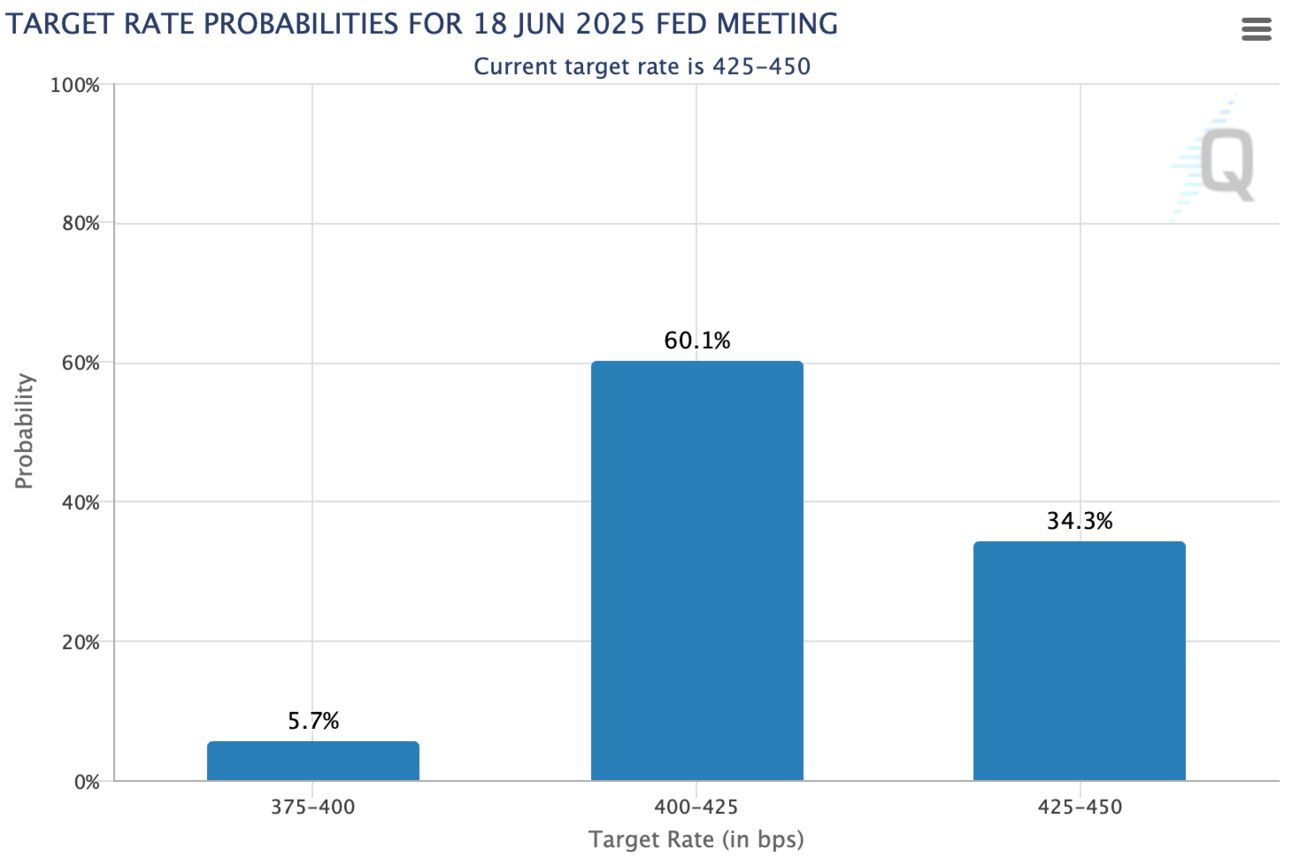

CME FedWatch now sees a 60.1% chance of a rate cut at the June 18 meeting.

(There’s a 9.1% chance we see a rate cut at the Fed’s May 7 meeting)

Markets may look relatively calm right now - but don’t be fooled.

Behind the scenes, a showdown is unfolding between the White House and the Fed.

Trump wants rate cuts.

Powell’s holding the line. (For now)

And Bitcoin is watching closely.

What Top Execs Read Before the Market Opens

The Daily Upside was founded by investment professionals to arm decision-makers with market intelligence that goes deeper than headlines. No filler. Just concise, trusted insights on business trends, deal flow, and economic shifts—read by leaders at top firms across finance, tech, and beyond.

NO REASON TO SELL 💎

Mike Alfred just made one thing very clear:

“If you’re under 60 and in good health... There’s no reason to sell Bitcoin for less than $1,000,000.”

If you don’t know him, Mike Alfred began investing 30 years ago from his college bedroom at Stanford University.

He’s historically been a long-term value investor. He has decades of experience trading in markets.

But his favourite investment?

Bitcoin.

This week, he tweeted this:

Mike’s not just saying that for clicks.

He’s spent decades in markets.

He’s seen the cycles.

He’s seen the noise.

Unless you're in the top 1% of traders?

You’re better off holding.

We agree with Mike.

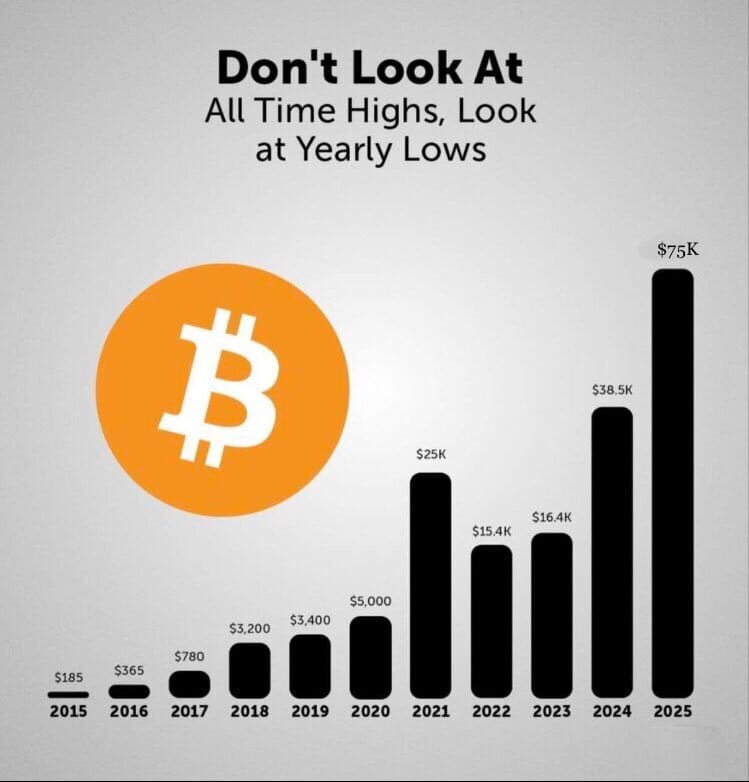

Although 2025 has been pretty lousy for crypto, here’s an interesting perspective reset:

Forget the yearly highs. Focus on the yearly lows.

It’s been slow.

It’s been sideways.

But taking a step back, the trend is crystal clear.

TICKING HIGHER 💪

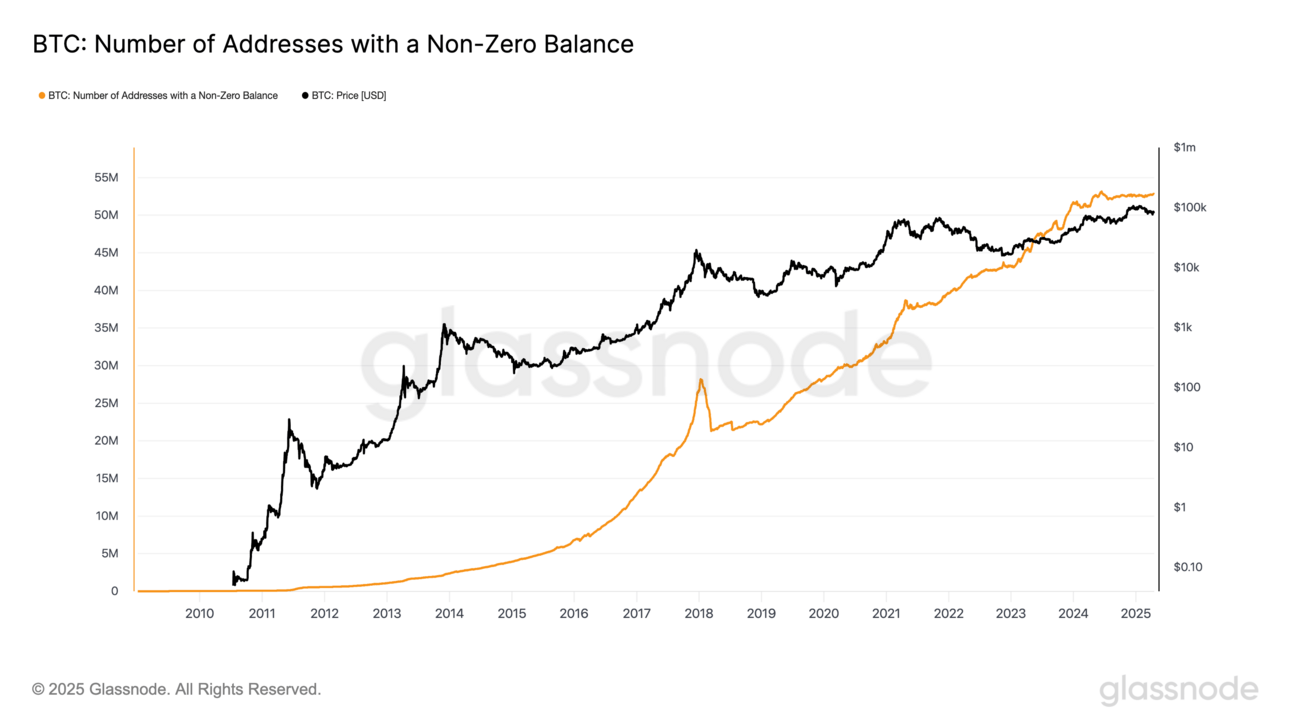

Today we’ll be taking a look at the amount of wallets that hold at least some Bitcoin. (anything greater than 0)

This metric offers a bird’s-eye view of user activity and adoption across the Bitcoin network.

But there’s a slight catch…

One wallet does not equal one user. A user can have many wallets.

What matters here is the trend of the chart.

Increasing number of addresses: increasing adoption levels 📈

Decreasing number of addresses: indicates users are selling their entire balance or consolidating wallets 📉

As of today, there are 52,823,656 addresses holding at least some Bitcoin.

That’s an increase of 131,723 since we last checked two weeks ago.

And since the start of the year, we’ve added over 300,000 new wallets to the network. 😱

Even through price chop and macro fear, Bitcoin adoption keeps ticking higher.

The bottom line?

The network is growing. The users are coming.

And Bitcoin isn’t slowing down. 🚀

CRACKING CRYPTO 🥜

Coinbase warns of potential new crypto winter as market signals turn bearish. Coinbase warns crypto winter may usher in new bear cycle, but eyes potential rebound in 2025

Kraken Sheds ‘Hundreds’ of Jobs to Streamline Business Ahead of IPO. A Kraken spokesperson said the firm is “making the difficult decision to eliminate certain roles and consolidate teams where redundancies exist, while continuing to hire in key areas of the business.”

Coinbase distances Base from highly criticized memecoin that dumped $15M. A Coinbase spokeswoman told Cointelegraph that “Base did not launch a token” after the blockchain’s X account was slammed for sharing a tokenized, tradable social post.

Retail curiosity is rekindled as Google search volume for 'Bitcoin' and 'Ethereum' jumps. This marks a 26% month-over-month relative increase in search volumes for “Bitcoin.”

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: 2024 🥳

After years of delays, the SEC approved multiple spot Bitcoin ETFs in January 2024, opening the floodgates for institutional inflows.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.