Today’s edition is brought to you by Crypto.com - put your crypto to work and start earning rewards today!

GM to all of you nutcases. It’s Crypto Nutshell #823 floatin’ in… 🪶🥜

We’re the crypto newsletter that’s more intense than a survival game where every move could be your last… 🎮⚔️

What we’ve cooked up for you today…

🏦 The UAE turns up the heat

⚔️ Sell your gold, buy Bitcoin

📈 We’re not slowing down

💰 And more…

Prices as at 2:15am ET

THE UAE TURNS UP THE HEAT 🏦

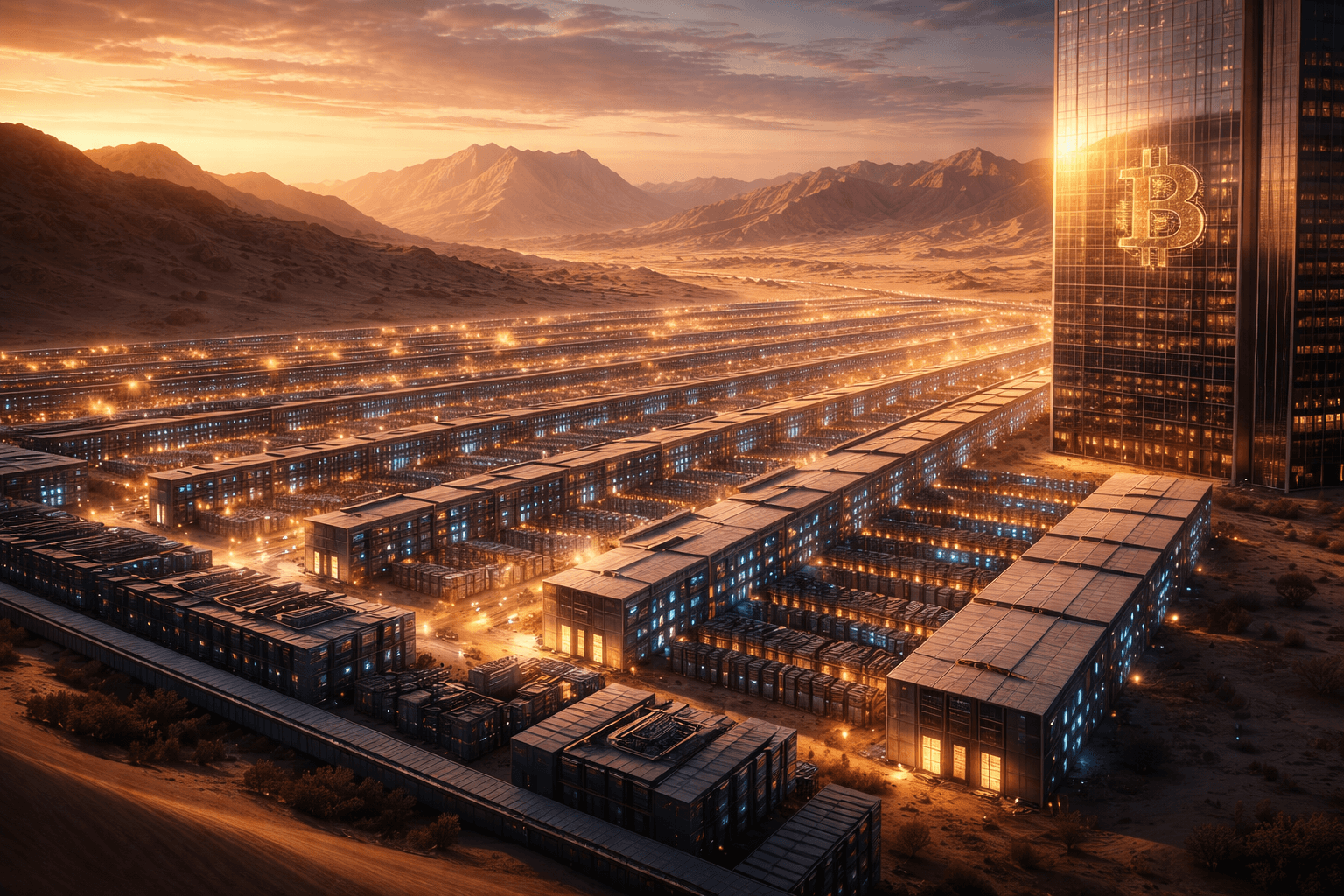

BREAKING: UAE-linked bitcoin mining amasses $344 million unrealized profit excluding energy costs

While most of the market has been heading for the exits… the UAE has been doing the opposite.

We covered Abu Dhabi's $1 billion Bitcoin ETF position on Wednesday. But the story goes even deeper.

According to new data from Arkham, mining operations linked to the UAE's Royal Group are sitting on roughly 6,782 BTC (~$454 million) with an estimated $344 million in unrealized profit, excluding energy costs.

And they're still producing. About 4.2 BTC per day over the last week.

The last recorded outflow from those wallets was four months ago.

This isn't a government that seized Bitcoin in a drug bust. The UAE built this position from scratch.

It started back in 2022, when Citadel Mining - tied to Abu Dhabi's royal family - set up large-scale rigs on Al Reem Island.

In 2023, Marathon Digital partnered with Abu Dhabi-based Zero Two to build 250 megawatts of immersion-cooled mining capacity. One of the biggest deployments in the region.

Now pair that with the ETF side…

Mubadala and Al Warda - both Abu Dhabi-backed funds - held a combined $1.1 billion in BlackRock's IBIT at the end of 2025. Mubadala alone added 46% to its position during Q4, while Bitcoin was falling 23%.

Mining plus buying. A multi-layered bet.

Compare that to Bhutan, which took the opposite path.

After building over $1 billion in mined BTC through hydroelectric power, Bhutan has sold more than $100 million in the last five months.

For context, the US holds 328,000 BTC worth $22 billion and the UK holds 61,000 BTC worth $4 billion. But nearly all of that came from law enforcement seizures.

The UAE is doing something different.

It's converting energy into a long-term digital reserve - and refusing to sell into weakness.

In a market full of sellers, that stands out. 🚀

Put Your Crypto To Work And Earn Rewards 🤑

Want your crypto to work harder while you hold?

Staking lets you earn passive rewards for helping secure blockchain networks - without selling or trading.

Here's why staking on Crypto.com makes sense:

Easy Setup: Stake in seconds directly from the app 💸

Competitive Returns: Earn up to 18% APR on supported coins like CRO, ATOM, SOL, and ETH 🎁

Flexible Terms: No minimum lock-up periods - unstake when you need to 👍

Automatic Rewards: Automated reward restaking available for supported coins💪

Whether you're holding through volatility or building long-term positions, staking turns idle assets into earning opportunities.

Crypto.com supports 30+ coins for staking with assets held in segregated wallets.

SELL YOUR GOLD, BUY BITCOIN ⚔️

Cathie Wood has never been shy about her Bitcoin conviction. But in her latest interview with The Rundown, she went a step further.

She's not just bullish on Bitcoin. She thinks gold is riding for a fall.

Wood pointed out that the only 2 times gold reached levels like this were during extreme economic crises. The double-digit inflation of the late 70s and early 80s.

And before that, the Great Depression, when the U.S. government confiscated private gold and devalued the dollar by 70%.

Her point? We're not in anything like either of those worlds right now. And yet gold is priced like we are.

That disconnect, in her view, is a setup. And the trade is simple:

Shift from gold into Bitcoin.

Wood acknowledged that Bitcoin has faced headwinds. Stablecoins have eaten into some of the role Bitcoin was expected to play in emerging markets, particularly as a transactional currency.

But she sees that as temporary. Stablecoins serve as the checking account. When people in those markets want real savings, real long-term value, they'll buy Bitcoin.

And where does she think that leads?

ARK Invest's bold case target: $1.5 million per Bitcoin by 2030.

That's not a typo. That's still the number. And Cathie Wood is putting her reputation behind it.

Gold had its run. Bitcoin is the next chapter. 🏆

WE’RE NOT SLOWING DOWN 📈

Today we’ll be taking a look at the amount of wallets that hold at least some Bitcoin. (anything greater than 0)

This metric offers a bird’s-eye view of user activity and adoption across the Bitcoin network.

But there’s a slight catch…

One wallet does not equal one user. A user can have many wallets.

What matters here is the trend of the chart.

Increasing number of addresses: increasing adoption levels 📈

Decreasing number of addresses: indicates users are selling their entire balance or consolidating wallets 📉

58,140,576 wallets now hold at least some amount Bitcoin.

That number keeps climbing - up 140,000 in just the last two weeks.

Price has been ugly. Macro's a mess. Sentiment's still in the dumps.

But the holder base? Still growing.

More distribution. More participants. More network resilience.

Adoption isn't slowing. (Despite the terrible sentiment) 💪

CRACKING CRYPTO 🥜

Coinbase CEO Says Quantum Computing 'Solvable Issue' for Crypto. Brian Armstrong downplayed fears that quantum computing will break blockchain encryption, pointing to Coinbase’s new advisory council.

Bitcoin ETFs Retain $53B in Net Inflows After Sell-Off. Despite months of withdrawals and Bitcoin’s pullback, US spot ETFs maintain $53 billion in cumulative inflows, topping initial projections.

Eric Trump reitrates claim bitcoin (BTC) is just getting started on its road to $1 million. Speaking at the Trump-backed World Liberty Financial forum in Mar-a-Lago, Trump called bitcoin one of the best-performing assets of the past decade.

Consensys-backed Ethereum treasury firm Sharplink now holds 867,798 ETH. Institutional ownership of Sharplink’s common stock has grown to 46% as of Dec. 31, according to the latest available 13F filings.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

Raremints (link) - Daily crypto news

Bitcoin Breakdown (link) - Daily Bitcoin news

Techpresso (link) - Daily tech news and insights

The Hustle (link) - Get Smarter on Business and Tech

Your Next Breakthrough (link) - Personal growth with Mark Manson

The Neuron (link) - AI trends and tools to keep you ahead

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What is the purpose of Ethereum's difficulty bomb mechanism?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: To force network upgrades 🥳

Ethereum's difficulty bomb exponentially increases mining difficulty over time, making the chain unusable if not defused through upgrades. This forced the community to implement planned hard forks rather than remaining on outdated software. It was ultimately removed after The Merge to Proof of Stake made mining obsolete.

GET IN FRONT OF 95,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.