Today’s edition is brought to you by Crypto.com

Start earning up to 5% back on all your spending! No annual fees. Sign up for the Crypto.com Visa Card today to receive your instant $25 bonus!

GM to all you crypto nuts. Crypto Nutshell #367 going’ to battle.. 🤺 🥜

We’re the crypto newsletter that's more thrilling than a race against time to prevent a global catastrophe... 🌍💥

What we’ve cooked up for you today…

🏦 It’s not as bad as you think

🥲 Short-term pain

🤷♂️ Outflow streak hits two

💰 And more…

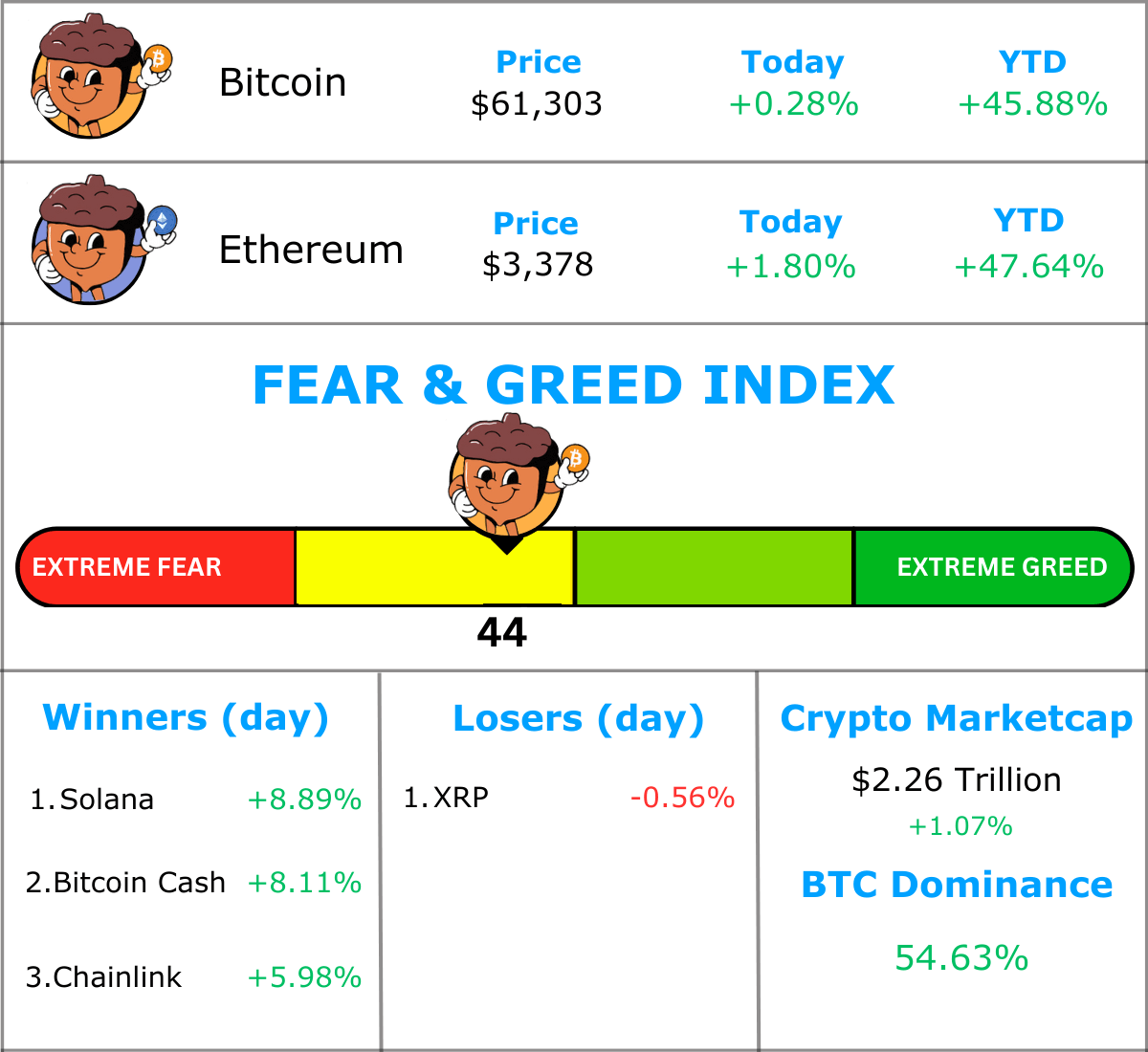

MARKET WATCH ⚖️

Prices as at 7:05am ET

Only the top 20 coins measured by market cap feature in this section

IT’S NOT AS BAD AS YOU THINK 🏦

BREAKING: Mt. Gox repayments won’t be as bad for Bitcoin as you think

Yesterday we learned that Mt. Gox would finally begin customer repayments starting July this year.

And the market didn’t take that news too well…

Which is fair enough - investors were speculating that 141,000 Bitcoin were about to be dumped onto the market. 😬

BUT, it may not be as bad as you think it is. (we’ve got another dose of hopium for you)

Alex Thorn, head of research at Galaxy Digital explained why:

Mt. Gox lost ~940k BTC ($424m at the time) and recovered 15% (141,868 BTC or ~$63.9m at the time) which is now worth $9 billion.

While only a 15% recovery, that’s a 140x gain for creditors in USD terms.

To get this “early” payout, creditors took a ~10% discount on their repayment.

Thorn estimates that ~75% of creditors chose this option which leaves 95k BTC being paid out.

Of this, ~20k coins are owed to claims funds and ~10k coins are owed to Bitcoinica BK, which leaves ~65k coins for individual creditors.

~65k BTC is WAY less than the reported 141,868 BTC.

Not so fast, Bitcoin bears.

Thorn also outlines 3 reasons why he believes these creditors are more diamond-handed than the market expects:

Creditors are skewed toward long-term holders - these are seriously early adopters

Creditors resisted years of aggressive offers by claims funds - they want their coins back instead of USD

Capital gains impact would be HUGE - these creditors are up 140x

With all of this said, Thorn is predicting that the amount of coins set to be dumped on the market is MUCH lower than reports would have you believe.

However, keep in mind these are only predictions…

No one knows for sure how much Bitcoin these creditors will actually sell.

START MAKING EVERY TRANSACTION COUNT 💳

If you haven’t got a crypto card yet, you’re living in the past.

With a Crypto.com Visa Card you can spend your crypto anywhere you want.

The benefits are insane.

Not only is there NO monthly or annual fee, you also get up to 5% back on every transaction.

With your Crypto.com Visa Card you can:

Enjoy 100% cashback on Spotify, Netflix, and Amazon as a new customer. 🍿

Get complimentary access to airport lounges and elevate your travel experience. ✈️

Flaunt your style with the sleek and stylish metal card 🌟

Here’s how to get your $25 bonus and start earning up to 5% back:

Click here to Download the Crypto.com App

Sign Up: Use our referral code - Nutty - for your instant $25 bonus.

Get Your Crypto.com Visa Card: Start making transactions, earning rewards, and enjoying the perks!

Start making every transaction count - the future is here.*

SHORT-TERM PAIN 🥲

With the market taking the Mt. Gox news poorly and the German government dumping Bitcoin, it’s not been a great time for crypto.

But there’s 1 more important factor that’s been suppressing the price of Bitcoin.

And that’s Miner capitulation.

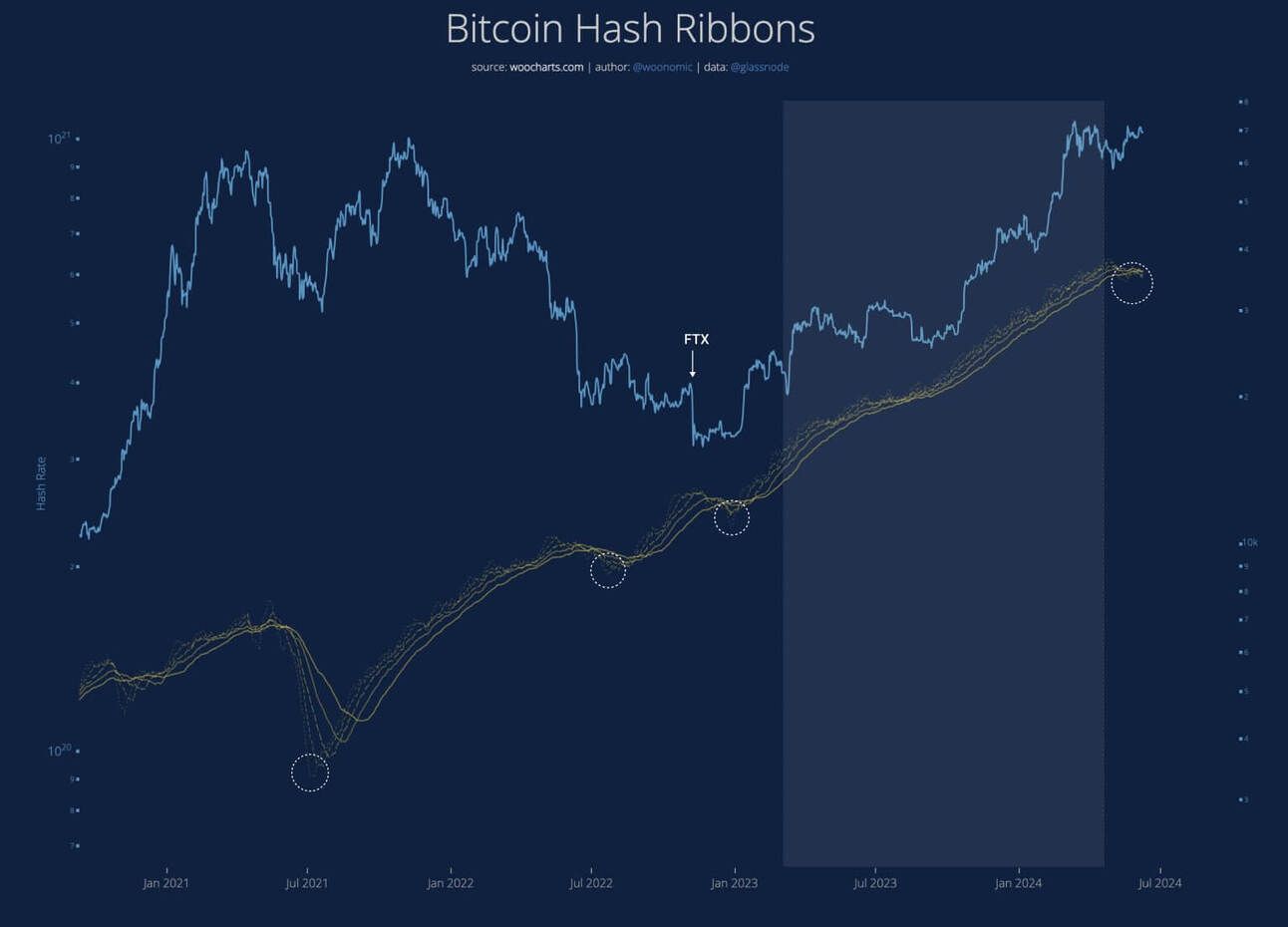

On-chain analyst Willy Woo recently explained why there’s a lil’ bit more doom and gloom for Bitcoin in the short-term.

The Bitcoin halving was a massive event for Bitcoin.

It cut the block reward in half - meaning new Bitcoin entering the supply is reduced.

As a result, the revenue that miners earn was also cut in half.

Post halving, unprofitable miners go on a selling spree to pay for hardware upgrades so that they can once again become profitable.

And unfortunately, the weakest miners end up closing shop, liquidating their holdings as they can no longer survive.

The chart above is quite complex, but all you need to know is that the circled areas indicate periods of intense selling from Bitcoin miners. (capitulation)

Taking a look at miner balances, we can see that they’ve decreased by over 30k BTC since June.

This is the fastest pace of miner selling we’ve seen in over 12 months.

Bitcoin Miner Reserves

BUT, this isn’t out of the ordinary.

It happens every cycle.

Woo explains that once intense miner capitulation ends, we usually always see a huge rally:

“I know it sucks, but BTC is not going to break all time highs until more pain and boredom plays out. On the bright side, miners are capitulating and when that is through, it nearly always ends in a huge rally.”

On the flip side, these periods of miner capitulation are often great times to buy… 💰

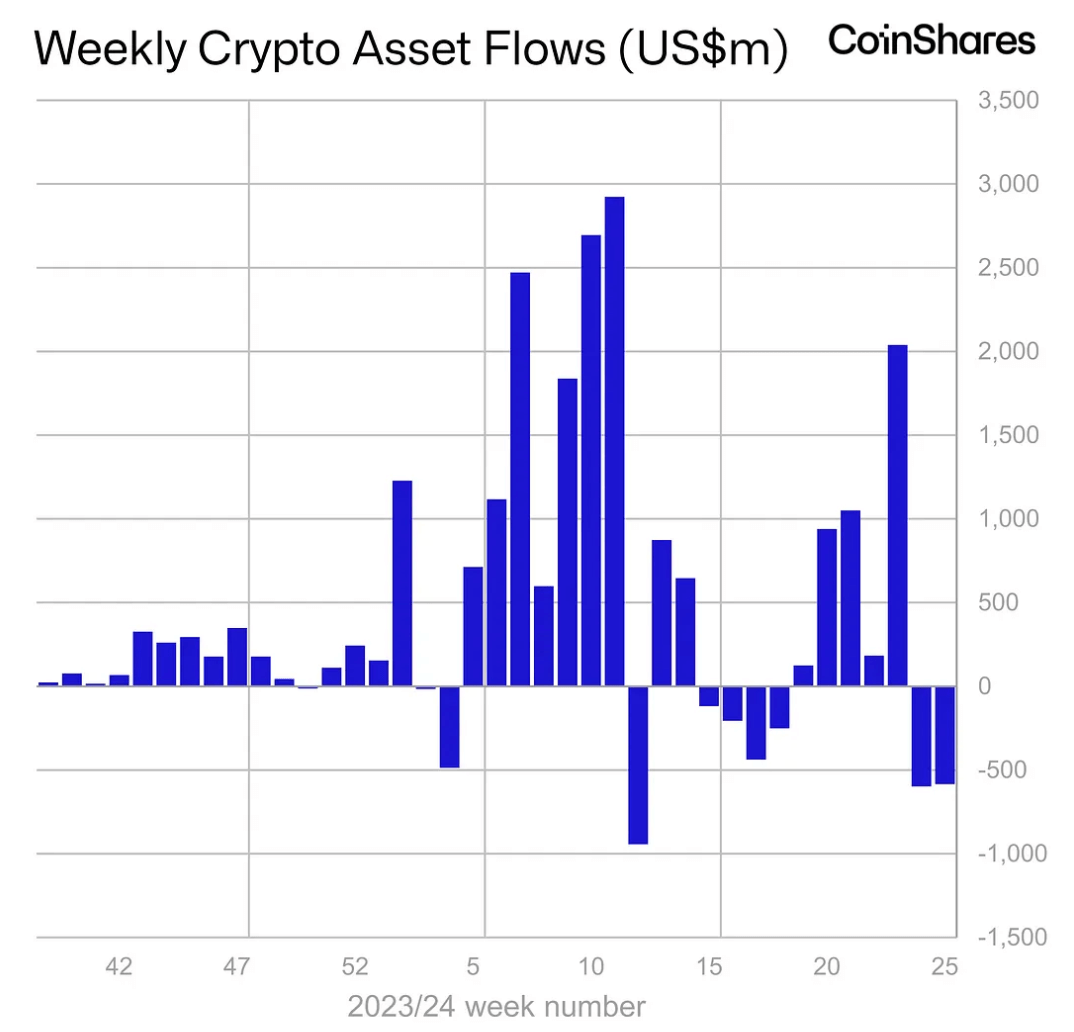

OUTFLOW STREAK HITS TWO 😢

Digital asset funds just had their second outflow week in a row.

Last week saw net outflows of $584 million.

Last week also saw the lowest volumes traded since the launch of the US Bitcoin ETFs…

Bitcoin was once again the primary focus, seeing $630 million in outflows.

Oddly enough, recent negative sentiment didn’t see investors add to their short positions.

Short-Bitcoin saw outflows of $1.2 million for the week.

Ethereum also had a rough week with $58.3 million in outflows.

Solana, Litecoin and XRP bucked the trend experiencing inflows of $2.7m, $1.3m & $0.7m respectively.

The United States once again experienced the largest outflows at $475 million for the week.

Canada also saw significant outflows at $109 million.

Interestingly Switzerland, Brazil and Australia all saw inflows of $38.9m, $8.5m & $0.8m respectively.

All in all, another rough week for digital asset funds.

The likely reason for these outflows is the uncertainty surrounding rate cuts by the FED this year.

Most analysts were expecting 2 or 3 rate cuts in 2024.

But now, it’s looking like there will only be 1 cut for the year.

Unfortunately this week also isn’t off to the greatest start…

Monday saw $174.5 million in outflows from the US Bitcoin ETFs.

Let’s see if they can turn it around for the rest of the week.

CRACKING CRYPTO 🥜

Analyst predicts limited impact from Mt. Gox Bitcoin distribution amid market slide. Galaxy's Alex Thorn believes the sell pressure from Mt. Gox's Bitcoin distributions is unlikely to be as severe as the market anticipates.

Bitcoin Miner Riot Platforms Ditches Bitfarms Takeover Bid, Seeks to Overhaul Board. Riot is Bitfarms' largest shareholder, owning 14.9% of the firm.

European Central Bank releases first CBDC progress update. In the first official progress update, the European Central Bank touched on features it is exploring for its proposed central bank digital currency.

Biden Administration Rehires Crypto Advisor Critical of the SEC. Is the White House's stance on crypto changing ahead of the election? A past advisor has returned to a post on the National Security Council.

WHAT WE’RE READING 📚

Want to get even smarter? Check these out.

p.s. all completely FREE (one click subscribe link)

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

When did FTX file for bankruptcy?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: A) November 2022 🥳

The bankruptcy of FTX, a Bahamas-based cryptocurrency exchange, began in November 2022.

GET IN FRONT OF 64,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.

*Terms and conditions apply. Offer valid for new users. Crypto investments involve risks; please do your research.