GM to all 17,341 of you. Crypto Nutshell #137 struttin’ in. 🐓 🥜

We’re the crypto newsletter more loyal than a dire wolf standing by the side of the children of the North... 🐺❄️

Today, we’ll be going over:

🙈 Bored ape’s go blind

👻 Two spooky accurate Bitcoin charts

🤔 What are long-term holders up to?

💰 And more…

MARKET WATCH ⚖️

Prices as at 4:40am ET

Only the top 20 coins measured by market cap feature in this section

BORED APE BLINDNESS? 🙈

Breaking: NFT Owners Partying at ‘ApeFest’ Report Vision Injuries (Not From Looking at NFTs)

Just when you thought it couldn’t get any worse for NFT’s…

Thousands of Bored Ape Yacht Club members travelled to Hong Kong this past weekend for ApeFest.

What was supposed to be a fun night celebrating JPEG’s soon turned tragic as multiple attendees reported eye injuries that landed them in the ER. 🚑

Twitter posts like the two below started popping up describing extreme eye pain and partial blindness.

The reason for these eye injuries has been identified as photokeratitis. The condition is caused by unprotected exposure of the cornea to ultraviolet radiation.

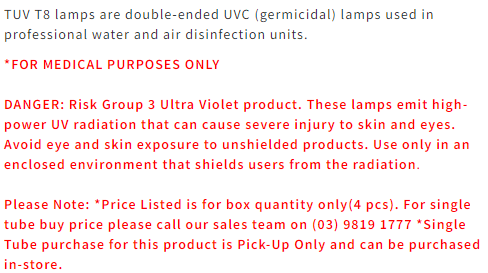

Apparently the contractor in charge of setting up lighting for the event decided to use a series of Phillip’s NLS TUV T8 Germicidal Tube lights…

The keyword here is “Germicidal’.

These lights are for medical use only…

Since the event, multiple reports have come out from BAYC members stating that the condition is treatable with medical assistance.

Although this is tragic and blindness isn’t a laughing matter…

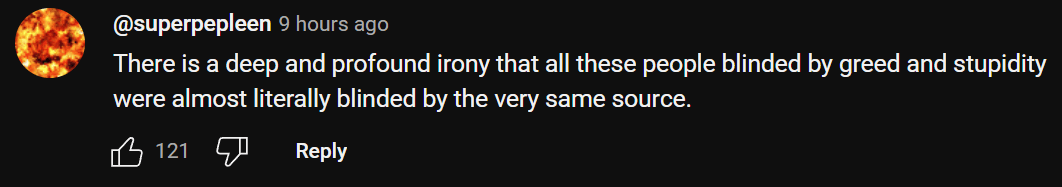

Crypto Twitter couldn’t help themselves…

There’s just one thing about this entire situation we don’t understand…

We thought NFT holders were already blind?

(we kid, we kid.) 😂

For more info on this event, checkout this YouTube vid.

TOGETHER WITH FAST FOOD SECRETS CLUB 🍔

As you can probably tell, we love newsletters.

They’re the most efficient and no B.S way to stay informed on a wide array of topics.

But one newsletter is our personal favourite…

It’s kind of our dirty little secret. 🤫 (don’t tell anyone)

The newsletter? Fast Food Secrets Club

Every 2-3 days, they’ll send you a 3-minute read detailing:

Menu hacks & tips to get the best deals & bang for your buck 🍪

Secret recipes from the biggest fast food chains 🍟

Coupons, deals & specials at all your favourite restaurants 🌮

As always, they’re completely FREE.

Uppercut that subscribe button below & it will automatically add you to their list. You’re wallet will thank-you. (your waist line will not) 🫡

Sponsored

Fast Food Club

The Official Fast Food Club. Get access to the world's largest group for fast food secrets, news, tips, menu hacks, and secret recipes. Once you subscribe you'll become a member.

2 SPOOKY ACCURATE BITCOIN CHARTS 👻

Bitcoin’s price will peak around Christmas 2025. At least according to The Rational Root.

The Rational Root is an on-chain Bitcoin analyst and the lead analyst for the platform Bitcoin Strategy.

He's known for his unique spiral charts. His pricing models have grown him a following of over 150,000 investors.

He chooses to remain completely anonymous, using the symbol of a carrot and the handle @therationalroot as his pseudonym.

Why?

Here’s what he said:

“One of the the main reasons is: if we measure Bitcoin in fiat currency, Bitcoin's price will go to infinity. If Bitcoin's price goes to infinity, will you still want to remain public in the future?”

Fair enough.

The Rational Root recently did a 30 minute keynote at the Bitcoin Magazine conference. Although the entire talk was filled with value, 2 points stood out.

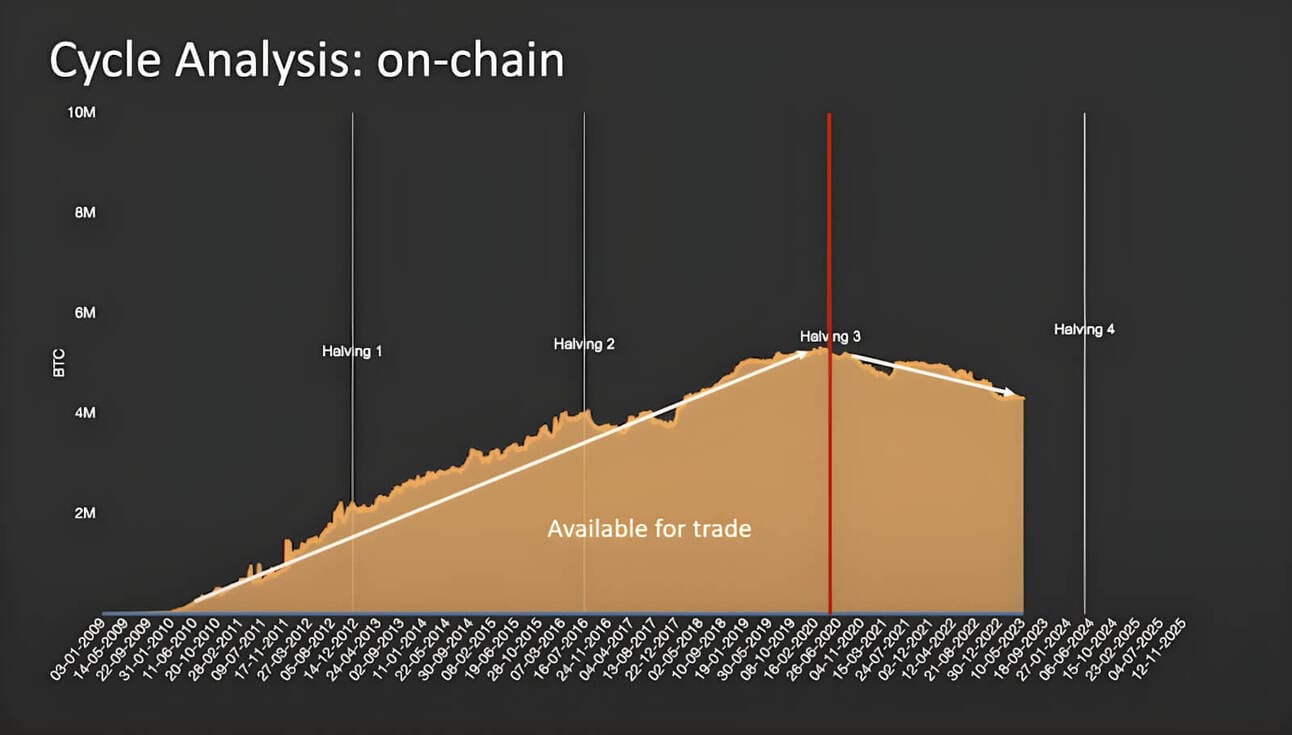

1. For the first time, the Bitcoin supply available for trade is decreasing heading into the halving.

As you can see, Bitcoin available for supply is decreasing. Why?

Bitcoin supply coming onto the market decreases every halving

The illiquid supply of Bitcoin continues to increase. Long-term Bitcoin HODLers continue to stack and more & more Bitcoin becomes permanently lost.

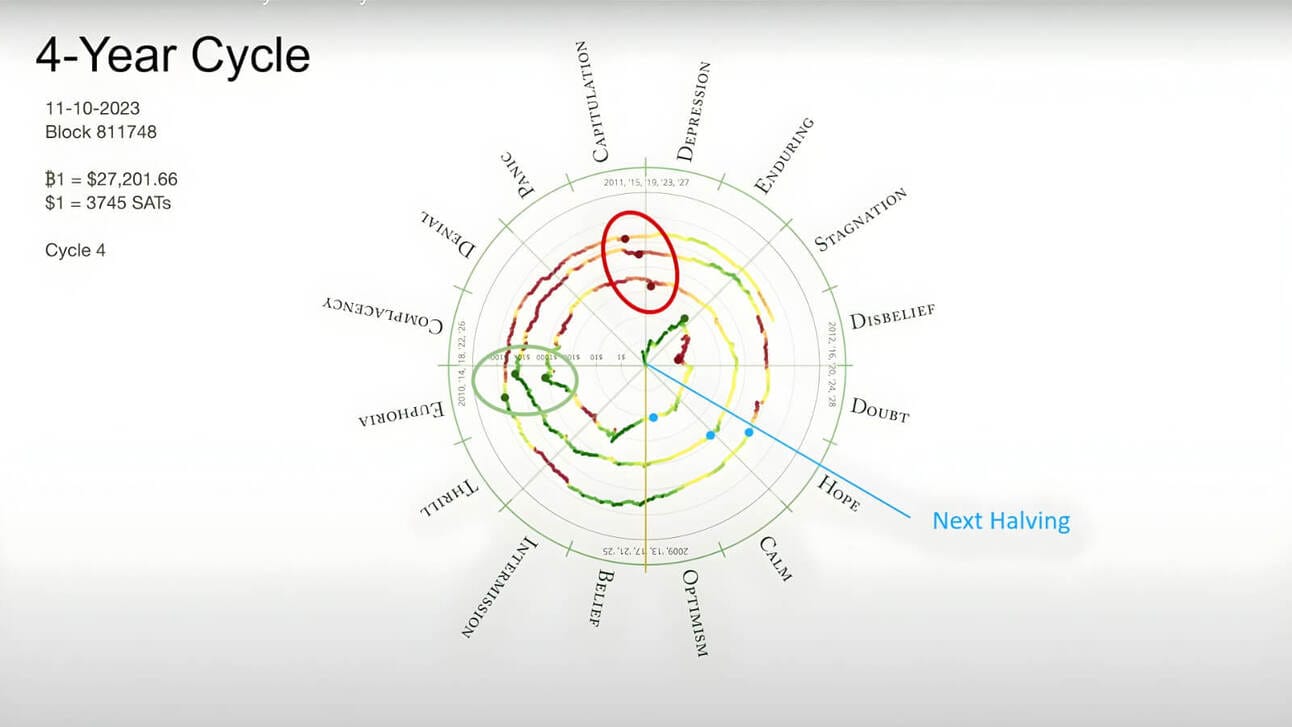

2. The Bitcoin 4 year cycle is playing out spookily accurate. 👻

Here’s how to read this spiral chart:

Each full rotation of the circle represents 4 years

Each ring represents a 10x increase in price, moving outwards

When you plot Bitcoin’s price on this graph, you start to see some fascinating patterns.

🟢 Bitcoin’s all-time high in each 4 year cycle is shown in green.

🔴 Bitcoin's cycle low is shown in red.

The accuracy is spooky.

Bitcoin’s peak & trough happens roughly at the exact same point in each 4 year cycle.

Extrapolating this chart out, The Rational Root predicts Bitcoin will peak in the next cycle around Christmas 2025.

At a price between $100,000 - $1 million. 🤯

I don’t think any of us will be complaining with that... 🥂

WHAT ARE LONG-TERM HOLDERS UP TO?🤔

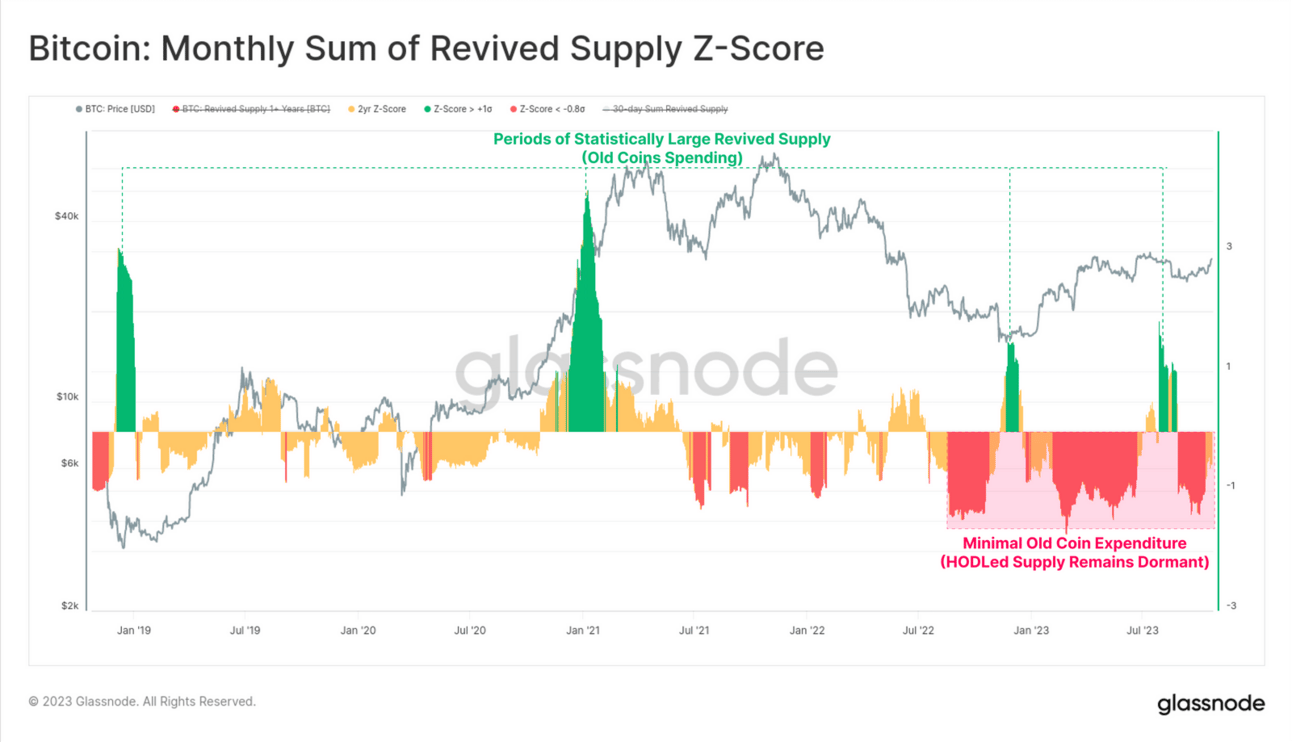

Today we’ll be taking a look at the Bitcoin Monthly Sum of Revived Supply Z-score.

Now we know this sounds a little complicated, but really it’s quite simple.

This metric looks for periods where coins that have been held for 1+ years are spent at a statistically significant rate compared to the prior 2 years (half a cycle).

Basically it asks the question: Are long-term holders selling or accumulating?

Here’s how to interpret the chart:

🟩High Expenditure: correlates with period of maximum profit taking (bull market) or panic selling (bear market)

🟥Minimum Expenditure: Investors are deciding to HODL their coins rather than sell. Periods of strong accumulation

High expenditure typically happens at cycle lows (2018, FTX collapse etc.) and cycle highs (2021 bull market).

When this metric spikes green, long-term holders are deciding to sell their coins at a higher rate than usual (statistically significant).

Interestingly, a large amount of long-term holders decided to sell as Bitcoin fell from $29,000 to $26,000 back in August.

As of today the HODLed supply remains dormant.

Long-term holders are simply not interested in selling at current prices.

Which makes sense.

Long-term holders are generally more informed investors compared to short-term holders.

Who would be selling Bitcoin just before the approval of the ETFs and the halving? 🤷♂️

Clearly not the long-term holders… 😎

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

The Intrinsic Value Newsletter

The weekly newsletter devoted to breaking down business and estimating their intrinsic value, in just a few minutes to read — Join 35,562 readers

Sponsored

Fast Food Club

The Official Fast Food Club. Get access to the world's largest group for fast food secrets, news, tips, menu hacks, and secret recipes. Once you subscribe you'll become a member.

CAN YOU CRACK THIS NUT? ✍️

Have you read yesterday’s edition?

We discussed Glassnode’s True Market Mean Price model. As of today what is the True Market Mean Price of Bitcoin?

A) $28,867

B) $20,692

C) $30,296

D) $32,443

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) $30,296 🥳

Make sure to checkout yesterday’s edition for the full breakdown.

GET IN FRONT OF 17,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research