Today’s edition is brought to you by Masterworks - invest in shares of blue-chip art today!

GM to all 19,516 of you. Crypto Nutshell #145 paddlin’ through. 🦢 🥜

The crypto newsletter that's more secure than waking up as a cybernetic organism tasked with protecting humanity... 🤖💪

🐂 The bull case for a Bitcoin ETF

🐻 The bear case for a Bitcoin ETF

💪 Bitcoin supply dynamics

💰 And more…

MARKET WATCH ⚖️

Prices as at 4:45am ET

Only the top 20 coins measured by market cap feature in this section

THE BULL CASE FOR A BITCOIN ETF 🐂

Breaking: Bitcoin spot ETFs will introduce crypto to broader investor base says Coinbase

Coinbase just released a report focusing on the impact that the Bitcoin ETFs will have.

The report mentions that the Bitcoin ETFs would open up crypto investments to:

Registered Investment Advisors (RIAs)

Retirement funds

Other large institutions

Current regulations have made it difficult for these institutions to invest in Bitcoin. These large institutions generally rely on ETFs for their investment strategies.

The biggest benefit of an ETF for these institutions is not having to hold their own Bitcoin. Where would they keep it? On a cold wallet? 🤷♂️

“Spot bitcoin ETFs can help meet the demand coming from the investors and institutions that want access to crypto but don’t have recourse to buying and holding such assets directly.”

Coinbase believes the ETFs will result in eased regulations for major money managers. This could be huge. We could see billions of dollars flow into the market.

“ETFs will ease the restrictions for large money managers and institutions to buy and hold bitcoin, which will improve liquidity and price discovery for all market participants”

Coinbase also believes that the ETF narrative couldn't have come at a better time.

Right now the world is a mess. We've got rising geopolitical tensions. The global economy is worsening. There's just not many "safe" investments right now. Where else do you put your money?

“The US Treasury bond market has been shaken up, dollars are expensive and the US banking sector remains highly vulnerable. We think this makes Bitcoin all the more attractive going into 2024 as an alternative to the traditional financial system.”

We highly recommend giving the full report a read. It's only 6 pages.

It's a great overview of the potential impact that the ETFs can have on the market.

TOGETHER WITH MASTERWORKS 🎨

This asset sold for $8 million… and everyday investors profited

When the painting by master Claude Monet (you may have heard of him) was bought for $6.8 million and sold for a cool $8 million just 631 days later, investors in shares of the offering received their share of the net proceeds.

All thanks to Masterworks, the award-winning platform for investing in blue-chip art. To date, every one of Masterworks’ 16 sales out of its portfolio has returned a profit to investors. With 3 recent sales, investors realized net annualized returns of 17.6%, 21.5% and 35%.

Shares of every offering are limited, but Crypto Nutshell readers can skip the waitlist with this exclusive link.

*Investing involves risk and past performance is not indicative of future returns. See important Reg A disclosures and aggregate advisory performance masterworks.com/cd

THE BEAR CASE FOR A BITCOIN ETF 🐻

There's a huge amount of hype surrounding a spot Bitcoin ETF.

For good reason too.

Experts in the space believe it will bring a tsunami of money into the space.

Hedge fund founder, Mark Yusko, believes an ETF could bring $300 billion of new demand.

Bloomberg ETF analyst, Eric Balchunas, believes it will bring $150 billion of new demand.

Expectations are high… but should they be?

Investors need to prepare to be disappointed.

That’s the message out from crypto analyst & writer - Jack Inabinet.

In his latest write up, Jack argued the bear case for a Bitcoin ETF.

He has 2 main arguments:

1. Canadian Disappointment 🍁

Canada has had a spot Bitcoin ETF for over 2 years. Holdings have remained virtually unchanged since July 2022.

Canada is exposed to the exact same narratives as Americans.

Their lack of demand for spot BTC products indicates that the Bitcoin narrative is not strong enough.

The same should be expected once a U.S spot Bitcoin ETF launches.

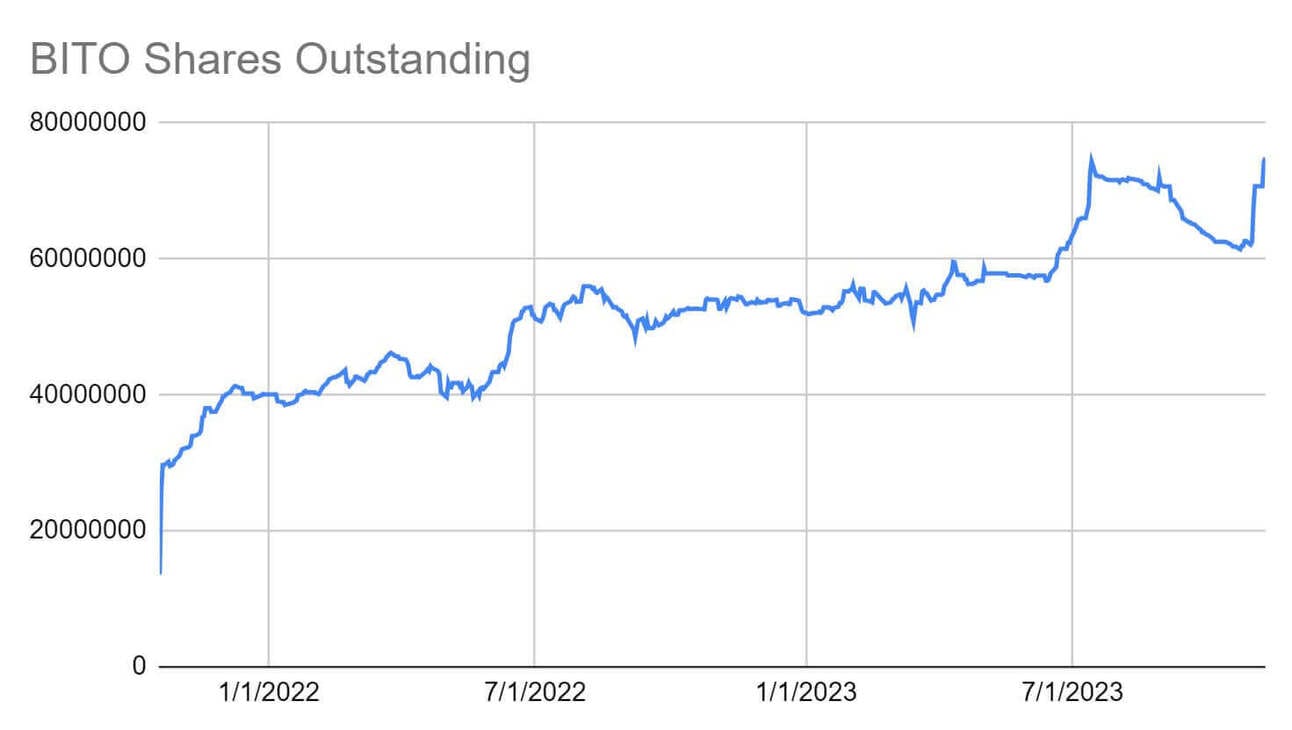

2. Stagnant Futures Demand 😢

If a spot ETF was going to result in massive demand, surely we’d see increased inflows into futures products?

Instead, we have seen inflows remain largely unchanged since July 2022.

Jack finishes his write up with this:

“Traders are at risk of being caught off guard when spot ETF approval comes and the inflows are a disappointment. There’s no harm in holding off to observe if spot ETF’s can truly fulfil expectations before increasing your crypto exposure…”

Our Take:

Jack makes some good arguments, but we think he’s missing 2 major points:

1. Like it or not, a spot Bitcoin ETF launching in the U.S is drastically different to Canada. 🇺🇸

The U.S is the number 1 economy and the USD is the reserve currency of the world. The entire world still looks to the U.S in terms of innovation and regulation.

The approval of a spot Bitcoin ETF in the U.S will be a huge stamp of approval & milestone for Bitcoin.

2. The world’s biggest asset managers are filing for a spot ETF. Juggernauts like BlackRock and Fidelity have literally trillions of dollars under management.

A spot Bitcoin ETF is a nod of approval from the biggest asset managers in the world. Additionally, they are now incentivised to push BTC to their clients.

Our Prediction:

We agree that it’s a good idea to taper expectations surrounding the ETF launch.

We predict inflows will be contingent upon momentum. If prices are flying and hype is returning to Bitcoin - we’ll see high inflows.

If prices are flat and there isn’t any hype? Inflows will be low.

With the Bitcoin halving around the corner, we would lean on the side of hype returning. 😉

BITCOIN’S SUPPLY DYNAMICS💪

For arguments sake let’s assume that the Bitcoin ETFs result in increased demand.

Well these institutions might have a tough time trying to buy their Bitcoin…

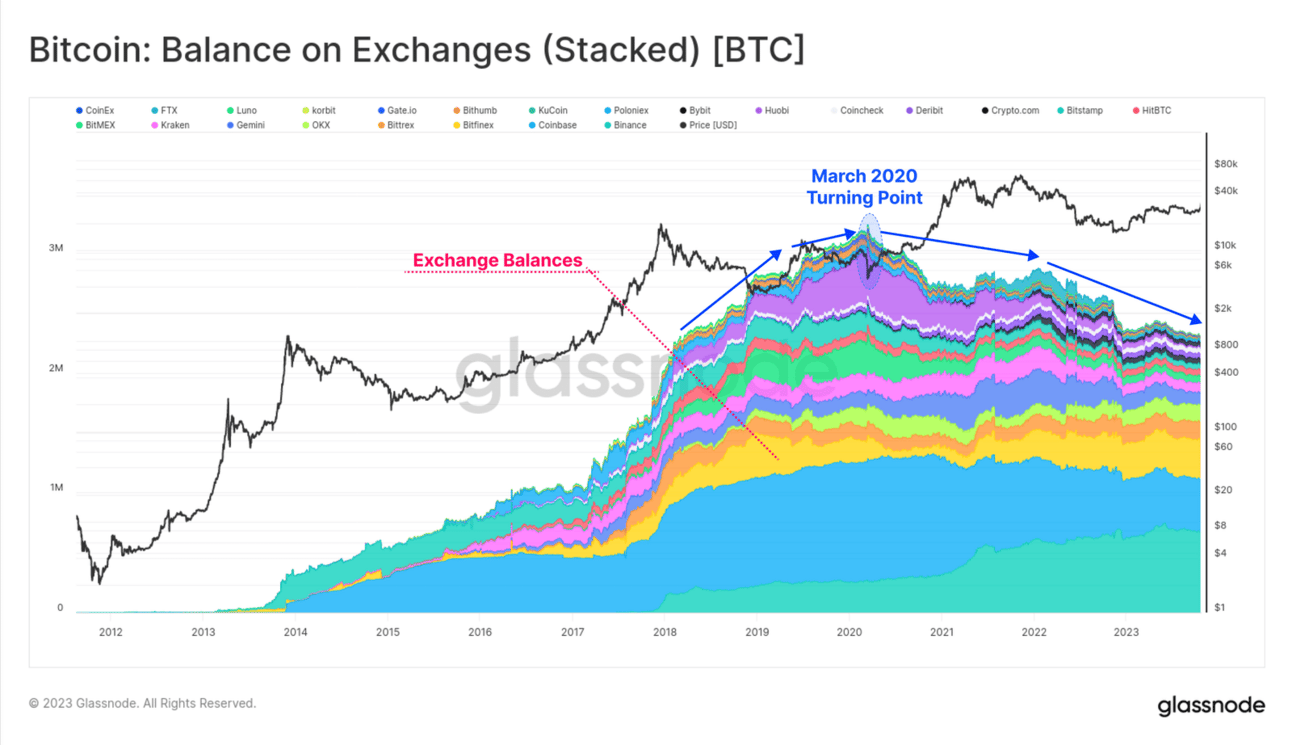

The amount of Bitcoin available for purchase on exchanges has dropped to its lowest level since 2018. 📉

Today, there are only 2,356,341 Bitcoin left on exchanges.

That’s only ~12.57% of the circulating supply. 😱

The chart below outlines Exchange balances for each individual exchange.

The top 3 exchange balances are:

Binance: 526,909.39 🥇

Coinbase: 440,406.68 🥈

Bitfinex: 389,852.37 🥉

Also, investors with less than 100 BTC are currently accumulating 92% of all newly issued Bitcoin. That is actually insane.

Don’t forget that the upcoming halving will cut the rate of newly issued Bitcoin in half…

With dwindling exchange balances and investors accumulating as much Bitcoin as they are… a Bitcoin supply shock is a real possibility. 🧨

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

The Hodl Report

Stay ahead of the Curve and Profit by Becoming a Crypto Expert

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

Sponsored

Stock Market Rundown

Your 3-minute morning read with an amusing angle on business and the stock market. Learn, laugh, stun your friends with your knowledge.

CAN YOU CRACK THIS NUT? ✍️

Yesterday we broke down the Bitcoin halving.

What was Bitcoin’s initial block reward before the first halving?

A) 100 Bitcoin

B) 50 Bitcoin

C) 12.5 Bitcoin

D) 25 Bitcoin

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) 50 Bitcoin 🥳

The initial block reward was 50 BTC. However, the reward decreases by 50% every 210,000 blocks

GET IN FRONT OF 19,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.