GM to all 14,874 of you. Crypto Nutshell #116 cruisin’ through. 🛥️ 🥜

We’re the crypto newsletter that's as epic as a band of rebels fighting for freedom in a dystopian future... 🏢🏴

Today, we’ll be going over:

🧑⚖️ The SEC wants clarification

🚀 This will make Bitcoin pump

💫 Capital rotation

🤑 And more…

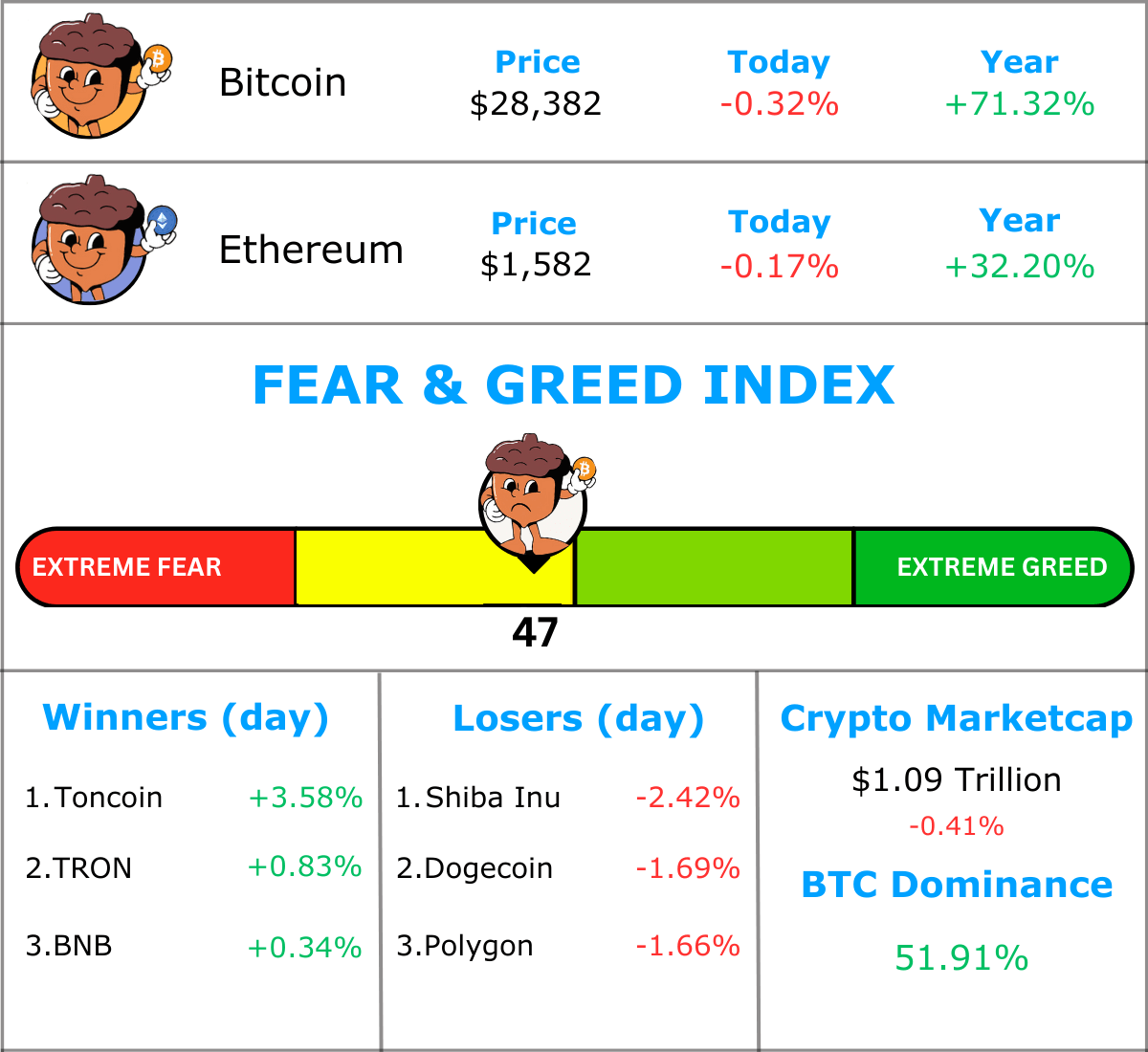

MARKET WATCH ⚖️

Prices as at 7:30am ET

Only the top 20 coins measured by market cap feature in this section

THE SEC WANTS CLARIFICATION 🧑⚖️

BREAKING: Fidelity updates its spot Bitcoin ETF filing in response to SEC feedback

Fidelity joins the list of firms that have updated their Bitcoin ETF filings. A few weeks ago the SEC sent letters to ETF issuers with a set a questions regarding the ETFs.

Ark Invest refiled their application on October 12th. Invesco Galaxy also refiled a day later.

These resubmissions have revealed 5 key areas that the SEC is focusing on:

Mechanics around hard forks

Valuation and pricing sources and adherence to GAAP

Risk disclosure around regulatory uncertainty

Mining is very energy-intensive

Risks involving illicit transactions

ETF analysts believe this to be a good sign.

James Seyffart also mentioned:

“there’s likely to be more amendments over the coming weeks and months. It’s an ongoing dialogue with feedback and responses etc.”

Here’s a reminder for the important dates:

15th January 2024: BlackRock next decision deadline

15th March 2024: BlackRock final deadline (a decision MUST be made on / before this date)

Keep in mind these dates are just deadlines. The SEC can issue decisions on these whenever they want.

TOGETHER WITH VINCENT SPOTLIGHT 🔦

If you’re into crypto, there’s a good chance you want to be wealthy.

Not BMW wealthy, but Bugatti wealthy. 🏎️

Unfortunately, this isn’t the 70’s anymore. Investing in real-estate, bonds or index funds just won’t cut it anymore…

That’s where alternative assets come in.

Alternative assets can be anything from crypto to fine art, trading cards, wine or vintage cars. Investments that have the potential for massive returns.

The problem? There’s so many to keep up with…

That’s where VINCENT SPOTLIGHT comes in:

Breaks down the top opportunities in the alternative asset space ✅

Behind the scenes look into the highest alternative asset sales 🤑

Delivered straight to your inbox in a weekly in 2 min read 📨

Annnnd you guess it, they’re completely FREE.

Subscribe now by slamming that big subscribe button below, the alternative asset market awaits… 💰

Sponsored

Vincent Spotlight

Alternative Investing News for the Savvy Investor

THIS WILL MAKE BITCOIN PUMP 🚀

There are 2 major Bitcoin catalysts that are inevitable.

Bitcoin Halving ✂

Spot Bitcoin ETF 💰

Yesterday we got a practice run of a spot Bitcoin ETF approval.

It was a small taste of what it will bring.

That price action was entirely retail. No institutional buyers.

Today, Eric Balchunas broke down what to expect once a spot Bitcoin ETF is really approved.

Eric is the senior ETF analyst at Bloomberg. When it comes to ETF’s, he’s THE MAN.

In his interview, he urged investors to focus on the big picture.

“Look, if you have 10 big asset managers - Fidelity, BlackRock. These are the biggest in the world. If they’re declaring Bitcoin an asset class, that’s all you need to know.”

It’s not 2021 anymore. Bitcoin & crypto aren’t in a mania phase. This means initial volume on a spot Bitcoin ETF could be underwhelming. (Like what we saw with the launch of the ETH futures ETF’s)

Even if it’s a ‘buy the rumour, sell the news’ event or volume is underwhelming, Eric says look at the 5-10 year time frame.

BlackRock, Fidelity and all the other TradFi companies have thousands of salespeople.

They are visiting advisors and wealth managers all the time.

Once they have the Bitcoin ETF in their tool-box?

There will be an army of salespeople pitching Bitcoin. To the wealthiest institutions and individuals in the world.

No matter what happens in the short term with these catalysts… the future is incredibly bright ⛅

CAPITAL ROTATION 💫

The coolest thing about on-chain data is the way you can visualise market dynamics. You can’t do this with other assets.

Today we’ll be looking at the Realized Cap HODL Waves. This metric shows us the shifts in wealth distribution.

It works by grouping coins by age bands as a percentage of the realized cap. We’re only considering the price of coins when they last moved. Think of it as the distribution of wealth (USD value) invested in Bitcoin.

Warmer colours are younger coins (red arrows).

Cooler colours are older coins (blue arrows).

Market uptrends: older coins are transferred from long-term holders to new investors

Market downtrends: speculators lose interest and generally transfer coins back to long-term holders

Currently the market is seeing a slightly positive inflow of newer investors entering the market.

Todays conditions are similar to those of 2016 and 2019. The market has been slowly recovering from an extended bear market drawdown.

We recommend checking in on this metric every now and then.

Once the market is dominated by young coins (warmer colours) it may be a good time to start taking profits. 😎

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Future Blueprint

Learn to do the impossible. We deliver insights and practical tools to give you AI superpowers.

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

Sponsored

Vincent Spotlight

Alternative Investing News for the Savvy Investor

CAN YOU CRACK THIS NUT? ✍️

Following on from yesterdays question. Which privacy token is the largest, measured by market cap?

A) Zcash

B) Oasis Network

C) Monero

D) Worldcoin

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) Monero 🥳

Monero is currently the largest privacy coin with a market cap of $2.77 Billion (almost 7x larger than the second place, Zcash).

GET IN FRONT OF 14,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.