GM to all 12,659 of you. Crypto Nutshell comin’ forth. 🐴 🥜

We’re the crypto newsletter that's less dramatic than a family's struggles in the criminal underworld... 👨👩👧👦💰

Today, we’ll be going over:

😢 Bad news about Bitcoin

👾 The Metaverse is back…

📈 Long term holders rising

💰 And more…

MARKET WATCH ⚖️

Prices as at 7:10am ET

Only the top 20 coins measured by market cap feature in this section

BAD NEWS: BITCOIN ETFS DELAYED 🔥

JUST IN: SEC delays spot Bitcoin ETF decision for BlackRock, Invesco, Bitwise and Valkyrie

The United States Securities and Exchange Commission (SEC) has delayed it’s decision on several Bitcoin ETFs ahead of an increasingly likely government shutdown.

Bloomberg analyst James Seyffart is expecting the ETF applications from Wisdom Tree, Vaneck and Fidelity to also be delayed tomorrow.

Seyffart explains that these delays are likely the result of the coming government shutdown (which we discussed last week).

The shutdown would leave the SEC with ~7% of it’s staff, meaning there isn’t enough capacity to complete the approval process for these ETFs. If Congress is unable to pass a funding plan, the shutdown will begin 12:01am October 1.

Unfortunately, a prediction on how long the shutdown will last is impossible. It could last weeks.

Mark these dates down in your calendars:

Mid January 2024: Next deadline for BlackRock’s ETF application

Mid March 2024: Final ETF decision deadline

Keep in mind, these dates are deadlines. The SEC could approve the Bitcoin ETF applications at any time… 🤷

TOGETHER WITH VINCENT SPOTLIGHT 🔦

If you’re into crypto, there’s a good chance you want to be wealthy.

Not BMW wealthy, but Bugatti wealthy. 🏎️

Unfortunately, this isn’t the 70’s anymore. Investing in real-estate, bonds or index funds just won’t cut it anymore…

That’s where alternative assets come in.

Alternative assets can be anything from crypto to fine art, trading cards, wine or vintage cars. Investments that have the potential for massive returns.

The problem? There’s so many to keep up with…

That’s where VINCENT SPOTLIGHT comes in:

Breaks down the top opportunities in the alternative asset space ✅

Behind the scenes look into the highest alternative asset sales 🤑

Delivered straight to your inbox in a weekly in 2 min read 📨

Annnnd you guess it, they’re completely FREE.

Subscribe now by slamming that big subscribe button below, the alternative asset market awaits… 💰

Sponsored

Vincent Spotlight

Alternative Investing News for the Savvy Investor

THE METAVERSE IS BACK…👾

The ‘Metaverse’ was the biggest buzzword and eventual flop of 2021 & 2022.

Facebook went all-in on the metaverse and rebranded from Facebook to Meta.

The result? Their stock fell 60% in the following 12 months. 📉

The metaverse was declared dead and it disappeared as a buzzword.

But it’s back.

This week, at Meta Connect, Mark Zuckerberg broke headlines. He revealed the Meta Smart Glasses. Teaming up with Rayban, Meta has launched a series of sunnies that blends real life with augmented reality. They're also shipping built in with Meta AI.

Honestly? The sunnies are pretty damn cool. Much cooler than glasses or VR headsets we’ve seen in the past. This is a huge step towards mass adoption.

Then, today, Lex Fridman dropped a podcast with Mark Zuckerberg.

The kicker?

It’s done in the metaverse. Using photo realistic 3D codec avatars, Mark and Lex appear to be in the same room. 😲

The podcast used Meta’s new virtual reality headset, the Quest 3. The results were truly mind blowing. 🤯

The interview is going viral, and for good reason. It’s like taking a glimpse into the future. 🔮

If you have some free time, it’s definitely worth a watch.

So, the Metaverse is back.

What does this have to do with crypto?

The metaverse and crypto are so intricately linked that the success of one will drive the other.

The metaverse needs a way of transacting value. That job will fall to tokens like Bitcoin and Ethereum.

From a narrative standpoint, as hype builds surrounding the Metaverse, that pours over into crypto.

Meta is definitely pro-crypto. Not only did they attempt to launch their own blockchain, Libra (which was ultimately shut down) but Zuckerberg has 2 pet goats... one of which he named Bitcoin. 🐐

Bottom Line: Hype surrounding the metaverse is ramping up. Narratives & adoption will spill over into the crypto sphere. We’ll be keeping a close eye on any developments here 👀

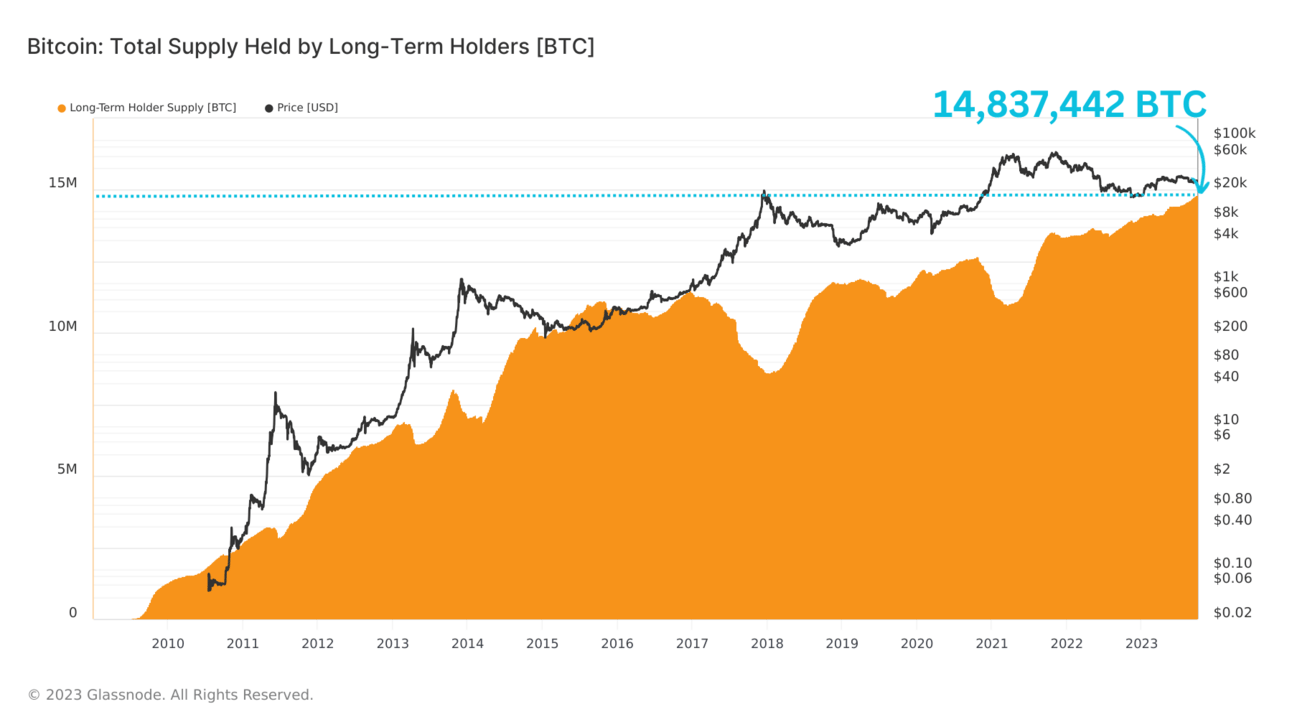

LONG TERM HOLDERS RISING 📈

The amount of Bitcoin held by long-term holders (LTH) continues to break all time highs.

Glassnode defines LTHs as any wallet address that has received and held Bitcoin for longer than 155 days. 💪

Interestingly Glassnode’s data says that after 155 days of holding, Bitcoin wallets become increasingly unlikely to move their coins.

The last 6 months we’ve seen super low price activity with Bitcoin hovering around the $26,000 to $27,000 price range for what feels like forever. 🥱

During this “accumulation” period, a lot of short-term holders (STH) couldn’t take it anymore and decided to liquidate their positions.

And guess what?

When STHs are selling, LTHs are buying.

As of today, 14,837,442 (76.09%) Bitcoin is in the hands of LTHs. And this number is only growing, take another look at the chart above…

This means that 3 out of every 4 Bitcoins in circulation are held by LTHs

Bottom Line: Long-term holders clearly have a strong conviction in the future of Bitcoin. There’s just too many bullish catalysts on the horizon (ETFs and Halving to name a few).

We’re in it for the long run. Are you? 🤔

Let us know in the poll at the bottom of this newsletter whether you’re in it for the long-run like us or just in it to make some quick trades. 👇

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Lettuce Trail

Packed with inspiring success stories, expert tips, and valuable recommendations that will empower you to unlock your full potential and achieve remarkable results.

Sponsored

Stock Market Rundown

Your 3-minute morning read with an amusing angle on business and the stock market. Learn, laugh, stun your friends with your knowledge.

Sponsored

Vincent Spotlight

Alternative Investing News for the Savvy Investor

CAN YOU CRACK THIS NUT? ✍️

On 11 November 2022, which major crypto exchange filed for bankruptcy?

A) Binance

B) Coinbase

C) Kraken

D) FTX

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: D) FTX 🥳

On 11 November, FTX, FTX US, Alameda Research, and more than 100 affiliates filed for bankruptcy in Delaware.

GET IN FRONT OF 12,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.