GM to all 15,629 of you. Crypto Nutshell #131 crawlin’ by. 🪲 🥜

We’re the crypto newsletter that's more thrilling than waking up with superpowers after a radioactive spider bite... 🕷️💥

Today, we’ll be going over:

🤑 Bitcoin hits new YTD high

🛸 18 months until Bitcoin hits $150,000

⏰ Ethereum’s time will come

💰 And more…

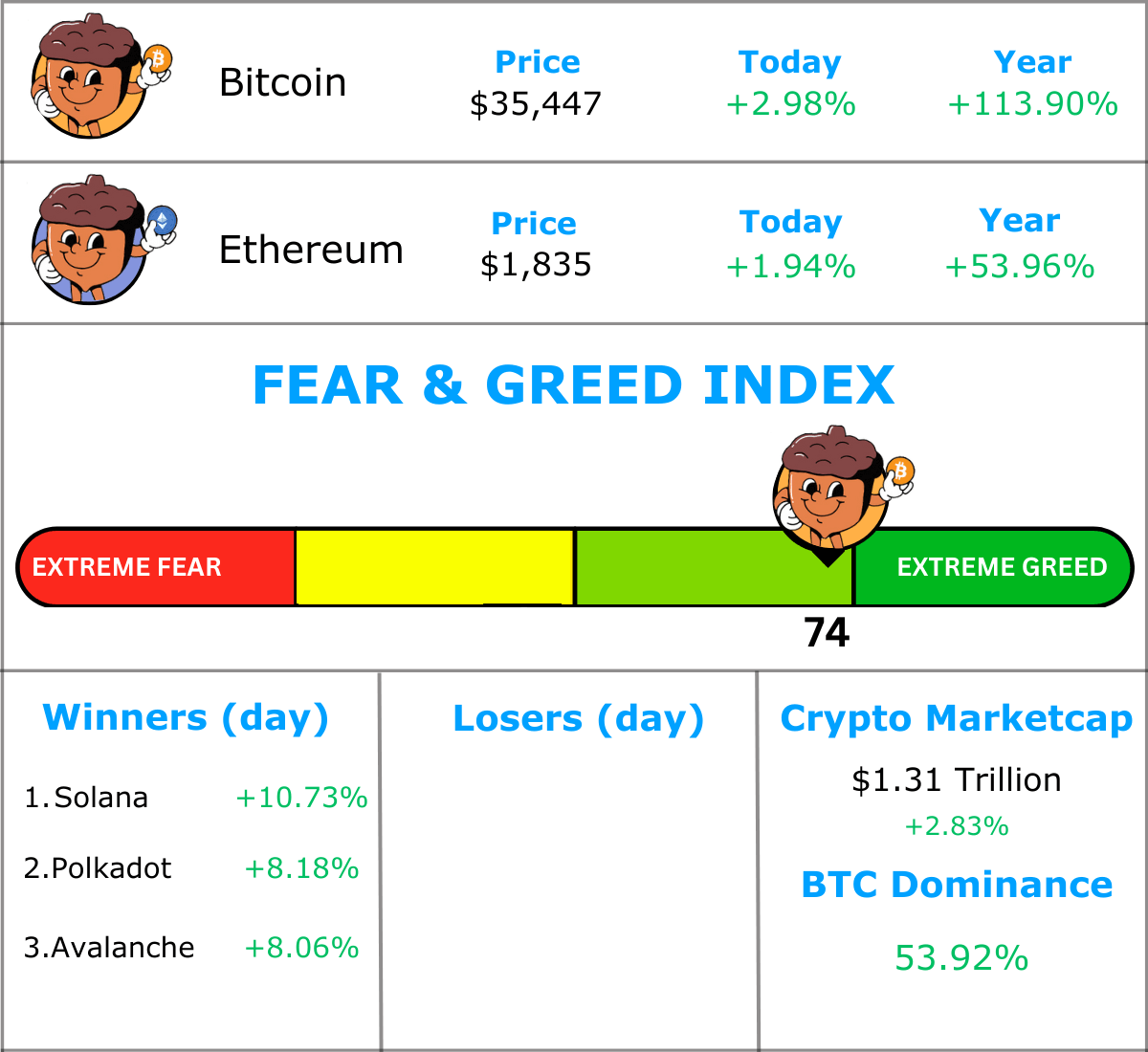

MARKET WATCH ⚖️

Prices as at 6:40am ET

Only the top 20 coins measured by market cap feature in this section

BITCOIN HITS NEW 2023 HIGH 🤑

BREAKING: Bitcoin retakes $35k after FOMC keeps interest rates steady

The U.S Federal Reserve’s Federal Open Market Committee (FOMC) decided to hold rates steady at 5.25% - 5.50%, as was expected (the highest level since 2001).

“In light of the uncertainties and risks and how far we have come, the committee is proceeding carefully. We will continue to make our decisions meeting by meeting.“

All eyes will now be on the next Bureau of Labor Statistics inflation reading on November 14. Should inflation decrease, we can expect to see money flooding back into risky assets. 🌊

To understand the impact that interest rates have on Bitcoin, checkout this article.

Off the back of this news, Bitcoin blasted through $35,000 setting a new year-to-date high of $35,984 at the time of writing.

Adding fuel to the fire, was the undisputed King of Bitcoin, Michael Saylor. 👑

He revealed that MicroStrategy has purchased an additional 155 Bitcoin for $5.3 million. That brings his total to a whopping 158,400 Bitcoin. 🤯

He’s really never going to stop stacking sats, is he? 👏

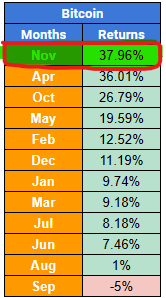

Looking ahead, let’s see what November has in store for us.

As it turns out, November is actually Bitcoin’s best performing month, with average gains of 37.96%.

Although the last two Novembers were negative… (-16.23% & -7.11%)

Also as a bit of fun, take a close look at the table below.

Do you see it?

Something special happened this year.

Bitcoin was green in both September and October.

This has only ever happened twice before in Bitcoin’s history. (2015 and 2016)

And when this did happen, November and December were both green. 🤑

We could be in for a big close to 2023…

TOGETHER WITH MODEMOBILE

First Disruption to Smartphones in 15 Years🤳

Tech Startup With Traction: Turn your phone from a cost to an income source. Intriguing idea, isn't it? This is why, we have our eyes on the launch of Mode Mobile’s Pre-IPO Offering. It’s the latest in a series of impressive raises among smartphone innovators, likely spurred by Apple’s recent $3+ trillion valuation.

Mode saw 150x revenue growth from 2019 to 2022, a leap that has made them one of America’s fastest growing companies. Mode is on a mission to disrupt the entire industry with their "EarnPhone," a budget smartphone that’s helped consumers earn and save $150M+ for activities like listening to music, playing games, and ... even charging their devices?!

Over 11,000 investors already acquired shares — and with only days remaining prior to their bonus tier closing, allocations are limited.

*Disclosure: Please read the offering circular at invest.modemobile.com. This is a paid advertisement for Mode Mobile’s Regulation CF Offering.

18 MONTH UNTIL BITCOIN HITS $150,000🛸

Allow us to introduce you to Bernstein...

They are a private wealth management firm with $646 billion under management.

They only provide financial advice to ultra high net worth investors.

And in their latest research report, they made a huge prediction:

Bitcoin will hit a cycle high of $150,000 by mid-2025.

The report was by managing director and senior analyst; Gautam Chhugani.

"You may not like Bitcoin as much as we do, but a dispassionate view of Bitcoin as a commodity, suggests a turn of the cycle.”

Here’s the reasoning behind the prediction:

Cryptocurrency is now a better investment than gold. This is due to its “fairly early stage of institutional adoption.” Additionally, Bitcoin will be more scarce than gold on a stock-to-flow basis, following the 2024 Halving.

A Bitcoin ETF is expected by first quarter, 2024. Bernstein predicts the ETF will swallow up to 10% of the circulating supply.

The Bitcoin Halving. Not only will the Halving improve supply dynamics, it will also improve mining efficiency. Bernstein predicts struggling miners to be “washed out”. Which means bigger gains & efficiency by the survivors.

Now a $150,000 prediction does seem huge, but it is only slightly more than 2x of the 2021 all-time high.

The real story here is the narrative being spun to institutional & ultra high net worth investors.

It’s research reports just like this that gets big money in the door. 🤑

And as we pointed out yesterday, once you are exposed to it… “You can’t unsee Bitcoin.”

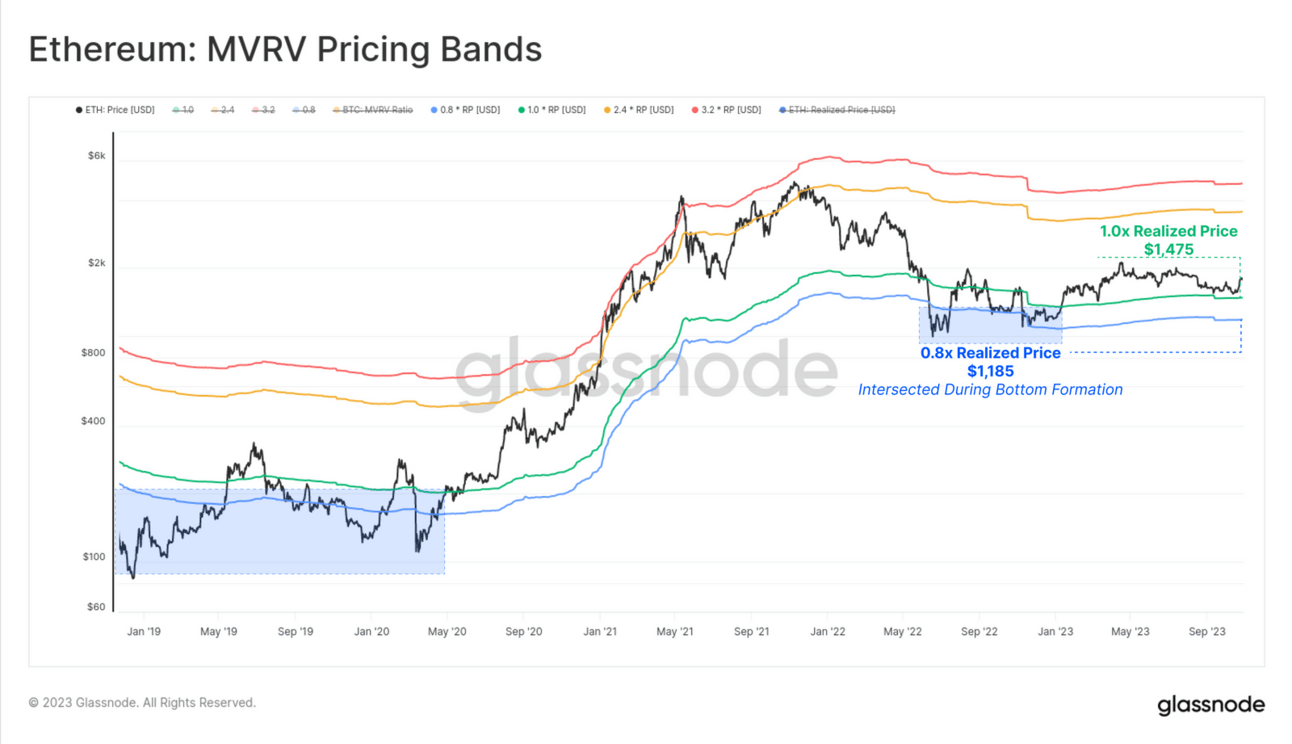

ETHEREUM’S TIME WILL COME ⏰

It’s about time we check in on Ethereum.

A quick way to gauge the profitability of the market is through the Realized Price. The Realized Price is the average cost basis of all coins in the supply.

It is calculated by taking the Realized Cap (price each coin last moved at) and dividing by the total supply.

The chart below uses multiples of the Realized Price to estimate cycle tops and bottoms:

🔵 0.8 * Realized Price: price trading below this indicates extreme unrealized losses, cycle bottom 😭

🟢 1.0 * Realized Price: The average cost basis of the entire ETH supply

🔴 3.2 * Realized Price: price trading above this indicates extreme unrealized profits, cycle top 😁

As the price approaches 🔴 the likelihood of profit taking increases (pretty straightforward). This is ultimately what establishes the cycle top.

With ETH currently trading above $1,800, it is ~22% above the Realized price ($1,475).

This means that the average ETH holder is in profit. 🥳

However, the price still has a long way to go before it’s anywhere near the extreme levels of bull market euphoria.

The start of 2023 saw ETH break through it’s realized price. This signaled a considerable shift in investor confidence. But it hasn't significantly blown past the realized price like in 2020 just yet.

Bottom Line: Ethereum is still in it’s “accumulation“ phase. We haven’t quite seen the insane price action that Bitcoin has been showing lately.

But this is expected. Bitcoin always moves first, then Ethereum, then altcoins.

Remember, the best gains are made when investors focus is elsewhere… 😉

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Fast Food Club

The Official Fast Food Club. Get access to the world's largest group for fast food secrets, news, tips, menu hacks, and secret recipes. Once you subscribe you'll become a member.

Sponsored

The New Money

Discover the world's most exciting stocks. The markets and trends that matter, made simple.

Sponsored

The Intrinsic Value Newsletter

The weekly newsletter devoted to breaking down business and estimating their intrinsic value, in just a few minutes to read — Join 35,562 readers

CAN YOU CRACK THIS NUT? ✍️

The "length" of a blockchain is known as its __________

A) Block weight

B) Block size

C) Block height

D) Block girth

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) Block height 🥳

The current block height of a blockchain is an indication of its current size or time in existence.

GET IN FRONT OF 15,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research