GM to all 14,041 of you. Crypto Nutshell #110 rockin’ on. 🎸🥜

We’re the crypto newsletter that's as legendary as a group of friends hanging out at their favourite New York coffee shop... ☕🗽

Today, we’ll be going over:

🧑⚖️ The trial of SBF - Week 2

🎅 Another Billionaire wants Bitcoin

🤫 Quiet times...

🤑 And more…

MARKET WATCH ⚖️

Prices as at 6:00am ET

Only the top 20 coins measured by market cap feature in this section

THE TRIAL OF SBF - WEEK 2 🧑⚖️

BREAKING: SBF demanded multiple versions of Alameda’s balance sheet, Ellison testifies

Caroline Ellison, the government’s star witness & former girlfriend of SBF, just dropped some bombshells.

Ellison, who was the CEO of Alameda Research, has been key to understanding the level of fraud that was going on at FTX.

As crypto market conditions worsened in 2022, Alameda lenders were beginning to recall loans. According to a Signal message shown in court, Genesis asked for $500 million back in June 2022.

Ellison claims that SBF instructed her to create seven different versions of Alameda’s real balance sheet. These fake balance sheets were then sent out to Genesis and other lenders.

“I wanted to reassure them… but the fact was… we had been borrowing more from FTX customers… I didn’t want to be dishonest but I also didn’t want them to know the truth.”

The government then proceeded to show the following tweet from SBF:

Ellison was then asked if FTX had enough assets to backstop it’s customers at the time of this tweet.

“No” said Ellison.

In reality, customers had deposited around $15 billion onto the exchange. And FTX only had around $6.8 billion in liquid assets…

Most of which was in FTT tokens…

For more on Caroline Ellison’s testimony click here.

TOGETHER WITH VENTURE SCOUT 🎯

Did you know Michael Burry made his investors $700 million dollars in 2008, just by looking where no one else was.

If only we could do the same…. 💭

That’s where Venture Scout comes in. They deliver to you the latest info & news on start-ups. The brand spankin’ new companies that no one is looking at yet.

It’s like a needle in a haystack being delivered straight to your inbox, once a week. (without the haystack)

It’s an easy & fun 3-min read, and the best part is they’re 100% FREE (so you have nothin’ to lose) Subscribe by clicking the button below 👇

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

ANOTHER BILLIONAIRE WANTS BTC 🎅

Paul Tudor Jones loves two things.

Christmas Lights🎄

Investing 💰

If you haven’t heard of him before, he’s one of the greatest hedge fund managers of all time.

Since founding his hedge fund in 1980, Jones has amassed a fortune of $8+ billion dollars.

His speciality? The ability to call market turns and make macro trades.

Yesterday he spoke on CNBC. He broke down why he believes the U.S is in the weakest fiscal position since WWII.

The assets he’s looking at?

Bitcoin & gold.

“I love Bitcoin & gold together. I think they take on a larger percentage of your portfolio than they historically would.”

There’s two things Jones believes will propel Bitcoin upwards.

2024 U.S election

Geopolitical situation unfolding in the Middle East❗

Jones has been a long-term fan of Bitcoin, revealing in May 2020 that he had ~2% of his assets in BTC. Since then, he has revealed that he continues to accumulate.

A huge vote of confidence from one of the greats. 💪

p.s we weren’t kidding about the Christmas lights. Here was one his displays back in 2012:

He really does love Christmas…

QUIET TIMES… 🤫

For most of this year Bitcoin has been trading within the $26,000 to $28,000 price range.

Although we have the upcoming Halving and ETF approvals, nothing major has happened to spark any large price movements.

Bitcoin has been extremely quiet and that’s reflected in the on-chain data…

Glassnodes Week On Chain Report picks out 3 key charts that perfectly explain why the markets appear so quiet.

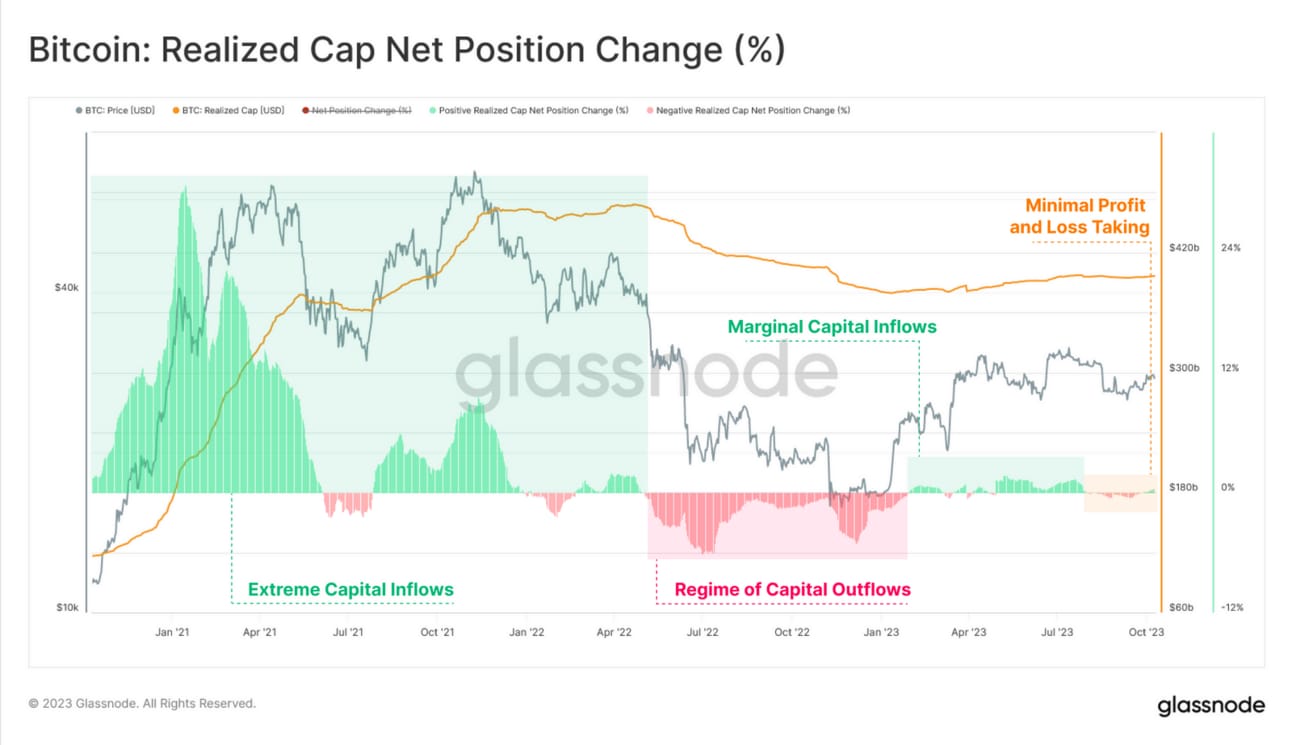

Realized Cap

The Realized Cap looks at the price of each coin when it last moved. Think of it as the amount invested in the network.

When someone buys a coin low and sells high, it'll get revalued higher. As a result, the Realized cap will also increase.

Bull markets: sharp increases in Realized cap (coins bought at the bottom get sold as the price rises) 📈

Bear markets: sharp decreases in Realized cap (coins bought at the top get sold as the price drops) 📉

The start of this year saw a small amount of capital inflow as the price increased. Since then the Realized cap has stagnated.

As of today, there aren't many coins moving on chain. The ones that are moving aren't locking in significant profits or losses.

This means that the majority of coins moving today are from the recent price range of $26,000 to $28,000.

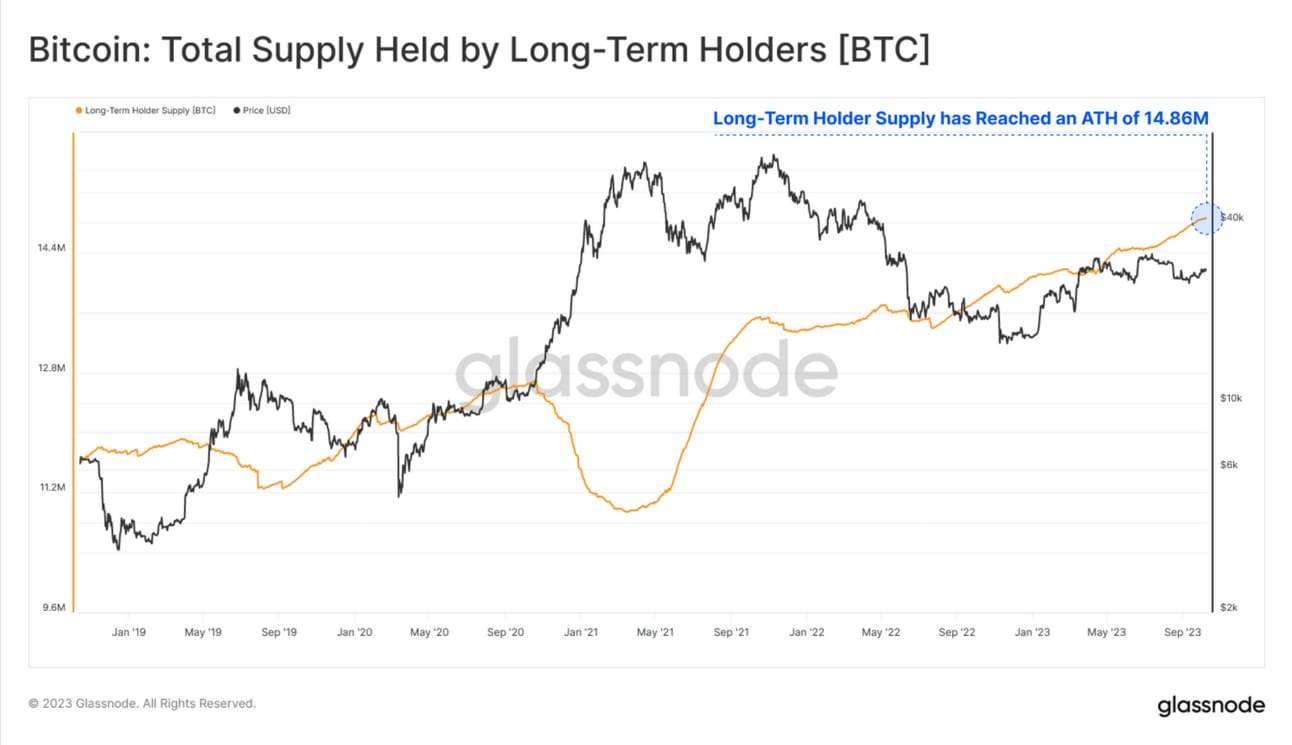

Long Term Holders

So if the realized cap isn’t growing then what’s going on?

Long-term holders are continuing to accumulate. 🤑

As of today 14.86 million Bitcoins have not moved in over 5 months. This is equal to 76.10% of the Bitcoin supply.

Two takeaways from this:

Long-term holders have never shown more conviction - unfazed by current world events

The HODLers are the only ones that remain - short-term holders are decreasing every day

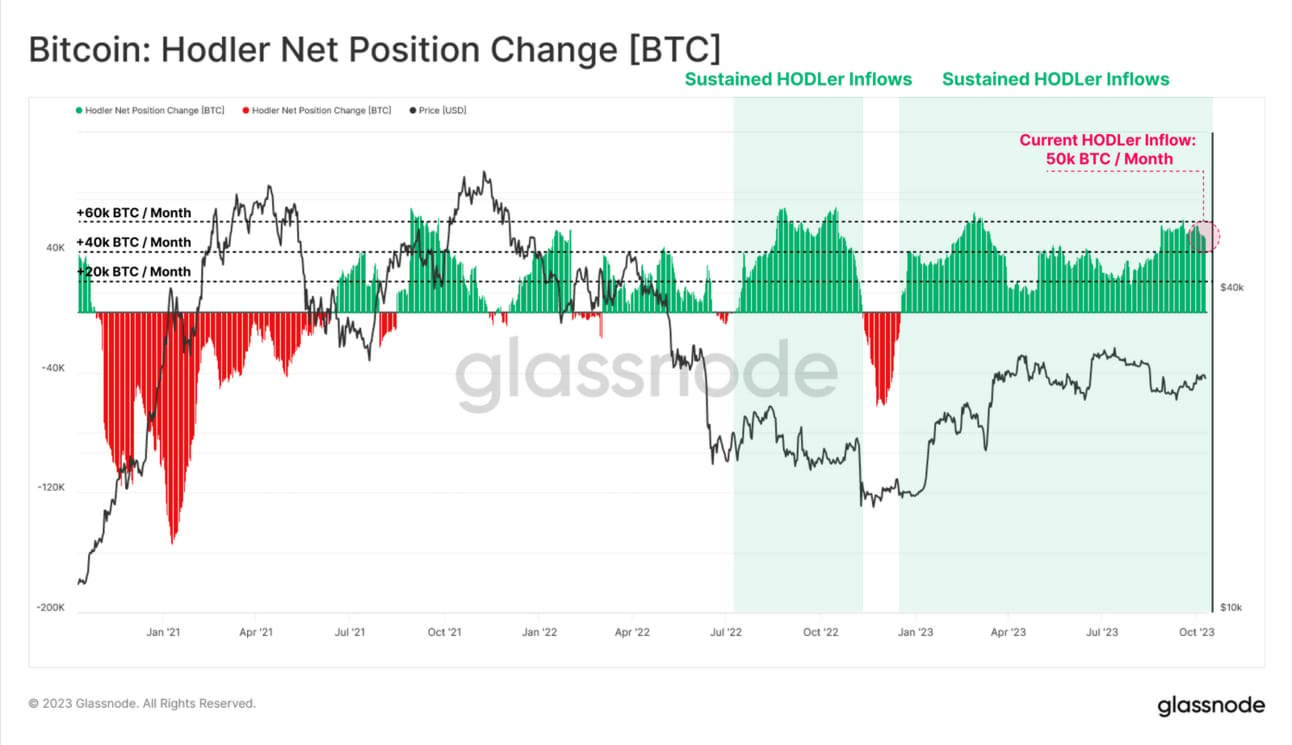

HODLer Net Position Change

Another way to look at this is through the rate at which coins are becoming dormant.

Green: HODLlers are accumulating more Bitcoin

Red: HODLers are cashing out

HODLer’s are accumulating Bitcoin at a rate of 50k per month

Bottom Line: This is the part of the bear market that is the most painful. It’s characterised by long, boring & slow sideways price action.

At the end of the day, it’s all just part of the cycle.

This is where the real money is made. Contrary to popular belief, money isn’t made in bull markets, but in the depts of the bear markets. 🐻

If you enjoyed this, checkout the full Glassnode report here.

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Vincent Spotlight

Alternative Investing News for the Savvy Investor

Sponsored

The Next Big Rush

⛏ Let's Explore the Wealth Beneath the Surface!

Sponsored

Venture Scout

High-quality software startups delivered straight to your inbox, every Wednesday.

CAN YOU CRACK THIS NUT? ✍️

How many Bitcoins are created every 10 minutes?

A) 3.125

B) 6.25

C) 12.50

D) 25.00

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) 6.25 🥳

Every 10 minutes, miners verify one block of Bitcoin transactions. The current reward for verifying one block of Bitcoin is 6.25 BTC. This will be reduced to 3.125 with the 2024 halving.

GET IN FRONT OF 14,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.