GM to all 12,750 of you. Crypto Nutshell stormin’ in.⚡️🥜

We’re the crypto newsletter that's as thrilling as a group of elite spies taking on international threats... 🕶️🌍

Today, we’ll be going over:

😢 Ethereum futures ETFs set to launch Monday

👾 Going all-in on crypto…

💪 These HODLers have seen it all

💰 And more…

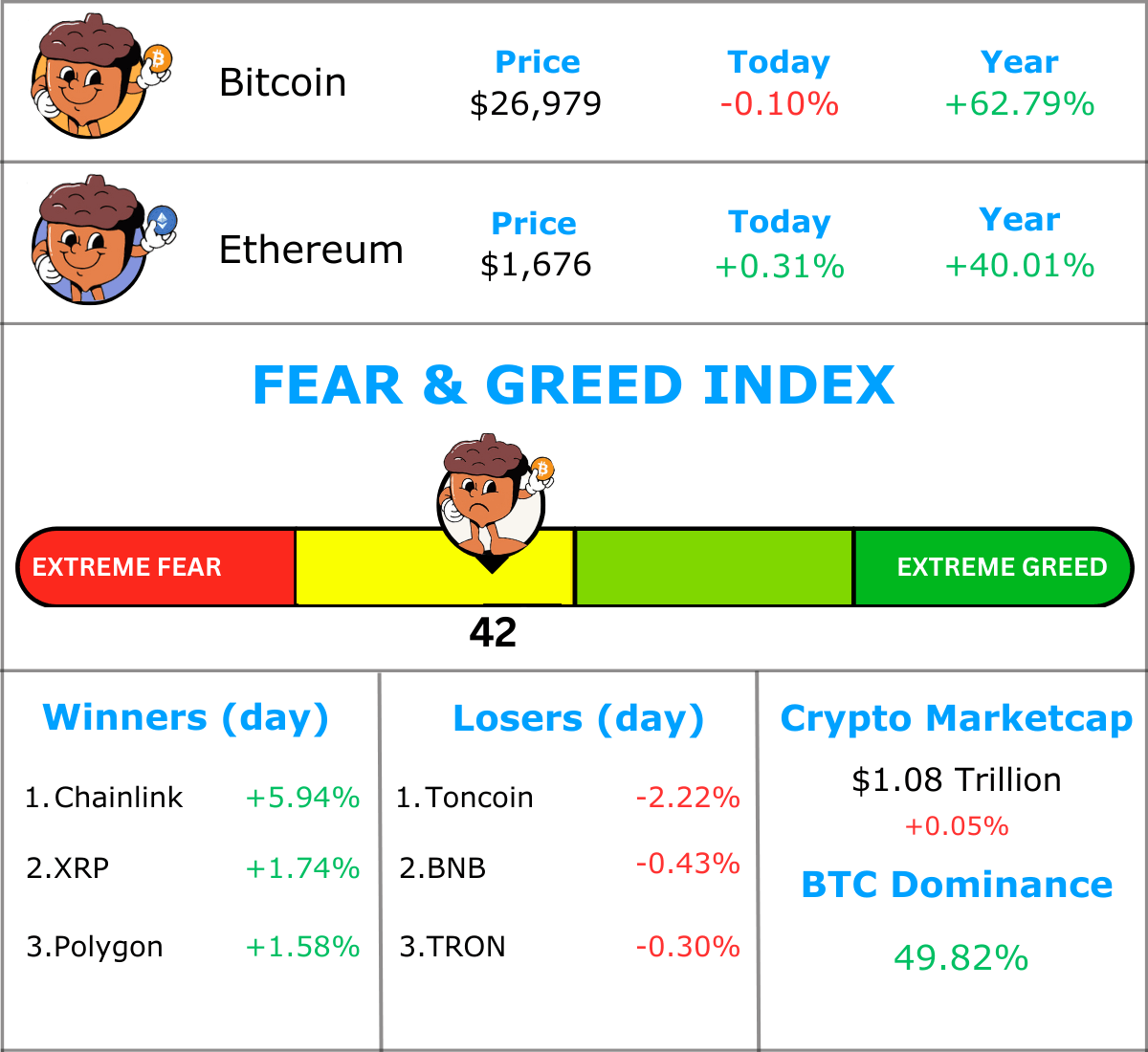

MARKET WATCH ⚖️

Prices as at 7:30am

Only the top 20 coins measured by market cap feature in this section

ETH FUTURES ETF TO LAUNCH MONDAY 😲

JUST IN: Ethereum Futures ETFs given SEC accelerated approval to launch on Monday

Bloomberg analyst James Seyffart has revealed a list of 9 funds that are ready to launch. James believes these funds will begin trading as early as Monday.

Why is the SEC approving these Ethereum ETFs and delaying the Bitcoin ones?

Simple. Back in 2021 the SEC approved a Bitcoin futures ETF so it's only fair they approve an Ethereum one.

It wouldn’t make any sense if the SEC denied these ETH futures ETFs...

Off the back of this BIG news for Ethereum, the price is currently up ~5% for the week.

ETF expert Eric Balchunas is predicting that these ETFs will bring in ~$200 million in the first week.

Here's the logic for this prediction: Bitcoin futures brought in $1 billion in the first week. Globally, ETH funds have 20% the AUM (assets under management) of Bitcoin funds.

Balchunas also mentions that we’ve never seen so many ETFs doing the same thing launch on the same day. It’s going to be a great preview of what’s to come with the spot Bitcoin ETFs.

Exciting times ahead for Ethereum 😎

TOGETHER WITH THE NEXT BIG RUSH ⛏️

Before Bitcoin, there was a little something called gold.

As much as we love to live in the future, commodities will always play a role in our lives.

How much will it cost to fill up my tank of gas? Are gold & silver prices rising or falling? 🤔

That’s where The Next Big Rush steps in.

Makes keeping up with the latest commodity & investing news dead simple and entertaining ✅

Helps you stay on top of the all the latest technological breakthroughs 🔨

Delivered straight to your inbox every single day in a 3 min read 📨

The cherry on top? They’re also completely FREE just like us.

Subscribe now by hitting that big subscribe button below. Not your cup of tea? You can always unsub. Nothing to lose 😎

Sponsored

The Next Big Rush

⛏ Let's Explore the Wealth Beneath the Surface!

GOING ALL IN ON CRYPTO 👾

Jason Yanowitz is an under the radar crypto expert. You probably haven’t heard of him, but he’s a straight up killer:

Founder of Blockworks, one of the largest crypto media companies (valued at $135 million in 2023)

Years of experience working in the crypto industry

Believes crypto is the best risk to reward industry in the world

Being the founder of a crypto media company, Jason is one of the most knowledgeable and up-to-date guys in the space.

On top of this, Blockworks has a huge research firm that covers on-chain data & analytics of all the top crypto chains.

So what’s the conviction of someone that has access to the most information in the space? 🤔

He’s all in.

In an interview this week, Jason revealed all.

Most of Jason’s wealthy is tied up in Blockworks, which is essentially a bet on crypto.

But of his liquid portfolio? Up until recently he was 100% allocated to crypto.

Why not 100% anymore? Jason says his wife thinks he’s insane and made him diversify. 😅

If it was up to him? He’d still be 100%.

“I have deep, deep, deep conviction. I think it's one of the best things to work on for the world. From an allocation perspective, like risk-reward perspective? There's no better industry in the world to work in than crypto right now.”

A true gigachad.

Bottom line: It’s a great sign when the top guys, with access to the most information, have such strong conviction in crypto. Enough to go all-in.

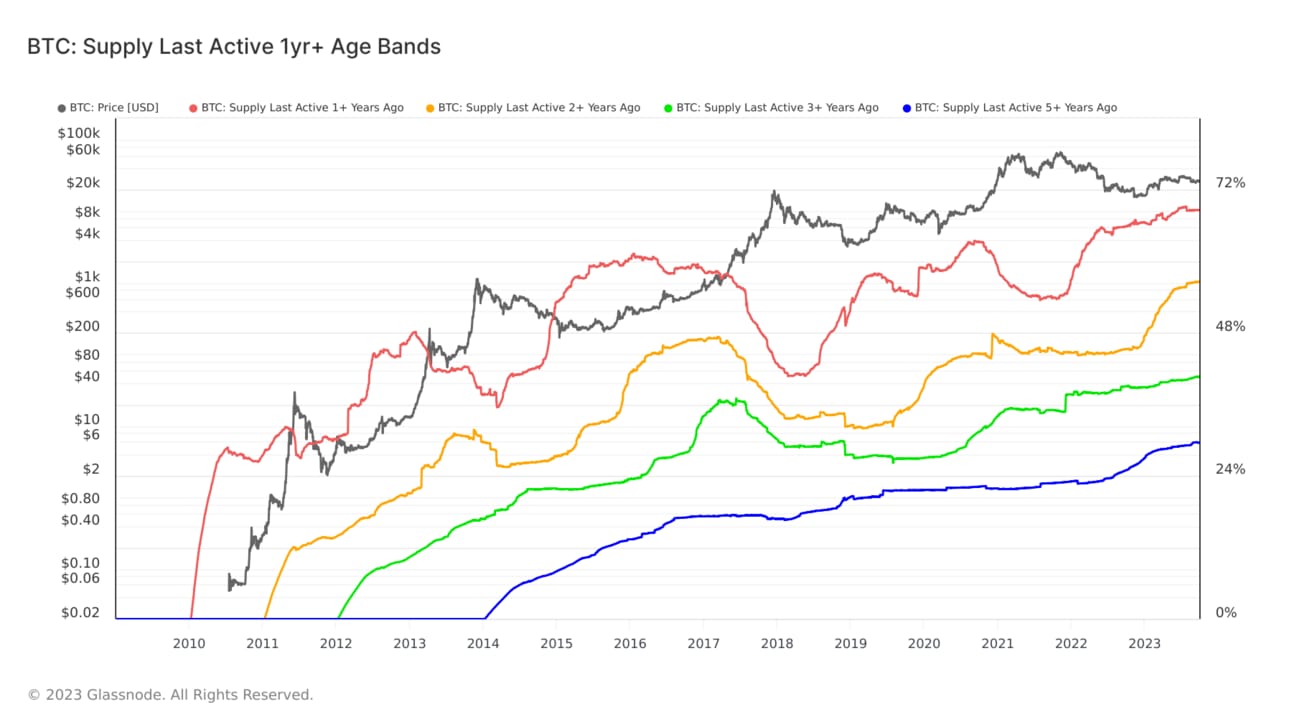

THESE HODLERS HAVE SEEN IT ALL 💪

Yesterday we discussed how the amount of long-term Bitcoin holders continues to break all-time highs.

Today we’ll be breaking this down even further. Let’s see exactly when some of these coins last moved.

We can categorise HODLers into groups based on the last time their coins moved. This is useful for getting a clear picture of long-term investor sentiment.

The “supply last active” groups as a percentage of the circulating supply:

🔴 Supply last active 1+ years ago: 68.62%

🟠 Supply last active 2+ years ago: 56.62%

🟢 Supply last active 3+ years ago: 40.64%

🔵 Supply last active 5+ years ago: 29.64%

Some quick takes from this data:

Supply last active 2+ years ago is the fastest growing cohort over 2023 🏃♀️

This cohort bought during the Bitcoin bull run of 2021 when Bitcoin’s price was ~$60,000 ⛰️

All other cohorts continue to break all-time highs 📈

The supply last active 2+ years ago has really seen it all. Some of the most notable events that have occurred during this period include:

The price of Bitcoin dropping 75% from its all-time high

China banning Bitcoin mining in 2021 which resulted in the hash rate dropping by more than 35%

The collapse of FTX, Luna and BlockFi

If these black swan events can’t shake out these HODLers… what can?

Truly diamond hands 💎🤲

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Lettuce Trail

Packed with inspiring success stories, expert tips, and valuable recommendations that will empower you to unlock your full potential and achieve remarkable results.

Sponsored

The Hodl Report

Stay ahead of the Curve and Profit by Becoming a Crypto Expert

Sponsored

The Next Big Rush

⛏ Let's Explore the Wealth Beneath the Surface!

CAN YOU CRACK THIS NUT? ✍️

Which of these blockchain’s is currently proof-of-stake?

A) Bitcoin

B) Ethereum

C) Litecoin

D) Ripple

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) Ethereum 🥳

The Ethereum Merge transitioned Ethereum from a proof-of-work to a proof-of-stake consensus model.

GET IN FRONT OF 12,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.