GM to all 13,723 of you. Crypto Nutshell #107 unveilin’ the magic. 🎩 🥜

We’re the crypto newsletter that's as epic as a journey to destroy a powerful ring and save Middle-earth... 💍🌋

Today, we’ll be going over:

👨⚖️ How FTX stole billions

⚠️ Crypto expert Ethereum Warning

🤔 Ethereum inflation?

🤑 And more…

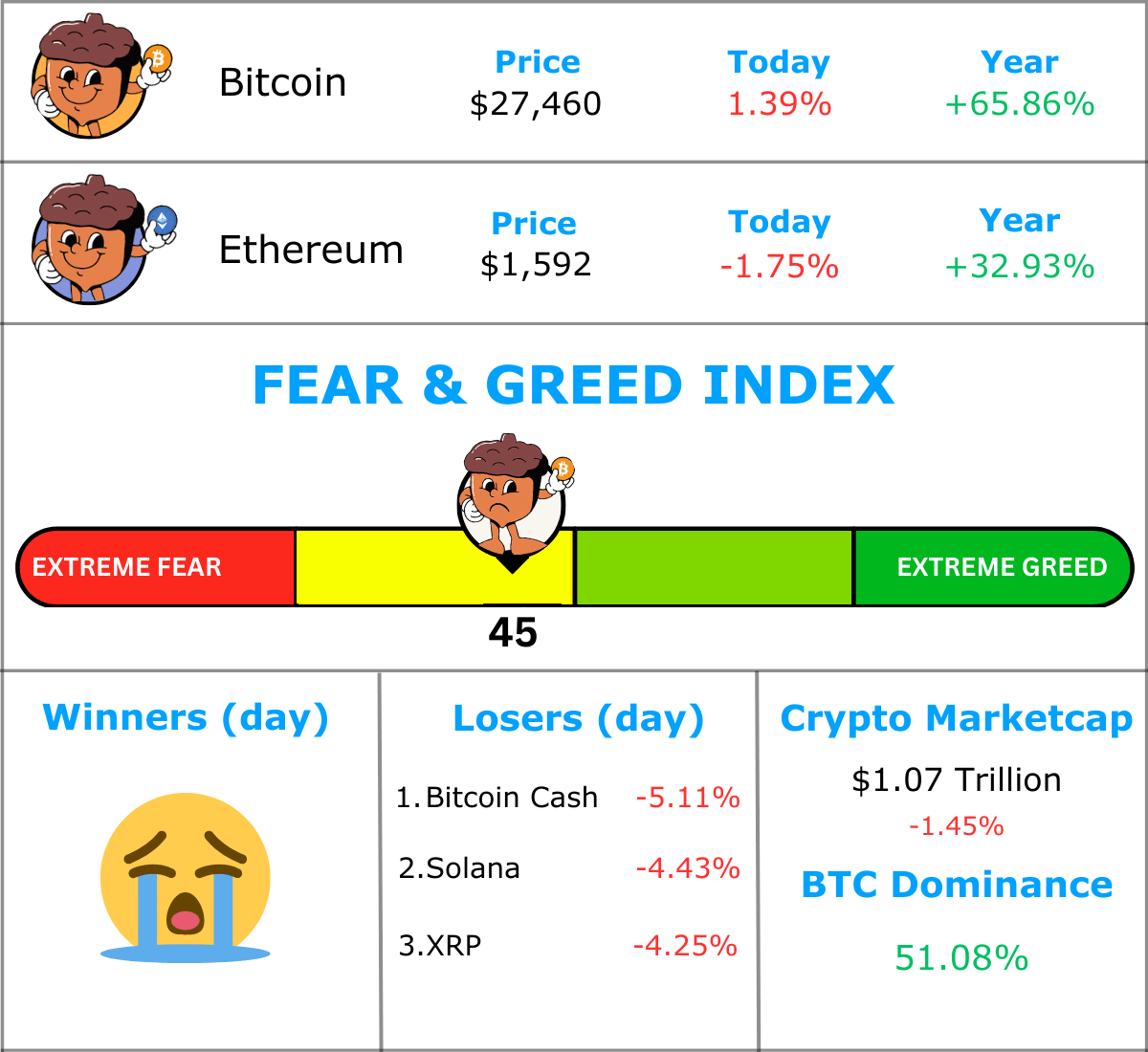

MARKET WATCH ⚖️

Prices as at 7:20am ET

Only the top 20 coins measured by market cap feature in this section

HOW FTX STOLE BILLIONS 🧑⚖️

BREAKING: The first week of SBF’s trial has just concluded.

It’s been a spicy one, as former colleagues and friends have become key witnesses against him.

The US Department of Justice (DOJ) has pulled no punches in their case. SBF has been portrayed as the central figure in an entirely fraudulent scheme.

To this day, SBF claims that he is innocent and was unaware of the fraud going on within FTX.

One of the biggest blows to the defence came from Gary Wang’s (FTX co-founder) testimony.

When asked by Assistant U.S. Attorney Nicolas Roos, “Did you commit financial crimes while working at FTX?”

Wang responded “Yes”.

Going further, Wang said Bankman-Fried, Nishad Singh and Caroline Ellison were all in on the fraud.

Wang also confirmed something BIG. Alameda had code built into FTX’s software that allowed special access to the exchange. This special access later became the main reason FTX collapsed. Alameda owed FTX $8 billion in customer deposits, which they couldn't produce.

“We gave special privileges on FTX that gave unlimited withdrawals on the platform to Alameda,”.

This means, Alameda was allowed to withdraw and transfer those funds and had a $65 billion line of credit. 😳

There was essentially no distinction between customer deposits and Alameda's funds...

“When customers deposited USD, it went to Alameda… It existed in the computer code. Alameda could have negative balances and unlimited withdrawals.”

The trial continues on Tuesday.

Everyone is eagerly awaiting the testimony of Caroline Ellison. The star witness of the prosecutors and former CEO of Alameda Research. Ellison is set to provide a deeper insight into SBF's involvement with the fraud carried out by FTX.

For more details on SBF’s trial click here.

TOGETHER WITH EVERYDAY AI 🤖

Crypto was the fastest adopted technology the world had ever seen… until Artificial Intelligence came along.

Which makes keeping up with A.I … complicated.

Between learning the newest tools and knowing the latest news, Artificial Intelligence can feel overwhelming.

But it doesn’t have to. That’s where EVERYDAY AI steps in.

Makes keeping up with the latest AI breakthroughs dead simple ✅

Helps you stay on top of the latest AI Tools to improve your productivity 🔨

Delivered straight to your inbox every single day in a 3 min read 📨

The cherry on top? They’re also completely FREE just like us.

Subscribe now by suplexing that big subscribe button below, there’s really nuttin’ to lose. 🥜

Sponsored

Everyday AI

Helping everyday people learn and leverage AI

CRYPTO EXPERT ETHEREUM WARNING ⚠️

Last week we saw the launch of 9 Ethereum futures ETF’s. Despite the lukewarm reception by markets, the launch was celebrated by the Crypto community. 🎉

Today’s crypto expert, Mark Yusko, believes celebrating is a mistake.

Yusko believes the launch of a futures ETF, without the launch of a spot ETF, will only put downwards pressure on price. 📉

The launch of futures products has historically marked the tops of asset prices.

Why?

A futures ETF allows people to sell an asset on paper, without actually owning the underlying asset. This is called ‘naked shorts’.

Shorting is borrowing an asset from someone else with the promise you will return it at some point in the future. It’s making a bet that the price will go down. ⬇️

A futures ETF has one main problem. If you have large enough balance sheet you can continuously sell paper ETH. This artificially suppresses the price.

Yusko argues it’s opening the door to manipulation.

“History says it's not a good thing for short-term price. History says it's not a good thing for free and open markets. It allows people with large balance sheets to manipulate.”

With Ethereum down over 5% since the futures launch, Mark has a point….

The good news?

As with Bitcoin, the launch of a futures ETF opens the door to a spot ETF down the line. Although it can cause short term pain, in the long-run it’s a step in the right direction. 👟

ETHEREUM INFLATION? 🤔

Last years Ethereum Merge was hyped by many. Ethereum’s transition from proof-of-work to proof-of-stake reduced ETH issuance by 90%. We started to see the circulating supply decrease.

Things were looking good. ☀️

Ethereum maximalists were convinced that becoming deflationary was the saving grace.

One year later and we’re not so sure about that. 😬

Over the last 30 days, the supply of Ethereum has increased by nearly 30,000. This is roughly equal to $47.9 million at the time of writing.

On August 31st, Ethereum flipped back into an inflationary state.

How does this happen? 🤷

Simple. Transactions fees and network activity have been declining. With the current level of network activity, issuance of new Ether is outpacing the amount burned. More detail here.

Two of the biggest reasons for decreased network activity are:

NFTs are all but dead (these contributed heavily to surging transaction fees)

Way less DeFi activity

This isn’t actually as bad as it sounds. In fact some are saying it’s a good thing…

Three days ago we spoke about how decreased transaction fees are good for the average user.

In the short term the supply of Ether will increase. But over the long term as demand picks up this will self correct. Basically Ethereum will once again become deflationary with enough demand. Checkout the full article here.

Even the team behind Ethereum aren’t concerned with this.

Danno Ferrin (core Ethereum developer) had this to say:

"It is still below the all-time high [ETH supply]… And [Ethereum’s] short-term inflation is well below other chains and the economy as a whole.”

Danno has a point…

Ethereum 30-day inflation: +0.3%

Ethereum inflation since Merge: -0.213%

US Dollar inflation: +8.5%

Bottom Line: Although the short-term doesn’t look great for Ethereum, sometimes you have to zoom out and look at the bigger picture…

Cheap transaction fees → Increased demand → increased utility → higher burn rate → Ethereum is once again deflationary. 🔥

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

Bitcoin Breakdown

Bitcoin-only daily newsletter with the highest signal-to-noise ratio in the industry

Sponsored

Vincent Spotlight

Alternative Investing News for the Savvy Investor

Sponsored

Everyday AI

Helping everyday people learn and leverage AI

CAN YOU CRACK THIS NUT? ✍️

What is the current Bitcoin block reward miners receive?

A) 3.125 Bitcoin

B) 12.5 Bitcoin

C) 6.25 Bitcoin

D) 25 Bitcoin

Find out the answer at the bottom of “Meme Corner” below 😀

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: C) 6.25 Bitcoin 🥳

Miners are rewarded with 6.25 bitcoins. This number will reduce to 3.125 bitcoins after the halving in 2024.

GET IN FRONT OF 13,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.