GM to all 29,216 of you. Crypto Nutshell #181 soarin’ through. 🐉 🥜

We’re the crypto newsletter less puzzling than waking up in a maze with no memory of how you got there... 🌀🧠

What we’ve cooked up for you today…

🤔 It all makes sense now

💵 Why crypto is inevitable in 2024

🤑 Stablecoins are back

💰 And more…

MARKET WATCH ⚖️

Only the top 20 coins measured by market cap feature in this section

IT ALL MAKES SENSE NOW 🤔

BREAKING: American Bankers Association influenced Warren’s contentious crypto bill

Two weeks ago we covered Jamie Dimon (CEO of JPMorgan) and Elizabeth Warren’s crusade against crypto.

It has now been revealed that the American Bankers Association (seriously?) assisted Senator Warren in creating the highly criticised Digital Assets Anti-Money Laundering Act.

U.S Senator Roger Marshall had this to say at the Parliamentary Intelligence-Security Forum:

“When Senator Warren presented that legislation to us, the first thing we did is we went to the American Bank Association and said help us craft this [because] we want crypto to be held up at the same standard as you are and I think that by doing that it gave us a lot of buy in and a lot of support.”

This revelation sparked outrage within the crypto community. (rightfully so)

Sam Lyman, Director of public policy at Riot Platforms:

Brian Armstrong, CEO of Coinbase:

Matt Hougan, CIO of Bitwise:

Having the American Bankers Association write up an anti-crypto bill is honestly laughable…

One thing is for certain, banks are not happy with the market share crypto is taking away from them.

Out with the old, in with the new… 👋

TOGETHER WITH INCOGNI 🥸

Every day, data brokers profit from your sensitive info—phone number, DOB, SSN—selling it to the highest bidder. And who’s buying it? Best case: Companies targeting you with ads. Worst case: Scammers and identity thieves.

It's time you check out Incogni. It scrubs your personal data from the web, confronting the world’s data brokers on your behalf. And unlike other services, Incogni helps remove your sensitive information from all broker types, including those tricky People Search Sites.

Help protect yourself from identity theft, spam calls, and health insurers raising your rates. Plus, just for our readers: Get 60% off the Incogni annual plan at this link with code PRIVACY.

WHY CRYPTO IS INEVITABLE IN 2024 💵

2024 is going to be a year of money printing & lower interest rates.

Why?

2 reasons:

Debt 🏦

The U.S Election 🇺🇸

If we know money printing is on the way - where should we be positioned?

Crypto.

That’s the latest message out from macroeconomic expert, Raoul Pal.

“As investors, we need to say: ‘Okay - what's going to create the biggest opportunity set?’ The multiplier on all of this is crypto. It always outperforms all other assets. Particularly in these moments.”

Why will 2024 so clearly be a year of stimulus?

Let’s break it down:

1. Debt 🏦

To battle high inflation, 2022 & 2023 saw interest rates increase from 0.25% to 5.5%.

A 22-fold increase in under two years! The fastest rate of change of interest rates in history.

It worked & inflation fell. However, such high interest rates are unsustainable.

Why?

Debt.

The U.S debt to GDP ratio is now well over 100%. When interest rates increase, so do the interest payments the government must make on it’s debt.

To avoid a debt spiral & to afford repayments, Raoul believes interest rates will have to be cut in 2024.

This means more liquidity & money in the economy.

2. U.S Election 🇺🇸

Every election year, both parties are heavily incentivised to stimulate the economy.

A strong or improving economy can be a key factor in voter’s decisions.

This again leads to more liquidity & money printing.

“In an election year, the government's job is to give out as much candy as possible to voters. All they want to do is buy votes. You will always get stimulus.”

So we know there’s a very high likelihood that 2024 is going to be a big year of stimulus.

What performs best in environments like this?

Technology stocks & crypto.

Assets further out on the risk curve out-perform in high liquidity environments.

The asset furthest out on the risk curve?

Crypto.

However, a word of warning from Raoul - this opportunity won’t last forever.

“Crypto is such a beautiful thing. This won't last forever. But it's a gift for us.”

P.S. Raoul also joined Bitwise & VanEck in predicting a new Bitcoin all-time high in 2024:

“I don't do predictions, I will just say: Bitcoin will trade a lot higher. At new all-time highs. Let's give it that.”

Who will be next? 😎

STABLECOINS ARE BACK 🤑

Today we’ll be diving into the stablecoin market.

Stablecoin’s play an important role in the wider crypto market. They are often used on centralized and decentralized exchanges to purchase other digital assets.

(Plus they make international payments a million times easier and quicker)

By taking a look at the stablecoin market, we can gauge the demand for digital assets.

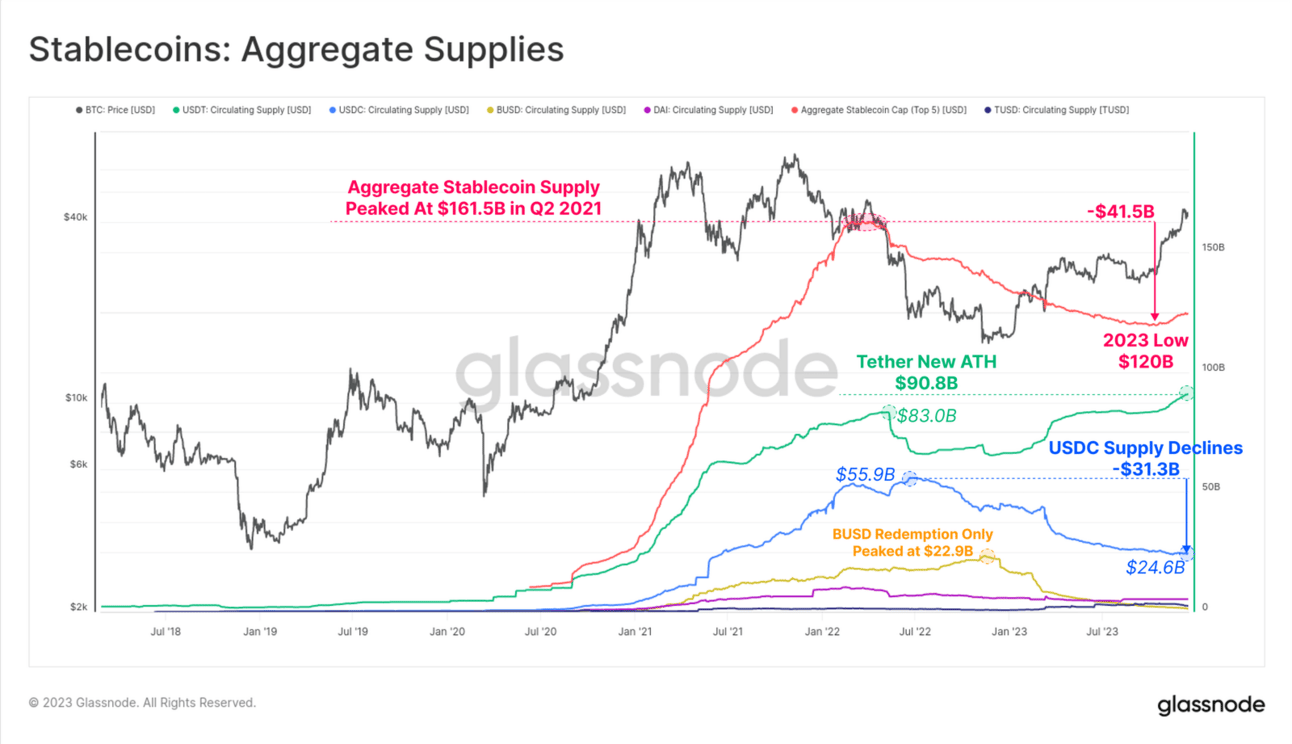

The stablecoin supply had been in decline since March 2022. Falling from a peak of $161.5 billion down to $120 billion.

This was largely due to regulatory pressures from the SEC and decreasing investor interest during the bear market. 🐻

The chart below tracks the aggregate change in the total stablecoin market cap.

🟢 Increased stablecoin supply: increased demand and capital inflows into the digital asset space 🐂

🔴 Contractions in stablecoin supply: risk-off environments and net capital outflows from digital assets 🐻

However, October was a turning point.

Since October, the stablecoin supply has continued to grow at ~3% per month.

Although this isn’t insane growth like we saw during 2021, it does mark the first supply expansion since March 2022.

A clear sign of returning investor interest.

Bull markets are often categorised by large expansions in the stablecoin supply (checkout those green peaks in 2021).

It’s another early metric to add to to the long list of indicators that interest & hype is returning to the crypto space. 👀

CRACKING CRYPTO 🥜

WHAT WE’RE READING ✍️

Want to get even smarter? Check these out.

p.s. all completely FREE

Sponsored

The Hodl Report

Stay ahead of the Curve and Profit by Becoming a Crypto Expert

Sponsored

Stock Market Rundown

Your 3-minute morning read with an amusing angle on business and the stock market. Learn, laugh, stun your friends with your knowledge.

Sponsored

Vincent Spotlight

Alternative Investing News for the Savvy Investor

CAN YOU CRACK THIS NUT? ✍️

Select your answer below and you’ll be redirected to the results page. (answer explanation can be found after “Meme Corner”)

What percentage of the Bitcoin circulating supply is currently held by Long-Term Holders?

MEME CORNER 😂

Because what would the crypto world be without its share of memes?

Trivia Answer: B) 76.1% 🥳

To checkout the full breakdown of the Long/Short-Term supply click here.

GET IN FRONT OF 29,000+ CRYPTO INVESTORS

Advertise with Crypto Nutshell to get your product or brand in front of the crème de la crème of crypto investors. Crypto Nutshell readers are high-income earners who are always looking for unique or interesting offers.

HOW DID WE DO? 🤷

We read every comment submitted in this poll and love to hear what you guys have to say. 😁 (bonus points for suggestions 🍪)

What did you think of today's Newsletter?

NUTCASE REVIEW OF THE DAY 🔍

DISCLAIMER: The content of this newsletter is not financial advice. This newsletter is strictly educational and is not investment advice. Please be careful and do your own research.